If you've heard of value investing or Warren Buffett, you've likely also heard of Benjamin Graham -- a writer, teacher, and investor who rose to prominence in the mid-20th century. His principles, described in two groundbreaking books, established the practice of value investing. Read on to learn about Graham's background and the key tenets of his investing approach.

Who is he?

Who is Benjamin Graham?

Graham is known as the father of value investing. He also befriended, taught, employed, and mentored Warren Buffett, a modern value-investing legend.

Graham's widely recognized professional accomplishments are impressive, given his tumultuous personal life. He endured tragedies that included the unexpected death of his father and fall into poverty, three failed marriages, and the deaths of two children.

Graham's father, a successful business owner, died when Graham was nine. The father's business subsequently collapsed, leaving the Grahams without the income needed to support their lifestyle. Just a few years later, Graham's mother lost much of the family's savings in the 1907 stock market crash.

A few months after his father's death, Graham got his first job selling magazines on a street corner to help his family. He continued holding odd jobs throughout college and even after he started his Wall Street career, tutoring young students in his free time.

Graham was an excellent student despite the hours he spent working. His academic performance earned him a scholarship to Columbia University. In 1914, at age 20, he graduated with a bachelor's degree. Before graduation, the school offered him teaching positions in Greek and Latin philosophy, English, and math. He declined the offers and sought an investing job to support his family.

His early career and the founding of Graham-Newman

Graham secured an entry-level role with a Wall Street brokerage, writing stock and bond prices on a blackboard. There, he began developing his research-based investment approach. As he moved up the ranks, he gained a reputation for choosing safe but profitable assets for his employer.

In 1926, Graham co-founded investment fund Graham-Newman Corporation. Two years later, his reported annual income was $600,000, about $10 million today.

After the crash of 1929

Graham lost much of his fortune in the 1929 stock market crash and its aftermath. As reported in Joe Carlen's book The Einstein of Money, Graham's portfolio showed outsized losses versus the market in 1929 and 1930. But he was able to change course, losing less than the market in 1931 and 1932.

Graham published his first book, Security Analysis, with David Dodd in 1934. Graham's second book, The Intelligent Investor, was published in 1949.

Graham-Newman Corporation remained in business until the 1950s, recovering from the Great Depression losses and generating sizable returns for its clients. The company's star investment was a 50% interest in Geico Insurance, purchased in 1948 for about $736,000 -- the same Geico that today is wholly owned by Buffett's Berkshire Hathaway (BRK.A -0.76%)(BRK.B -0.69%).

Benjamin Graham's personal stats

- Age: Graham was born May 9, 1894, and died Sept. 21, 1976.

- Source of wealth: Graham was self-made. His family moved from London to the United States in the 1890s and fell into poverty in the early 1900s. Graham worked odd jobs as a child and secured a scholarship to pay for college. He began his professional finance career at Wall Street brokerage Newburger, Henderson & Loeb after college.

- Marital status: Graham was married three times -- to Hazel Mazur, Carol Wood, and Estelle Messing. All three unions failed, though Graham and Estelle never officially divorced.

- Residence: At the end of his life, Graham lived in Aix-en-Provence, France.

- Children: Graham had five children with his first wife, Hazel, and one with Estelle. Two sons from his first marriage died before he did.

- Education: Graham earned a bachelor's degree from Columbia University.

Investment approach

Benjamin Graham's investment approach

Graham's investment style was defensive. In his writings, he promotes capital preservation as a priority, with growth being almost secondary. This approach is likely a product of his era. He experienced some of the worst stock market crashes in history in 1907 and 1929.

Here are six key tenets of Graham's investing approach.

1. Know yourself and invest accordingly

Graham offered different strategies for different types of investors. Investors short on experience or time should stick to high-quality, established stocks. They won't deliver the strongest growth but will have the most stability.

More experienced investors can cast a broader net but must lean on fundamental analysis to support their decisions. Even for more experienced investors, Graham recommended large, financially strong companies that pay dividends and come at a reasonable price.

2. Invest, don't speculate

An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.Security Analysis, by Benjamin Graham and David Dodd

Graham firmly believed that following the market or even investing without disciplined analysis was a fool's game. As such, he approached stock purchases carefully, as if he were buying the entire company.

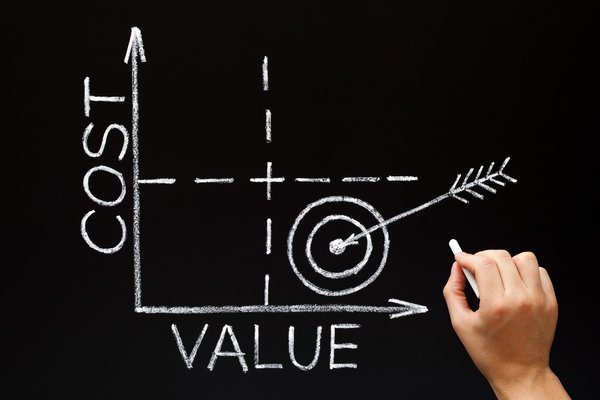

3. Focus on quality and value

Graham preferred stocks that today's investors would describe as high-quality. He liked balance sheets with good liquidity, tangible assets, and modest debt levels. He preferred big, mature companies over smaller, nimbler ones. He also favored stable earnings and consistent dividends.

