Tax benefits of Roth IRAs

Roth IRAs have valuable immediate and future tax benefits. Here are the ways that a Roth IRA can help you save on taxes:

- Your contributions grow tax-free. Although Roth IRAs have contribution limits, you can receive an unlimited amount of dividends, interest, and realized capital gains without increasing your tax liability for the current year.

- You can withdraw funds tax-free once you reach age 59 1/2 and five years have passed since you first contributed to your Roth IRA.

- A Roth IRA can also indirectly spare you from paying income taxes because you don't have to take RMDs from this type of account. For retirement accounts with taxable distributions, the IRS requires RMDs after you turn 73.

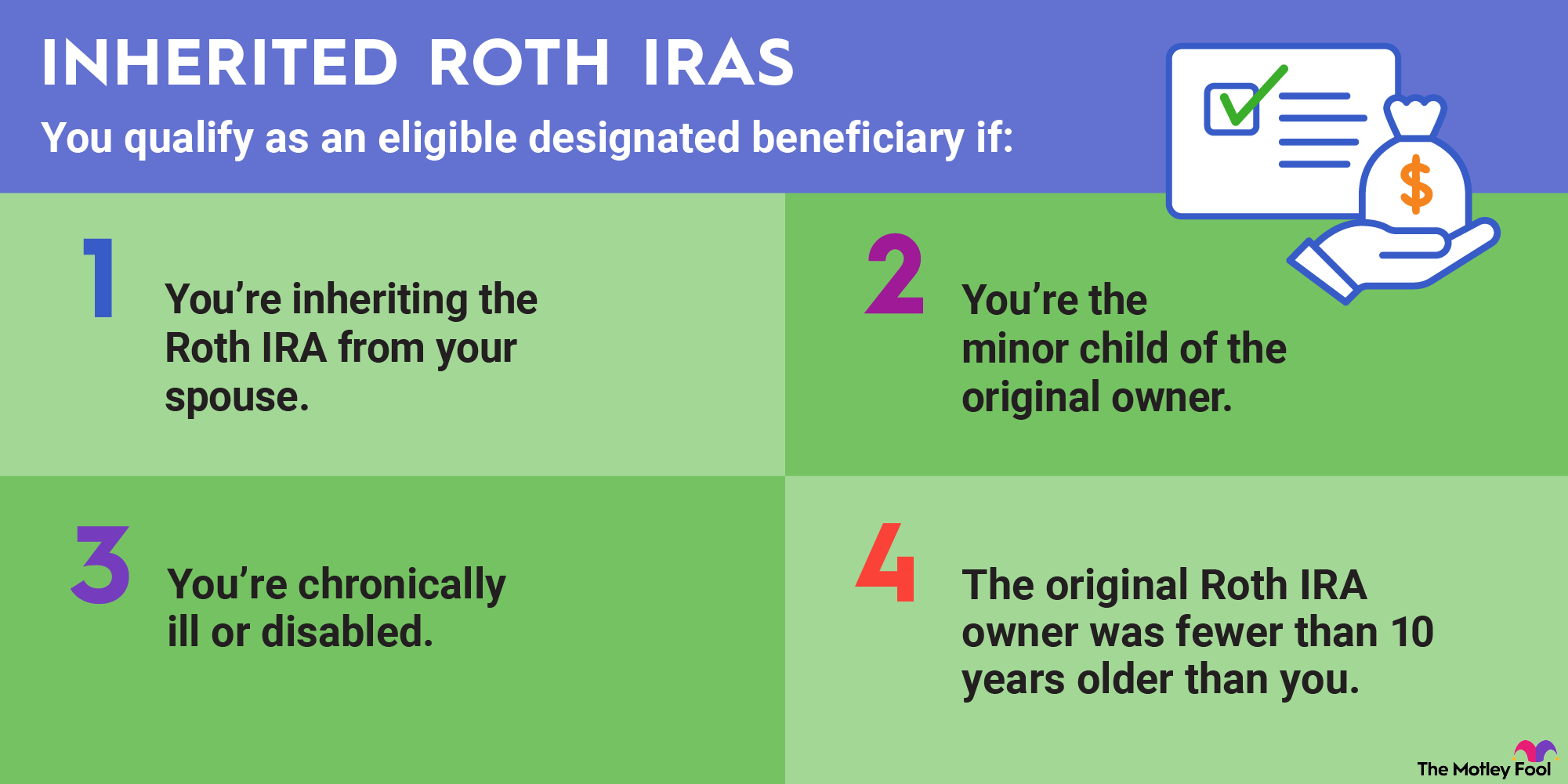

- You can even pass on your Roth IRA to your heirs. Withdrawals by the new beneficiaries are tax-free if the Roth IRA has been open for at least five years. Your beneficiaries only need to withdraw all the funds from the inherited Roth IRA within 10 years of your death.

