Who was John "Jack" Bogle?

Who was John "Jack" Bogle?

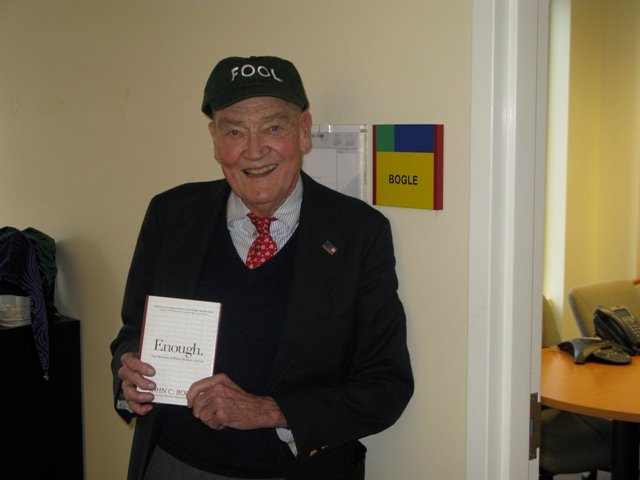

John Clifton "Jack" Bogle was a game-changing investor, economic scholar, and philanthropist.

Bogle is best known for his creation of the first index mutual fund and the founding of The Vanguard Group. His work has had a profound impact on the way individuals invest, emphasizing low costs and long-term passive investing. His investing approach focused on simplicity, diversification, long-term thinking, and expecting short-term market fluctuations to be erased by consistent secular trends.

His work empowered the individual investor and inspired his peers among financial giants. Master investor Warren Buffett often paid tribute to Bogle, reminding the rest of us that "Jack Bogle has probably done more for the American investor than any man in the country."

In addition to his work in finance, Bogle was also known for his philanthropy, often advocating for greater corporate responsibility and ethics in the investment industry.

John Bogle’s personal stats

John Bogle’s personal stats

- Age: John Bogle died on Jan. 16, 2019, at the age of 89.

- Source of wealth: Founded and managed The Vanguard Group, creating one of the world’s most respected investment businesses.

- Marital status: Married Eve Sherrerd in 1956. The marriage lasted until John’s death.

- Children: The Bogle couple had six children, 12 grandchildren, and six great-grandchildren.

- Residence: Bryn Mawr, Pennsylvania.

- Education: Bogle graduated magna cum laude in economics from Princeton University in 1951. His 133-page senior thesis on "The Economic Role of the Investment Company" started his lifelong passion for mutual funds.

John Bogle’s investment style

John Bogle’s investment style

Many well-known investors are famous for picking single companies with great qualities.

Not John Bogle.

His greatest claim to fame was the realization that a broadly diversified investment strategy could produce fantastic results over time. Inspired by this idea, he was the first economist to combine a wide-ranging market index with the automated portfolio management of a mutual fund, creating the then-new asset class of index funds. This fund is now known as the Vanguard 500 Index Fund Admiral Shares (NASDAQMUTFUND:VFIAX).

That was far from his only contribution to the theory and practice of successful investing, of course. Under John Bogle’s leadership, Vanguard pioneered many groundbreaking ideas. For example:

- Vanguard was not the first asset manager to offer a money market fund, but what’s now known as the Vanguard Cash Reserves Federal Money Market Fund (NASDAQMUTFUND:VMRXX) was a game-changer in 1975 with low fees and high interest yields. It is still a leading money market solution in 2023, with $106 billion under management.

- Based on his own research, Bogle insisted on minimal fees because even a small fee-based performance gap can make a big difference to your long-term returns.

- In 2001, Vanguard offered exchange-traded fund (ETF) versions of established mutual funds. Vanguard Total Stock Market ETF (NYSEMKT:VTI) was the first index fund ETF, mirroring the holdings of the traditional Vanguard Total Stock Market Index Fund (NASDAQMUTFUND:VTSAX). The twin funds have consistently delivered identical returns ever since, tracking a basket of almost 4,000 American stocks.

John Bogle wasn't interested in specific companies or sectors. Instead, his investment philosophy was built around the idea that broad market exposure and low costs were the keys to successful investing. He believed in the efficient market hypothesis, which posits that it's almost impossible to consistently outperform the market through stock picking or market timing. Instead, he advocated for investing in the entire market through index funds, which are designed to replicate the performance of a specific market index.

Bogle's philosophy hasn't changed much over the years. Even today, Vanguard continues to champion the cause of low-cost index investing, offering a variety of index funds and ETFs that cover different segments of the market, from broad market funds like the Vanguard Total Stock Market ETF to sector-specific and international index funds.

More from John Bogle

More from John Bogle

For those interested in learning more about John Bogle and his investment philosophy, here are some resources:

- Books: Bogle wrote several great books on investing, including The Little Book of Common Sense Investing, Common Sense on Mutual Funds, and The Clash of the Cultures: Investment vs. Speculation.

- Speeches and Interviews: Bogle gave numerous speeches and interviews over the years, many of which are available online. His 2005 speech at the Morningstar Investment Conference, "A Question So Important That It Should Be Hard to Think About Anything Else," is particularly noteworthy.

He also wrote an op-ed for the Wall Street Journal in 2007 that explores the questionable investor value of so-called "value strategies" where actively managed ETFs come with high turnover of the stock holdings and lofty management fees. - The Bogle eBlog: Bogle shared his thoughts on investing and the financial industry on his blog, which is still available online. One of the blog’s most popular features is the "Ask Jack" series of answers to investing questions.

Related investing topics

John Bogle’s legacy

John Bogle’s legacy

John Bogle revolutionized the investment industry with his focus on low-cost, broad-market index investing. His philosophy, centered around simplicity, diversification, and long-term thinking, has influenced countless investors and continues to guide Vanguard, the company he founded.

Whether you're a seasoned investor or just starting out, Bogle's approach to investing is worth a deeper look.

John Bogle FAQs

John Bogle FAQs

What sort of investment strategy did Bogle create?

John Bogle created the first index mutual fund, which is designed to replicate the performance of a market index. The strategy, known as index investing, allows investors to gain broad market exposure at a low cost.

The Motley Fool's investing strategy has been deeply influenced by John Bogle's ideas. In particular, The Fool’s strategy reflects his emphasis on long-term investing with a diverse portfolio, along with Bogle’s advocacy for low-cost index funds.

What is John Bogle known for?

John Bogle is best known for founding The Vanguard Group and creating the first index mutual fund. His advocacy for low-cost, broad-market investing has had a profound impact on the investment industry. He was a champion for ordinary people managing their own investments long before it was cool and remains a hero to retail investors to this day.

What is a Bogle portfolio?

A Bogle portfolio, also known as a "Boglehead" portfolio, refers to a portfolio that follows the investing principles of John Bogle. This typically involves a diversified mix of low-fee index funds, with allocations across different indexes adjusted for the investor's age and risk tolerance.