What do flower petals, spiral galaxies, hurricanes, the ratio of male to female honeybees in a hive, and technical stock analysis have in common? They’re all considered to be influenced by the Fibonacci sequence, a series of numbers in which a number equals the sum of the two preceding numbers (1,1,2,3,5, and so on). Use the numbers in the sequence for width, and you’ll see a spiral.

Divide any number by its predecessor, and you’ll eventually reach 1.618, known as the Golden Ratio, a number discovered 1,000 years ago that shows up in flower petals, spiral galaxies, hurricanes, and the ratio of male to female honeybees in a hive.

What is a Fibonacci retracement?

That’s all very interesting, but what does this have to do with your portfolio? Believe it or not, some traders swear by the Fibonacci retracement level. Fortunately, you don’t have to measure the distance between flower petals or count honeybees by gender to figure it out.

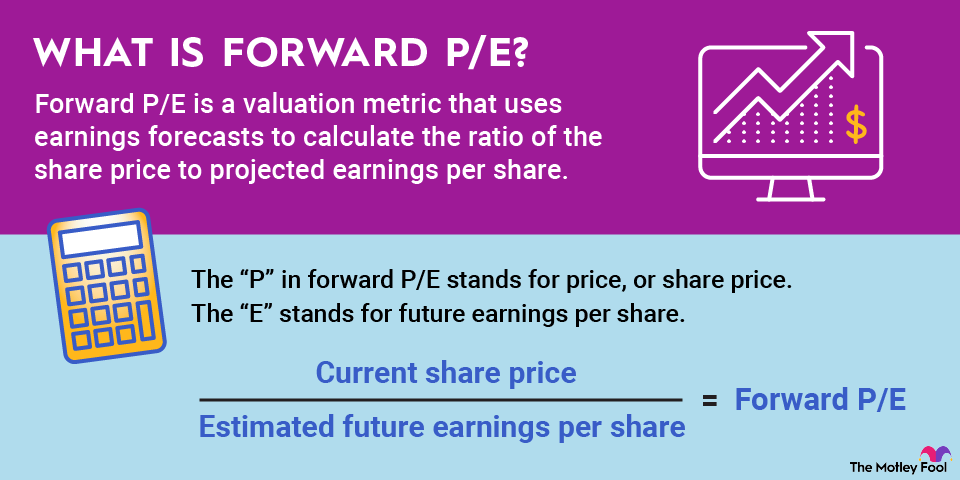

The Fibonacci retracement level generally relies on a half-dozen percentages to determine when the price of a security will stop and reverse course. Three are fairly obvious: 0%, 50%, and 100%. The other three? Not so much: 23.6%, 38.2%, and 61.8%.

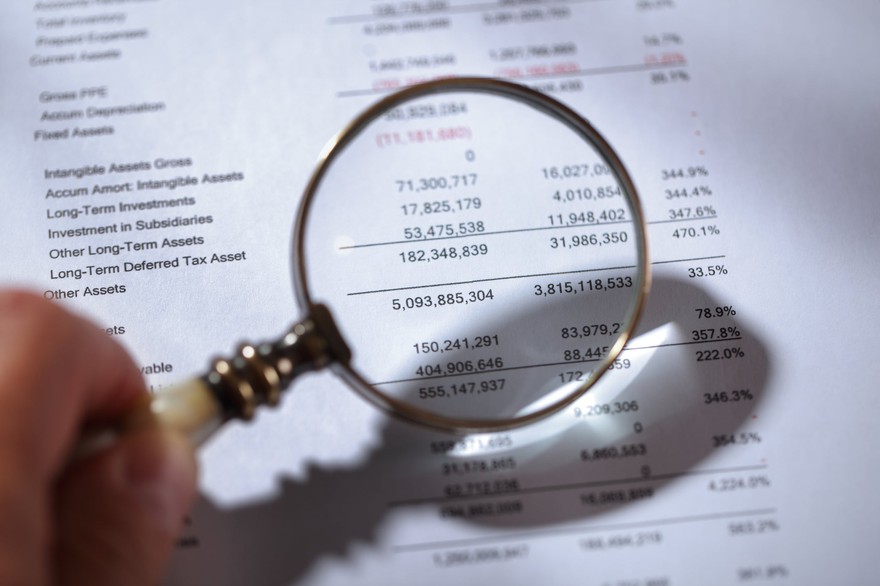

To look at the Fibonacci retracement, simply overlay a horizontal line for the three rather uncommon numbers and the 50% figure over a stock chart showing prices over a predetermined time, and then decide which two prices you want to compare.

Next, you’ll look for retracements, or minor changes in the direction of a price; think of them as stutters. You’ll be able to use the chart to see where the prices stop and retrace a previous move before trending in the original direction. (There are also a number of online calculators that will help you develop a Fibonacci retracement.)

How do investors use a Fibonacci retracement?

The Fibonacci retracement is a tool that’s fairly easy to understand in theory but often difficult to execute in practice. The Fibonacci retracement levels don’t change (23.6, 38.2, and 61.8, with the last figure approximating the Golden Ratio).

Many investors who rely on technical analysis think the Fibonacci retracement makes perfect sense for setting price goals, entry points, or stop-loss orders. The idea is to watch where a price goes when it reaches one of the three primary retracement numbers and see if the price is going up or down. If it’s going up, it might be a good buy; if it’s going down, it might be time to get rid of it. The idea is to watch the trend, identify the retracement, then trade in the direction of the trend.

Like any other form of technical analysis, Fibonacci retracements are best used in combination with other information and over longer time periods to eliminate the risks of routine volatility skewing the analysis.

It may be hard to believe that random numbers developed almost a millennium ago by an Italian mathematician would have much relevance for a modern stock market. Critics argue that corrections in prices are likely by chance alone simply because of Fibonacci levels at 23.6%, 38.2%, 50%, and 68.1% -- a pretty broad swath of potential price changes. Advocates of the Fibonacci retracement strategy note that academic studies have supported the approach, including a 2022 Financial Innovation study of cryptocurrency and energy industry stock prices.

Related investing topics

Fibonacci retracement example

Let’s say you’re watching a stock (or an index, or any other investment), and the price has risen from $5 to $10. The 23.6% mark will be at $8.82, using this simple formula:

($10 – ($5 * .236)

The 38.2% mark would be found at $8.09:

($10 – ($5 * .382)

The 50% mark would be at $7.50:

($10 – ($5 * .5)

Likewise, the 61.8% mark would be at $6.91:

($10 – ($5 * .618)

If you notice a retracement at one of the four Fibonacci levels, you can use the trend to determine whether it’s worth buying, selling, or holding. As with any other form of technical analysis, using the Fibonacci retracement as the sole basis for an investment decision is a poor idea; the more information you collect, the greater your chances will be for a successful and profitable investment.