Your Roth IRA could also help you reduce or even avoid taxes on your Social Security benefits. The IRS assesses what portion of your Social Security benefits is taxable based on your combined income, which equals half of your annual Social Security income, plus any other taxable income and any nontaxable interest.

You may be taxed on up to 50% of your Social Security income if your combined income is between $25,000 and $34,000 as a single taxpayer or between $32,000 and $44,000 as a married couple filing jointly. If your combined income exceeds $34,000 as a single tax filer, or $44,000 as a jointly filing married couple, then the IRS may tax up to 85% of your Social Security benefit.

Roth IRA withdrawals, since they are not taxable in retirement, don't count toward your combined income. Investing enough money in your Roth IRA to receive, say, $100,000 annually, would limit your combined income to be just half of your Social Security benefit, provided that you don't also have other sources of taxable income or nontaxable interest.

Benefits of Roth IRAs for young adults

Roth IRAs are well-suited for young adults who are early in their working careers, for a few reasons. Having a relatively low income maximizes the tax advantages of a Roth IRA. You contribute with after-tax dollars and get the tax benefits when you retire. This arrangement is advantageous because your tax bracket when you first start working is likely lower than your tax bracket later in life.

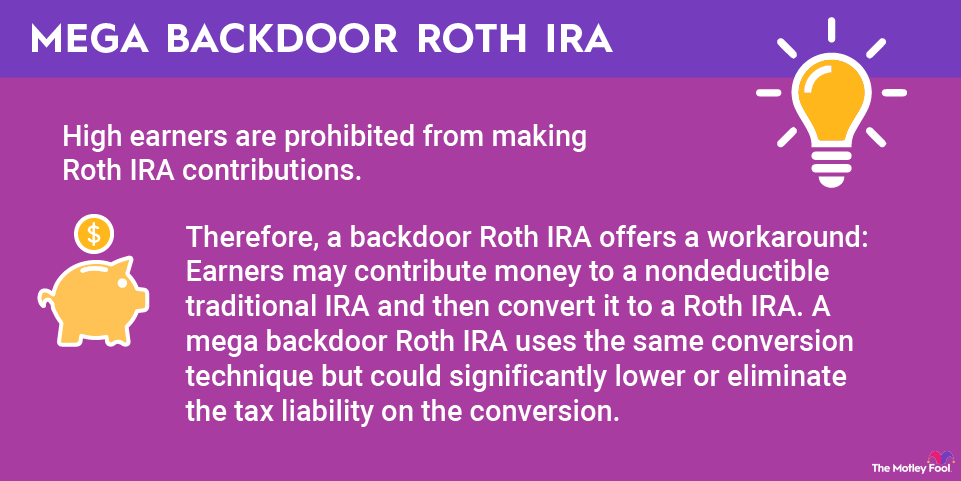

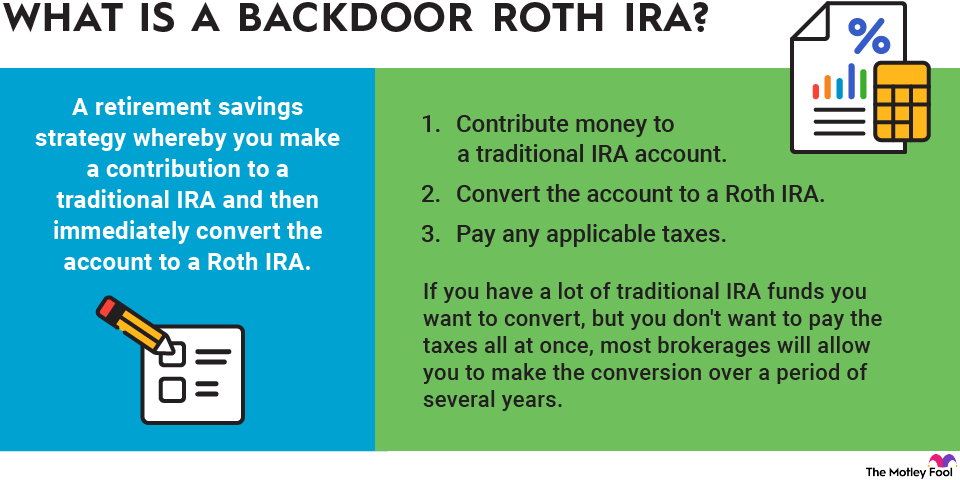

You also probably won't exceed the Roth IRA income limits yet. In 2025, you can't contribute to a Roth IRA if your modified adjusted gross income (MAGI) is more than $165,000 for a single filer or $246,000 for married taxpayers filing jointly. In 2026, the income limits are $168,000 for single filers and $252,000 for married filing jointly. The only way for a high earner to still contribute to a Roth IRA is to use a backdoor Roth IRA strategy.

Finally, the earlier you start contributing to a Roth IRA, the greater the tax advantages. You have more years to increase your earnings on a tax-deferred basis and more money to withdraw tax-free in retirement.