Learn how this angel investor turned a six-figure investment into a nine-figure fortune.

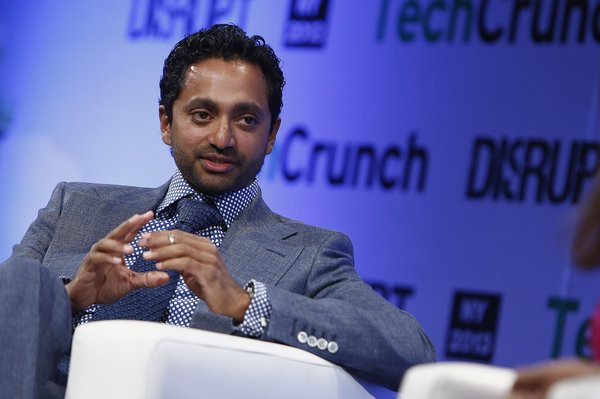

Behind every successful angel investor, there's a big idea that set them on the path to wealth. For Jason Calacanis, there have been several. The internet entrepreneur, investor, and social media influencer can lay claim to a major role in some of the most high-profile online tech start-ups over the last two decades.

Calacanis' range of knowledge makes his voice indispensable for anyone interested in angel investing. We'll talk about his background, career, and greatest hits, and catch his advice on the best way to jump into technology start-ups.

Jason Calacanis' investment approach

Jason Calacanis' investment approach

There's not a great deal of mystery in what it takes to find a successful start-up, according to Calacanis. He focuses on two criteria: the ability of the person who's creating the company and the fit of a product with a market.

"As you go through your angel investing life, take some time to evaluate the person and their motivations," he said. "Ask yourself a simple question: Would I buy stock in this person if I could? If you wouldn’t buy stock in a founder, you shouldn’t buy stock in their company."

Like many other longtime Silicon Valley inhabitants, Calacanis is becoming increasingly skeptical of the benefits of the tech industry. Robotics and artificial intelligence are likely to wipe out millions of jobs and continue to concentrate wealth among a smaller group of people, creating a recipe for extreme social unrest. "We’ve got a 70% chance of figuring out this massive sea change without starting a full-on revolution in the streets," he wrote in his 2017 book.

Calacanis, however, doesn't think the middle class is doomed -- at least, not if they prepare for change by betting on start-ups. He suggests that new angel investors start slowly and consider joining a syndicate that exposes them to other investors -- such as his angel investing club, known simply as "the Syndicate." They should be willing to devote at least 20 hours every week to their investments, and they should move to Silicon Valley.

Who is Jason Calacanis?

Who is Jason Calacanis?

Jason Calacanis is a native of Bay Ridge in Brooklyn, New York. He attended Fordham University, earning a degree in psychology, and began his career as a programmer. He and restaurateur Barry Wine, who operated one of the most famous nouvelle cuisine establishments in New York during the 1980s, created a virtual chatroom for America Online (AOL).

Calacanis consulted for Flatiron Partners, a New York-based venture capital firm, before turning his attention to publications. He founded the influential Silicon Alley Reporter in 1996. Many such publications flamed out during the dot-com bust of the early 2000s, but Calacanis saved his newsletter by changing its name to Venture Reporter and switching its revenue base from advertising to database subscriptions. Calacanis would sell the publication in 2003 to Wicks Business Information (which would then flip it to Dow Jones, publisher of the Wall Street Journal).

Although blogs had been a feature of the internet since 1994, Calacanis and Brian Alvey -- with some financial help from Mark Cuban -- launched Weblogs Inc., a network that quickly became one of the most widely used templates for blogs. The network, which included the tech blog Engadget, was sold to AOL for $25 million in 2005.

Calacanis joined Sequoia Capital as an "entrepreneur in action" in 2006. During his year at the Menlo Park, California–based venture firm, he invested $25,000 in a friend’s ride-sharing company, which was worth an estimated $5 million. His investment in the company -- Uber -- turned into $100 million and gave Calacanis a title for his 2017 book, Angel: How to Invest in Technology Startups: Timeless Advice From an Angel Investor Who Turned $100,000 into $100,000,000.

