Both a Roth individual retirement account (IRA) and a 403(b) plan are tax-advantaged investment accounts that enable you to save for retirement. But there are important differences between the two in terms of who can invest in each type of account, when you actually receive the tax advantages, and how much you may contribute.

Here we explain how both accounts work and examine the pros and cons of each. We'll also help you to decide whether to contribute to a Roth IRA or a 403(b) plan, or both.

What is a 403(b)?

What is a 403(b)?

A 403(b) is a tax-advantaged retirement savings plan that can be offered by public schools and eligible tax-exempt organizations. Employees can elect to contribute money to their 403(b) plans by authorizing direct deductions from their paychecks. These contributions are made with pre-tax dollars and are subject to annual contribution limits. Many employers match at least a portion of their employees' contributions.

A 403(b) is similar to a 401(k), which is a retirement plan offered by private-sector employers.

403(b) plan contribution limits are similar to the contribution limits of 401(k) plans, with most employees eligible to contribute a maximum of $23,000 in 2024 ($22,500 in 2023). Individuals older than age 50 are eligible to contribute an additional $7,500 annually in both 2023 and 2024, and eligible employees with at least 15 years of tenure may contribute an additional $3,000 annually as "catch-up" contributions. These standard and catch-up limits are not affected by any matching funds contributed by employers.

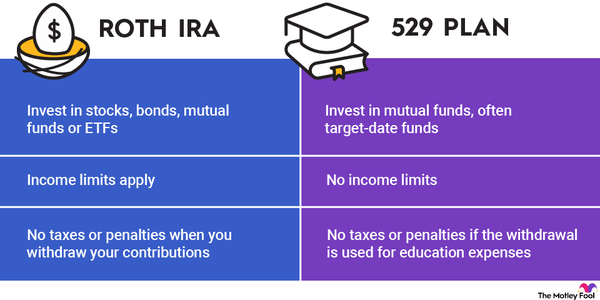

Investment options for 403(b) plans are limited, usually to mutual funds and annuities, and early withdrawals (before age 59 1/2) are generally subject to penalties.

What is a Roth IRA?

What is a Roth IRA?

A Roth IRA is an individual retirement account that you as an individual can open for yourself. You don't need an employer to offer one in order to invest in this type of retirement savings account. Your contributions are not tax-deductible, however. Roth IRAs are funded with after-tax dollars, and withdrawals in retirement are tax-free.

Anyone can open and contribute to a Roth IRA as long as their annual income does not exceed the maximum limit. Contribution limits for Roth IRAs are comparatively low -- for 2024, you can contribute just $7,000, or $8,000 if you're older than 50 and eligible to make catch-up contributions. In 2023, those limits were $6,500, or $7,500 with catch-up contributions. Since Roth IRAs are not employer-sponsored, there's no possibility of receiving employer-matching contributions.

Early withdrawals from Roth IRAs before age 59 1/2 can be subject to penalties. However, any potential penalties apply only to gains on your investments. You can withdraw your contributions at any time penalty-free.

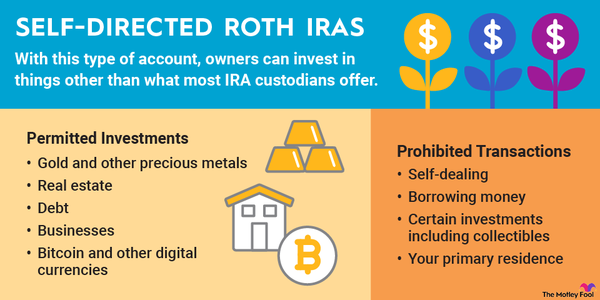

Many different types of financial institutions, including online brokers, offer Roth IRAs. You can invest your Roth IRA funds in a wide range of securities.

