Ever since the launch of ChatGPT, the business world has been captivated by artificial intelligence (AI), so it shouldn't be a surprise that investors are looking for new ways to use AI in investing.

The applications for generative AI and other forms of the emerging technology are opening up new ways for its use in investing. Now, investors are not only looking for companies that could make a fortune from AI but also for ways to use AI to become better investors and improve their returns.

In this look at AI and investing, we'll review the definition of artificial intelligence, discuss several ways that AI is being applied in investing, and explore how artificial intelligence could affect the future of investing.

What is AI?

What is AI?

Artificial Intelligence

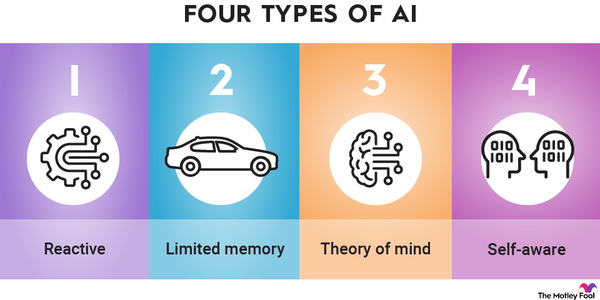

In the real world, artificial intelligence takes shape in a number of different ways. The most common application of AI is machine learning, which describes the way in which computers can be trained with data to make inferences that would typically require human thinking. This is the kind of AI that allows computers to recognize images like faces or identify a specific species of plant.

Other commonly used forms of AI include computer vision, which is critical for applications like autonomous vehicles, and natural language processing, which underpins technology like ChatGPT and other generative AI tools.

There's also robotics, which has a wide range of applications, including industrial robots that can be used for painting or welding and domestic robots like robot vacuum cleaners that are used for cleaning or home security functions.

Finally, neural networks are another example of AI that mimics the connectivity of the human brain and underpins technologies like speech recognition and natural language processing.

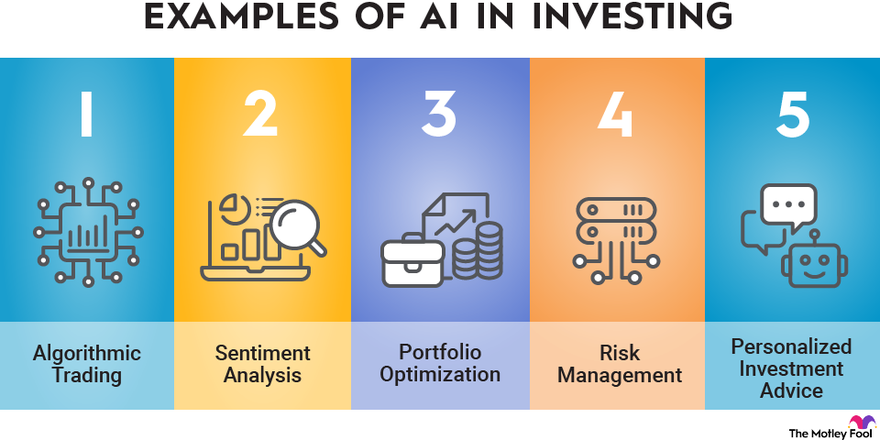

Keep reading to see five ways that AI is used in investing.

Five applications of AI in investing

Five applications of AI in investing

1. Algorithmic trading

1. Algorithmic trading

Algorithmic trading might be the most direct way in which AI is used in investing.

Traders use AI algorithms to analyze large datasets and trade at high speeds, making trades based on market trends and patterns.

Computers have the ability to analyze data much faster than humans can, giving them an advantage in high-frequency trading. Algorithms also aren't subject to human biases, which range from loss aversion to anchoring to framing, none of which affect AI algorithms.

Algorithmic trading often focuses on taking advantage of price discrepancies such as the bid-ask spread, and the gains are often small enough that it only works in high volume.

Algorithmic trading does work, but no trading strategy works 100% of the time since market conditions and traders adjust to new information quickly.