In 2007, the investor launched Mahalo, a web directory that attracted funding from Cuban, News Corp. (NWS 0.08%), and Elon Musk, among others. Initially a success, it was shut down in 2014 after a change in the Google (GOOG 9.96%)(GOOGL 10.22%) search algorithm cut traffic sharply. Calacanis may have reached more long-lasting internet prominence that year, however. He's given credit for coining the term "fatblogging," posting weight loss progress on one's personal blog in hopes of receiving support from other bloggers.

In 2009, Calacanis created the Open Angel Forum, a networking opportunity to enable early-stage start-ups to connect with angel investors. Over the decade, Calacanis would invest in more than 150 companies, including at least four multibillion-dollar unicorns, private tech companies valued at more than $1 billion.

Jason Calacanis' personal stats

Jason Calacanis' personal stats

- Age: 52.

- Source of wealth: Investing in early-stage start-ups.

- Marital status: Married.

- Residence: San Francisco.

- Children: Three.

- Education: Fordham University, B.A. in psychology.

Jason Calacanis' investments

Jason Calacanis' investments

Calacanis is given credit for investing in four unicorns:

- Uber (UBER -0.38%). The ride-sharing app has its roots in a 2008 Paris trip when a friend was unable to find a taxi. From humble beginnings -- three cars in New York -- it became the most valuable start-up in the world in mid-2015, then worth an estimated $51 billion.

- Thumbtack. The privately held online directory, founded in 2008, allows users to find and rate people who provide services ranging from home improvement to legal services. Calacanis invested $1.2 million in the start-up. The company reported in 2021 that it had raised $275 million from a funding round that valued it at $3.2 billion.

- Robinhood Markets (HOOD 4.44%). Calacanis was also an early investor in Robinhood, a broker-dealer offering commission-free trades of stocks, exchange-traded funds, and cryptocurrencies. Founded in 2013, the Menlo Park, California, firm was valued at $1.3 billion by 2017 and rolled out an initial public offering (IPO) in mid-2021. By mid-2023, its market cap was roughly $9.1 billion.

- Desktop Metal (DM -0.29%). The 3D printing start-up drew several high-profile Series A investors, including Calacanis and Kleiner Perkins. It was one of the fastest-growing unicorns in U.S. history and went public in late 2020 via a reverse IPO with a special-purpose acquisition company (SPAC).

More from Jason Calacanis

More from Jason Calacanis

Calacanis famously detests Meta Platforms (META 0.43%) founder Mark Zuckerberg, calling him "completely immoral" and "anti-competitive" and saying he "steals everybody’s innovations." His dislike of the Meta boss, however, doesn't extend to ignoring social media. Far from it, in fact: Calacanis has a robust presence on LinkedIn and Twitter.

- LinkedIn: Jason Calacanis

- Twitter: @Jason

- Website: The Syndicate

- Podcast: This Week in Startups and The All In Podcast

- Book: Angel

Learning from Jason Calacanis

Learning from Jason Calacanis

Calacanis is a big believer in the power of syndicates to profit from start-ups, as long as they're well informed and do their homework. Indeed, he's so committed to the idea that he said in 2017 that he had offered to let his three children spend money earmarked for college tuition on start-ups. (His 7-year-old daughter was leaning in favor of the idea.) "No gamble, no future," he argues.

Not all financial advisers are persuaded by the merits of gambling on start-ups, favoring a portfolio that prioritizes well-established tech companies over firms that could crash and burn. The Motley Fool still favors a long-term buy-and-hold strategy with a diversified portfolio as the surest, safest way to accumulate wealth.

Jason Calacanis FAQs

Jason Calacanis FAQs

What is Jason Calacanis best known for?

Jason Calacanis is best known for his successful investments in early-stage tech companies that are known as "unicorns," or privately held firms that are valued at more than $1 billion. Calacanis is a prominent podcaster, lecturer, author, and social media influencer as well.

What are some of Jason Calacanis' biggest investments?

Calacanis turned a $25,000 early investment into a friend's company -- Uber -- into a $100 million holding. He's also been credited with being among the first to see the value of companies like Robinhood, Thumbtack, and Desktop Metals, which are all valued at more than $1 billion.

What is Jason Calacanis' investment philosophy?

The fabled angel investor is a big believer in the power of syndication, or pooling the money from groups of people to invest in start-ups with strong founders and a good product/market fit.