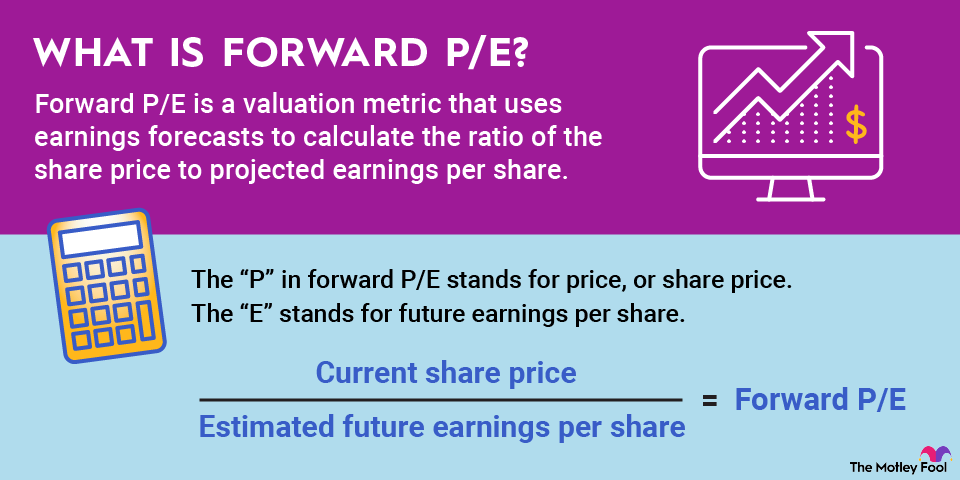

Investments have lots of different characteristics besides their current price point or face value. For example, one important characteristic of investments is how similar or different they are from one another. Here's how it relates to your investing.

What is fungibility?

Fungibility is a characteristic of items and other property that means that things are so similar that they can be easily swapped for one another. To be clear, these aren't necessarily identical items, although when it comes to value, you can certainly think of them as identical.

For example, dollar bills are fungible. They aren't identical, but they are so similar that there's no reason not to accept one for another. They are effectively identical, even if they have different serial numbers and different ages. They're considered identical for the purposes of valuation.

What kinds of things are fungible?

Lots of things in the investing world are considered fungible. Most of these are things you'd almost certainly think of right away, given the definition, but a few may surprise you.

Fungible things include:

Cash. Money has a set value and is considered like for like in a value transaction. Of course, a very small percentage of money is also collectible, but that doesn't make it not fungible if a person was willing to take that misprinted dollar or mis-stamped coin to the bank and deposit it into their account.

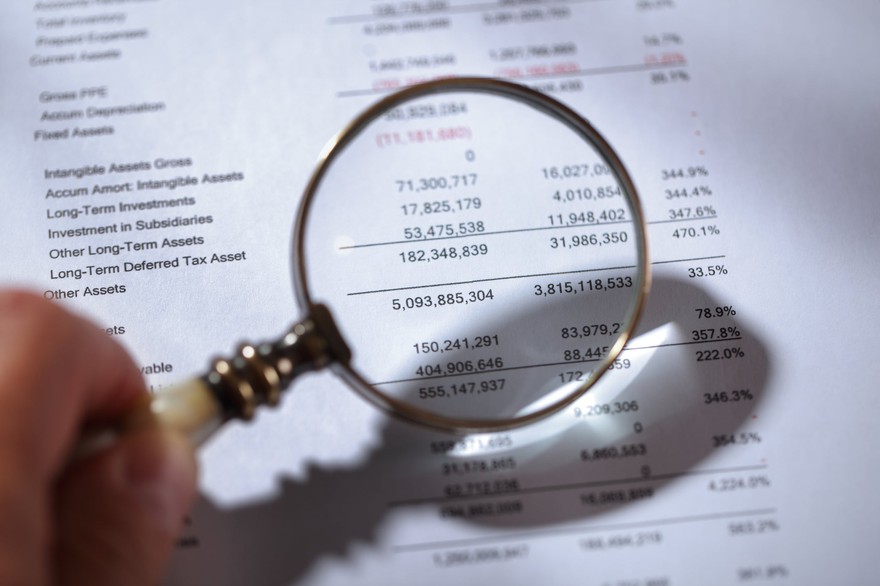

Stocks. Shares of companies of the same class are identical and can be swapped without any fuss. There's not a single common stock that's any different from another. They all offer the same value, the same benefits, and the same percentage of ownership. This also goes for shares of exchange-traded funds (ETFs) and similar investments.