Quality didn't make a good investment on its own, however. Graham specifically sought out quality at a good price. To evaluate a stock's price, he looked at the price-to-earnings (P/E) and price-to-book-value (P/B) ratios.

Graham's maximum investable thresholds for these ratios were 15 for P/E and 1.5 for P/B. However, he was willing to accept a higher P/B ratio when the P/E was low. So he would also look at the P/E ratio multiplied by the P/B ratio -- targeting a maximum value of 22.5.

4. Invest with a margin of safety

Graham pushed the idea of buying stocks at a discount from their intrinsic value. He named the discount the "margin of safety" and considered it an important protective measure. If the stock were already undervalued, it would be less likely to experience major declines. Also, if the stock were trading for less than book value, investors could likely recoup capital in the worst-case scenario of bankruptcy.

Margin of Safety

Implementing a margin of safety requires investors to determine the company's intrinsic value, which is not a black-and-white exercise. Graham's valuation process leaned heavily on technical analysis as a means of eliminating emotion from his decisions.

5. Use volatility to your advantage

Graham accepted market volatility as an opportunity to buy or sell. When the market's down, stock prices can dip below their underlying values, and the value investor can scoop up stocks that meet technical and margin of safety requirements.

In hot markets, many stocks end up selling for more than they're worth. The savvy investor can use that dynamic to take profits. Graham's view was contrarian: Buy when others are selling, and sell when others are buying.

6. Diversify to protect against losses

Graham believed that even with thorough analyses and a margin of safety, investors would make mistakes. He argued for diversification within and across asset classes to protect against mistakes. In his view, diversification combined with a disciplined investing approach ensures that investing profits will exceed losses over time.

Investments

Benjamin Graham investments

As noted, Graham preferred large, established companies that could stand the test of time. He believed they were the best options for average investors who don't have the time or inclination to manage their stocks closely.

The table below shows three assets that provide exposure to mature companies and/or value-priced assets.

| Name | Ticker | Total Assets/Market Cap | Description |

|---|---|---|---|

| iShares Core S&P 500 ETF | NYSEMKT: IVV | $449 billion | Low-fee ETF holding the components of the large-cap S&P 500 index |

| SPDR Portfolio S&P 500 Value ETF | NYSEMKT: SPYV | $20.7 billion | Low-fee ETF holding S&P 500 constituents demonstrating strong value characteristics |

| Berkshire Hathaway | NYSE: BRK.A, NYSE: BRK.B | $871 billion | Holding company run by Graham's protégé, Warren Buffett |

More from Benjamin Graham

More from Benjamin Graham

- The Intelligent Investor Rev Ed: The Definitive Book on Value Investing, by Benjamin Graham and Jason Zweig

- Security Analysis: Sixth Edition, Foreword by Warren Buffett, by Benjamin Graham and David Dodd

- The Interpretation of Financial Statements, by Benjamin Graham and Spencer B. Meredith.

Benjamin Graham, the father of value investing

Graham was the original value investor and securities analyst. His defensive, contrarian investing style and numbers-based approach are still relevant and instructive today. Technical and nontechnical investors can follow his lead to find investable assets, either by completing thorough valuation analyses or simply choosing high-quality stocks and holding them.

FAQs

Benjamin Graham FAQs

What is Benjamin Graham's investment strategy?

Graham was a value investor and contrarian. He distrusted market valuations and growth projections. He preferred to value a stock himself based on the company's tangible assets, debt levels, earnings, and dividends. He would then limit his purchases to stocks that were priced near or (ideally) below his valuation. Investors could use this approach to select assets less likely to create big losses.

What was Benjamin Graham known for?

Graham is known for founding the practice of value investing. His books outlining his investment philosophies are still widely read today. Graham was also a mentor to Warren Buffett and a finance professor at Columbia University and the University of California, Los Angeles.

What were Benjamin Graham's two rules of investing?

Graham's most recognized rules of investing are to protect yourself from losses and distrust market prices. Loss protection measures include investing with a margin of safety and diversifying across and within asset classes.

Graham's margin of safety concept is closely related to his distrust of market prices. The margin of safety is the difference between the stock's price and what your analysis indicates it's worth. He felt the safest investment was the underpriced stock, while the overpriced stock was the riskiest.