Bid and Ask

2. Sentiment analysis

2. Sentiment analysis

Another way AI is used in investing is for sentiment analysis. Markets move according to a variety of factors, such as macroeconomic data, earnings reports, geopolitical issues, interest rates, and market sentiment.

Sentiment is difficult to quantify, but investor feelings often dictate the direction of the stock market more than any other data.

Artificial intelligence programs can help traders assess market sentiment by collecting news articles, social media posts, and other online activity to measure market sentiment and predict movements.

Sentiment can also have a significant impact at the sector level, driving booms in industries like electric vehicles, cannabis, cryptocurrency -- and now, artificial intelligence stocks.

3. Portfolio optimization

3. Portfolio optimization

Portfolio management is another bedrock concept in investing. Money managers try to maintain a balance around diversification, risk, and factors like income and growth. AI can help fund managers optimize their portfolios to balance between these goals and prioritize any one of them.

There could also be a future where generative AI technologies like ChatGPT are used in portfolio management; one research team found that ChatGPT can be effective as a co-pilot when putting together a portfolio. Such a tool can be especially useful for retail investors who may not be as experienced at managing their own investments.

AI investing bots can also advise money managers on what's missing in their portfolios, informing them on how to better balance them.

4. Risk management

4. Risk management

AI can also play a role in risk management, helping money managers and companies by analyzing historical market data, volatility, and any correlations that could affect returns.

Machine learning techniques are also used in risk management to help improve efficiency and reduce costs.

In some ways, the technology can replace human labor since it's able to analyze large datasets at fast speeds with relatively little need for human intervention.

These models have demonstrated better forecasting accuracy than traditional regression models and are able to capture nonlinear relationships between risk factors and other variables.

5. Personalized investment advice

5. Personalized investment advice

Thanks to the innovation behind ChatGPT and generative AI, AI programs are starting to be able to offer personalized investment advice.

One such app is called Magnifi, which uses ChatGPT and other AI tools to provide real-time investment advice.

Magnifi acts like something of an AI-powered Robinhood (HOOD 4.44%), functioning as a trading platform that can answer questions with a chatbot interface like ChatGPT.

Although Magnifi only recently launched, we'll likely see more such AI investing platforms as investors are eager to take advantage of the new technology.

Mainstream trading platforms like Robinhood and others could also start to incorporate some of these AI trading tools soon.

Related investing topics

Is artificial intelligence the future of investing?

Is artificial intelligence the future of investing?

There's no single way to invest, and investing can't be neatly categorized like other industries.

However, investors are likely to embrace any new technology that can improve performance and alleviate some of the labor of investing, and artificial intelligence fits both criteria.

Although there will always be a human component in investing, picking stocks, and managing a portfolio, artificial intelligence is likely to play a greater role in investing as the technology develops.

If you're interested in getting exposure to artificial intelligence in your own portfolio, consider looking at AI stocks or an AI ETF to gain broad exposure to this emerging technology.

FAQ

AI in investing FAQ

How is AI being used in investing?

AI is being used in investing in a number of ways, including algorithmic trading, sentiment analysis, and chatbot interfaces to help investors analyze data and ensure that their portfolios are diversified.

Can I use AI for stock trading?

There isn't an AI that will fully automate stock trading for retail investors, but there are tools like Magnifi, an AI chatbot, that can help you invest better.

What is the best AI to invest in?

There are number of different AI stocks that have emerged as early winners in the AI boom, including GPU maker Nvidia (NASDAQ:NVDA), and AI server pro Super Micro Computer (NASDAQ:SMCI). As the generative AI revolution evolves, we're likely to see more winners.

Can AI really predict the stock market?

Some professional traders use algorithmic trading tools to help them beat the market or predict trends, but no human or computer can accurately predict the stock market all the time.

Market prices move according to a wide range of unpredictable and news-driven inputs, and there's no formula that dictates stock movements, although there are patterns.