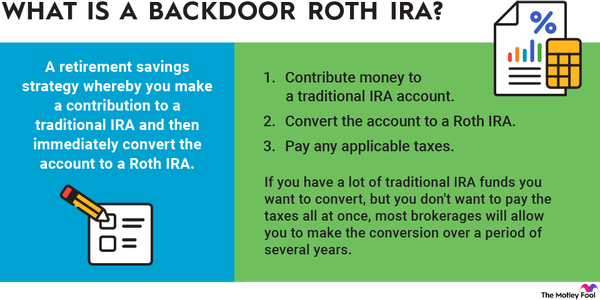

A Roth IRA conversion is a strategy people use to change their tax-deferred retirement savings, like traditional IRA and 401(k) funds, into Roth savings so they can enjoy tax-free withdrawals in retirement. High-income individuals also use it as a roundabout way to contribute to a Roth IRA if they cannot contribute to one directly. In this case, it's known as a backdoor Roth IRA.

Completing a Roth IRA conversion is pretty straightforward, but you must be prepared to pay taxes on your converted funds. Here's what you need to know before initiating a Roth IRA conversion.

Conversion limits

Roth IRA conversion limits

The IRS only allows you to contribute $7,000 directly to a Roth IRA in 2024 or $8,000 if you're 50 or older. These limits are $500 higher than the 2023 limits of $6,500, or $7,500 for those who are 50 or older. But there is no limit on how much you can convert from tax-deferred savings to your Roth IRA in a single year.

You can convert all of your tax-deferred savings at once if you want, though this isn't always wise because converting a large sum could push you into a higher tax bracket. More on that below.

Taxes

Taxes on Roth IRA conversions

You pay taxes on traditional IRA and 401(k) savings when you withdraw the funds, while you pay taxes on Roth savings when you make your initial Roth contribution. Switching from tax-deferred to Roth savings involves paying taxes on the converted amount. This raises your overall tax rate for the year.

The tax bracket is set up so those with larger taxable incomes owe a larger percentage of their income tax to the government. You should try to stay below the upper limit of your tax bracket if you can. If your Roth conversion pushes you into the next tax bracket, you'll give up a larger portion of your earnings.

The other factor that affects your tax bill is whether your tax-deferred savings have a basis. Basis means money you've paid taxes on already. It's not that common, but if you've made non-deductible contributions to a tax-deferred retirement account and you later decide to convert some of that money to a Roth IRA, you won't have to pay taxes on your basis. Unfortunately, the IRS doesn't enable you to convert your entire basis, leaving your deductible contributions alone.

In order to calculate the percentage of your Roth conversion that's tax-free if you have some basis, you'd divide your total nondeductible contributions by the year-end value of all of your IRA accounts plus the value of all conversions and any distributions taken during the year.

Say you have $20,000 in a traditional IRA and $5,000 is non-deductible contributions. If you decide you'd like to convert $5,000 to a Roth IRA, you would divide your total non-deductible contributions ($5,000) by the total value of your IRA at year's end (the $15,000 remaining in the account after your conversion) plus the amount you're converting ($5,000). In this case, that adds up to $20,000. Dividing your $5,000 in nondeductible contributions by $20,000 leaves you with 25%. So you wouldn't owe taxes on 25%, or $1,250, of your $5,000 conversion because that's part of your basis. You'd only owe taxes on the remaining $3,750.

Owing taxes on your Roth IRA conversion doesn't mean you'll receive a tax bill, though you could. But if you qualify for enough tax deductions and credits, you may just end up with a smaller tax refund for the year. If you do owe the government, you will need a plan to pay for these funds.

Dipping into your retirement savings to cover the cost of the conversion is an option, but it's usually a bad one. It will set your retirement savings back, and you could pay a 10% early withdrawal penalty on top of income tax for the withdrawal. You're better off relying on personal savings or setting up a payment plan with the IRS, though that may require you to pay some interest, to cover your extra tax bill.

The five-year rule

The five-year rule for Roth IRA conversions

The five-year rule for Roth IRA conversions says you must leave your converted funds in your account for at least five years before withdrawing them, or else you'll pay a 10% early withdrawal penalty if you're under 59 1/2. This is different from the rule for Roth IRA contributions, which you can withdraw tax- and penalty-free at any age.

The five-year period begins at the start of the calendar year you do the conversion. So if you convert traditional IRA funds to a Roth IRA in September 2024, your five-year clock begins on Jan. 1, 2024, and you could withdraw the funds penalty-free on Jan. 1, 2029. You must do your conversion by Dec. 31, 2024, if you want your five-year countdown to begin on Jan. 1, 2024. If you wait until January 2025 to do the conversion, your countdown begins on Jan. 1, 2025.

If you do multiple Roth IRA conversions in different years, each is subject to its own five-year rule. You must be mindful of how long it's been since you converted your funds to know how much you can withdraw penalty-free.

Conversion ladders

Roth IRA conversion ladders

Roth IRA conversion ladders are a series of Roth IRA conversions made year after year. They're commonly used by those hoping to retire early as a way to circumvent the 10% early withdrawal penalty on retirement distributions under 59 1/2.

The idea is to convert the amount you want to withdraw in your first year of retirement at least five years before so you can withdraw these funds penalty-free by the time you're ready to use them. Then, you convert the same amount every year thereafter until you have enough Roth savings to last you through age 59 1/2, at which point you can access all of your tax-deferred savings penalty-free.

Imagine you plan to retire at 50, and you believe you'll spend about $50,000 per year in retirement. Starting in the year you turn 45, you would convert $50,000 from tax-deferred savings to Roth savings. When you turn 50, the five-year countdown on those funds would be up and you could withdraw them tax- and penalty-free. In the year you turn 46, you'd convert another $50,000 to use in the year you turned 51, and so on, until you'd converted enough to cover you up until 59 1/2.

It's a sound strategy if you want to retire early and have a lot of tax-deferred savings, but you must decide whether it's worth the larger tax bills you'll have in the years you're building the Roth IRA conversion ladder. You must also make sure you'll still have enough savings to last you through the rest of your retirement, however long that may be.

Related Retirement Topics

How to do a conversion

How to do a Roth IRA conversion

The simplest way to do a Roth IRA conversion is to request your tax-deferred retirement account provider roll over funds to your Roth account. After you provide the needed information, the account provider will automatically roll over the funds, and you won't have to worry about the government taxing you for an early distribution.

You can also withdraw funds from your tax-deferred retirement account and then deposit them into your Roth IRA yourself, but you must do so within 60 days of the withdrawal, or the government considers the withdrawn amount a distribution and taxes you accordingly.

Roth IRA conversions can be beneficial for a number of reasons, but you must plan for them and the tax bill they bring so you don't incur penalties or problems with the IRS.