Major differences

403(b) vs. Roth IRA: Major differences

Here are the key differences between 403(b) plans and Roth IRAs.

| Aspect | 403(b) plan | Roth IRA |

|---|---|---|

| Eligibility | Employees of qualifying nonprofit organizations and public schools whose employers offer 403(b) plans. | Any individual with annual income that does not exceed maximum permissible limits. |

| Tax benefits | Contributions are made with pre-tax dollars, conferring tax savings in the year the contribution is made. | Withdrawals are tax-free in retirement since contributions are made with after-tax dollars. |

| Contribution limit |

$23,000 in 2024 ($22,500 in 2023) + $7,500 catch-up contribution if older than age 50 for both 2023 and 2024 + $3,000 catch-up contribution for employees with service records of 15 years or more for both 2023 and 2024 |

$7,000 in 2024 ($6,500 in 2023) + $1,000 catch-up contribution if older than age 50 in both 2023 and 2024 |

| Employer match | Employers may match employee contributions up to annual contribution limit. | No employer matching contributions are available. |

| Investment options | Limited investment choices, which are determined by your plan administrator. | Almost any type of investment. |

| Withdrawal rules | Early withdrawal penalties apply to most withdrawals made before age 59 1/2. | Early withdrawal penalties apply only to investment gains withdrawn before age 59 1/2. |

Pros and cons

403(b) vs. Roth IRA: Pros

Both 403(b) plans and Roth IRAs confer benefits to investors. Here are some of the key advantages of a 403(b) plan:

- Employers typically match part of your contributions.

- Tax savings are conferred in the same year that you make a contribution.

- Contribution limits are high, especially if you are eligible for catch-up contributions.

- Your eligibility is not affected by your annual income.

Here are some of the key advantages of a Roth IRA:

- You can open and contribute to a Roth IRA independently of your employer.

- Your investment choices are broad.

- You can withdraw money tax-free as a retiree as long as you follow certain rules.

- You can withdraw your contributions without penalty at any time.

403(b) vs. Roth IRA: Cons

Some of the key disadvantages of a 403(b) plan include:

- Your investment choices are limited.

- You pay a penalty for early withdrawals of both contributions and gains.

- You are obligated to pay taxes at your ordinary income tax rate when you receive distributions in retirement.

Some of the key disadvantages of a Roth IRA are:

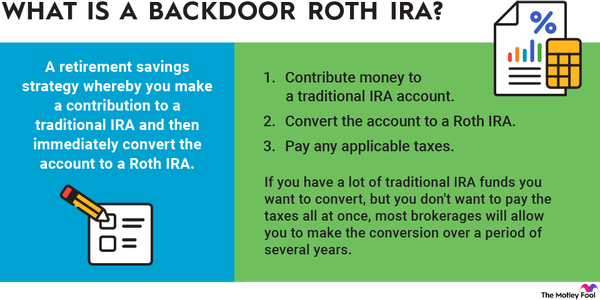

- You can't contribute to a Roth IRA if your annual income exceeds a certain limit.

- Annual contribution limits are relatively low.

- You must wait until you retire to receive any tax benefits.

- You must comply with the five-year rule to make tax-free withdrawals as a retiree.

Should you open a 403(b) or a Roth IRA?

You don't necessarily have to choose between a Roth IRA and a 403(b) plan.

If your employer offers a 403(b) plan, and your annual income does not exceed the limit for Roth IRAs, you can contribute to both a 403(b) plan and a Roth IRA. Doing so would provide you with a mix of retirement accounts, enabling you to take advantage of both current-year and deferred tax breaks.

If you don't have enough money to contribute the maximum amounts to both types of accounts, then prioritize contributing at least enough to your 403(b) plan to receive the maximum possible matched contribution from your employer. Take advantage of any free money from your employer before putting money into a Roth IRA.

Also, consider your likely tax rate as a retiree. If you expect to be taxed at a higher rate later in life, then a Roth IRA may be your better option.

Your employer may offer a Roth 403(b) plan, to which you may want to consider contributing. While the investment options available through this type of retirement account are limited, much like the investment options for traditional 403(b) plans, Roth 403(b) plans enable you to defer tax savings until retirement, just like Roth IRAs.