Bonds. Like stocks, all bonds of the same issue and maturity date are considered to be the same and can be traded, even if you may find them listed for different prices on a secondary market. The face value and coupon rate of each bond are the same, so their actual value is the same. This sameness makes them fungible.

Cryptocurrency. Crypto is a funny thing, and I'm sure we've all heard plenty about it in the last few years, but it's important to note that cryptocurrencies are fungible. Like stocks and bonds, each digital coin is worth the exact same amount; they're identical in function, and they're indistinguishable, value-wise. Not everything in the crypto world is fungible, but cryptocurrency is, just like paper money.

Fungible versus non-fungible

Something that's fungible is fundamentally the same in all the ways that count. Generally speaking, it has similar characteristics that make it worth the same amount to anyone who might be interested in the item, and almost no one will be ruffled if you swap a dollar, bond certificate, stock, or Bitcoin for another.

Non-fungible items, on the other hand, are sometimes very different from one another, and these unique characteristics give them unique values. A good example is real estate. Even in an empty field being developed for building lots, each lot is different and has different characteristics. Some are closer to the main road than others; some will be closer to fire hydrants, or get more sun, or maybe even have a few trees that the others don't. They're never identical. They're non-fungible and cannot be directly swapped because they are not functionally the same.

Related investing topics

Turning a fungible item into a non-fungible item

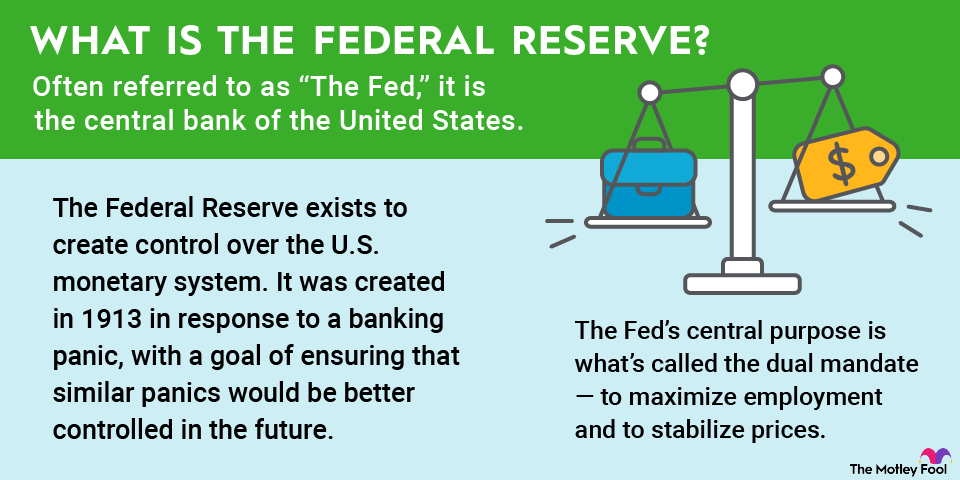

Things that are fungible can also be turned into non-fungible items. Although fungible items are ideally identical, what happens if you do something to make them unique? A great example of this is the gold bars stored by the Federal Reserve Bank of New York. These bars are, essentially, the same -- they're all made of gold, which is definitely fungible in a general sense.

But, when pressed into bars by the various world governments who own this particular gold and stamped with a unique identifier, each gold bar becomes non-fungible. They're no longer the same. They're special. The government that deposits each individual gold bar wants that exact gold bar back if they make a withdrawal.

What's fun about gold is that as soon as one of these governments were to take it out and melt it down to, say, make coins, it becomes fungible once again. It's the act of giving it a unique identifier that makes it special.

It's also the same principle that makes non-fungible tokens (NFTs) non-fungible. Yes, they are digital items that can be easily reproduced, but by permanently tagging them with identification numbers, they also become wholly unique. So, even if you have 15 copies of an identical art NFT, those digital items have gone from fungible to non-fungible if they're each given a unique identifier and issued as part of a series.