When you think of artificial intelligence (AI), you probably don't think of AI in real estate. After all, real estate has traditionally been a slow industry to innovate as most transactions are still done through traditional brokers and independent landlords, even as real estate investment trusts (REITs) are the big players.

However, like much of the rest of the business world, the real estate industry is embracing the power of artificial intelligence (AI), which holds implications for both commercial real estate and residential real estate.

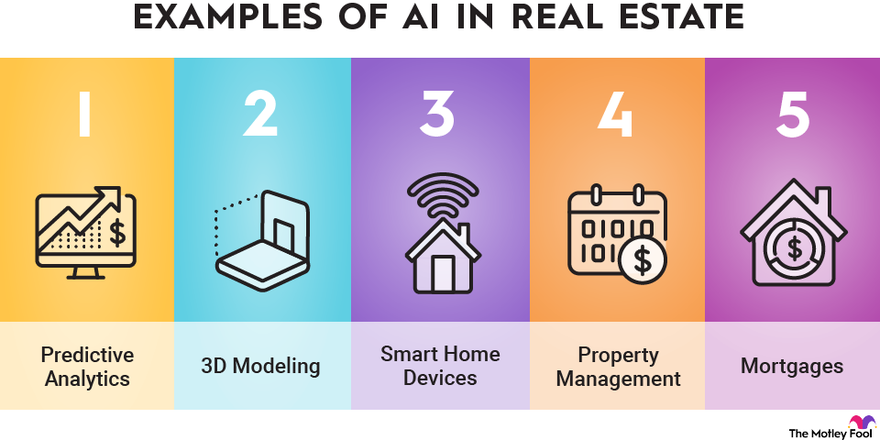

Any business that involves data is a good target for artificial intelligence, and there's plenty of data in real estate. Appraisals and estimates have traditionally been based on neighborhood comparisons and human opinion, but AI-based algorithms are increasingly used to generate these estimates.

Even generative AI now plays a role in creating three-dimensional models of properties so that potential buyers can use any connected device, such as a smartphone or tablet, to get a sense of how they look. The technology took off during the pandemic when sellers were reluctant to have buyers in their homes, and it has continued to grow.

Finally, AI also plays a role in smart home devices like thermostats, lighting, cameras, and monitoring devices to keep landlords informed of any problems that need attention, such as a plumbing leak.

In this look at AI in real estate, we'll explore how the new technology is changing the real estate industry and some examples of AI in the real estate industry.

Understanding artificial intelligence

Understanding artificial intelligence

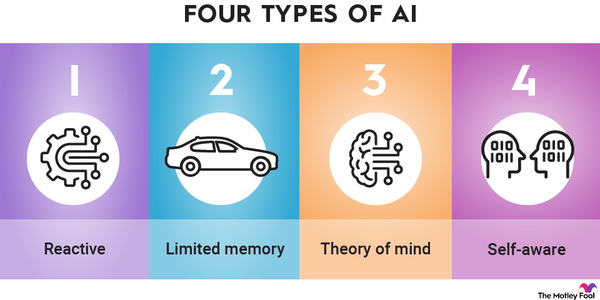

Artificial intelligence is generally understood as the ability of computers and machines to handle tasks that require human intelligence.

Machine learning, which is one of the most common applications of AI, involves training machines with large amounts of data to recognize patterns, analyze data, and run forecasts and algorithms.

Supervised Machine Learning

These applications are common in real estate.

More broadly, artificial intelligence technology includes computer vision in industries like autonomous vehicles, as well as robotics, neural networks, voice recognition, and natural language processing.

Keep reading to see five ways AI is used in real estate.

5 uses of AI in real estate

5 uses of AI in real estate

1. Predictive analytics

Perhaps, the most common and practical usage of AI in real estate is in predictive analytics.

When you see an estimate on the value of a property, it's generally based on predictive analytics from artificial intelligence.

