Freddie Mac plays a vital role in stabilizing the mortgage market in the U.S. It's a government-sponsored enterprise (GSE) that buys home mortgages from banks and pools them into securities it sells to investors on the secondary mortgage market. In this article, you'll learn how Freddie Mac and its counterpart, Fannie Mae, work and why both are vital to the U.S. housing market.

What is Freddie Mac?

What is Freddie Mac?

If you bought your home using a conventional loan, you may be surprised to discover that your original lender no longer owns your mortgage. That's where Freddie Mac (short for the Federal Home Loan Mortgage Corporation) and its twin, Fannie Mae (short for the Federal National Mortgage Association), come in.

Freddie and Fannie are GSEs, which are private quasi-governmental agencies created through an act of Congress to enhance the availability of credit in certain markets.

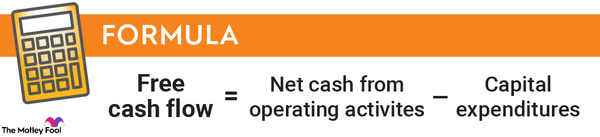

Both GSEs buy home loans from banks and credit unions on the secondary mortgage market. They keep some mortgages on their books and make money from the interest. But usually, Freddie and Fannie pool many mortgages together into bundles called mortgage-backed securities and then sell them to investors. Both guarantee that investors will get paid even if some homeowners in the pool default, making mortgage-backed securities extremely safe investments.

By buying loans from financial institutions, Freddie and Fannie improve liquidity in the mortgage market. In other words, lenders don't have to keep loans on their books for the entire life of the mortgage. Instead, banks and credit unions can resell mortgages to Freddie and Fannie, freeing up cash for them to make additional loans.

Freddie and Fannie will only purchase loans that meet conventional standards, which they're responsible for setting. The standards for a conventional loan are virtually identical. They include a 620 minimum credit score, a debt-to-income ratio of 45% or less, and a 3% down payment.

Freddie Mac vs. Fannie Mae

What's the difference between Freddie Mac and Fannie Mae?

Freddie Mac was established in 1970, long after its counterpart, Fannie Mae, in 1938. A piece of federal legislation called the Emergency Home Finance Act of 1970 led to the creation of Freddie Mac. President Richard Nixon signed the bill into law to expand the secondary mortgage market and give certain groups, like veterans, more access to mortgages.

Both GSEs have the same mission: to provide liquidity, stability, and affordability to the U.S. housing market. The primary difference lies not in what they do but in who they serve. Freddie Mac primarily works with smaller banks and credit unions, while Fannie Mae tends to buy home loans from major financial institutions.

Fannie Mae

Will Freddie Mac stay in conservatorship forever?

Will Freddie Mac stay in conservatorship forever?

Although Freddie Mac and Fannie Mae are publicly traded companies, they've been operating under government conservatorship since September 2008, the peak of the 2008 financial crisis. As markets panicked over whether the GSEs could service more than $5 trillion in debt, the U.S. Treasury provided financial support through a preferred stock purchase agreement.

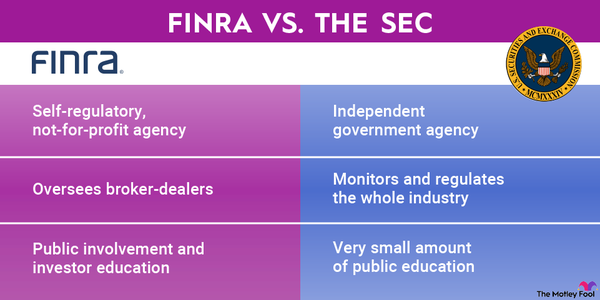

The Federal Housing Finance Agency (FHFA) now functions as the regulator of each institution, essentially playing the role of shareholders and the board of directors for both.

As of this writing in 2023, the Biden administration hadn't taken steps to dismantle the conservatorship. The FHFA and Treasury Department would need to agree to end the arrangement and map out an exit plan.

Example

Example of how Freddie Mac works

Suppose you want to buy a home and have decent credit plus money for a down payment. You visit your local credit union and learn you qualify for a conventional loan.

You make mortgage payments to your credit union, which continues to service the loan. But you later learn that your credit union no longer actually owns your mortgage. Instead, it was purchased by Freddie Mac, which then packaged it with other loans and sold it on the bond market as a mortgage-backed security.

This technicality probably doesn't matter to you. You continue to pay the loan as agreed. But by buying your mortgage, selling it to investors, and guaranteeing those investors that they'll get paid even if you default, Freddie Mac freed up money for your credit union to loan money to someone else.