Zillow (Z 1.68%) (ZG 1.7%), the leading online real estate marketplace, uses AI for its "Zestimates," or the proprietary valuation estimates it provides, as well as personalized recommendations, floor plans, and photos.

Rival Redfin (RDFN 8.49%) also uses AI for similar estimates and has partnered with ChatGPT creator OpenAI with a chat-based search plugin that can help searchers find the right home for them.

Forecasting is important, especially when investing in commercial real estate. Investors, agencies, and economists use AI to predict where the real estate market is headed, hoping to get an edge on the competition and buy at the right price.

2. 3D modeling

Visual representations have become increasingly important in real estate, and it's one of a number of industries that are taking advantage of "digital twins," or AI-based computer images that allow users to explore a space digitally.

Matterport (MTTR 0.85%) is among the leaders in the technology. It creates 3D virtual tours of properties that allow potential buyers to explore a property using augmented reality and other features before going to visit in person.

The technology helps increase the pool of potential buyers since anyone with a connected device can get a good look at the property. It also helps buyers, sellers, and agents save money since it screens potential buyers to make sure they're interested.

Startups are building similar technologies that show renderings of properties that don't exist yet. Some focus on assisting architects and offer tools that can give cost estimates based on different designs.

3. Smart home devices

Real estate is a massive industry, and property tech might be overlooked next to REITs that are worth tens or hundreds of billions of dollars.

However, property tech, or proptech, represents a fast-growing niche in the real estate industry. It focuses on devices that help landlords and homeowners remotely monitor properties. These include smart doorbells, smart locks, smart thermostats, cameras, and other smart home devices that help notify people of any problems that might occur inside the property.

AI helps devices learn user preferences and adjust settings as needed. They can help save money on utilities, improve tenant satisfaction, and help the landlord stay up to date and avoid major repairs.

4. AI in property management

Property management is another important subsector of real estate. Artificial intelligence also plays a role in helping managers screen tenants, collect rent, and schedule maintenance.

AI chatbots can play a role in tenant screening, much like their uses for customer service in other industries. They can answer questions about rental rates and availability and guide customers through the application process, alleviating some of the work required of human agents.

Automation through AI can also help with payment processing, managing workflows, doing market analytics, and managing collections.

AI assistants are also used to generate reports to track leasing performance to help improve occupancy and operational efficiency.

5. Mortgages

Artificial intelligence is also gaining increasing adoption in financing, including mortgages.

In underwriting, AI is used to analyze borrower information such as credit scores, income, and employment history to evaluate the borrower's risk profile and find the best rate to charge.

Artificial intelligence tools help detect and prevent fraud and can automate loan servicing tasks such as payment processing and customer communication.

Some mortgage lenders like Rocket Companies (RKT 1.23%) use AI to deliver near-instant decisions on mortgage applications. For instance, the company offers mortgage approvals in as little as eight minutes.

Related investing topics

Will AI change the world of real estate?

Will AI change the world of real estate?

Real estate is a massive, fragmented industry that is typically slow to change, but the examples above show that AI is already having an impact in areas like predictive analytics, property estimates, smart home devices, mortgages, and others.

As artificial intelligence improves, it's likely to become an even bigger part of the real estate industry.

If you're an investor looking for exposure to AI, consider looking at AI stocks or AI ETFs, or you can learn more about real estate investing to investigate more opportunities with AI in real estate.

Keep your eye out as more real estate companies are set to embrace AI in the future.

FAQs

AI in real estate FAQs

How is AI used in real estate?

Artificial intelligence is being used in real estate in a variety of ways. For example, AI-generated 3D models allow prospective buyers to tour a property without leaving the comfort of their homes. AI is also gaining popularity in underwriting to evaluate credit scores or employment history.

Is AI going to take over real estate?

Like many market sectors, AI is unlikely to replace humans entirely within the real estate industry. There are too many instances that require a personal human touch for this to be realistic. However, artificial intelligence will likely continue to grow within real estate as it can help cut costs.