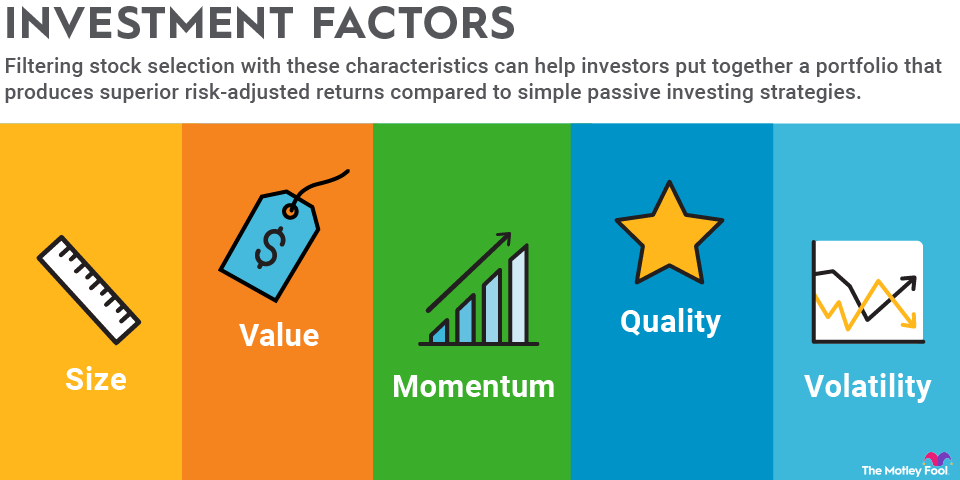

Factor investing is a strategy for selecting securities based on certain characteristics that historically outperform the broader market on a risk-adjusted basis. Factor investing attempts to explain outperformance that doesn't align with the capital asset pricing model and efficient market hypothesis.

By investing based on specific factors and combining styles, investors can create a diversified portfolio that generates better risk-adjusted returns than the total market. As such, factor investing represents an alternative to passive investing in broad market index funds.

Understanding factor investing

The core idea behind factor investing is explaining market returns that aren't fully accounted for by beta as defined by the capital asset pricing model. Beta is a measure of a stock price's volatility in relation to the overall market. If a stock has a beta measure of 2.0, that means that for every percentage point the overall market moves, the stock price moves two percentage points.

However, researchers have found that beta cannot explain total market performance. Theoretically, stocks with a high beta should outperform over time since the stock market tends to go up over the long term. In fact, a study by Robert A. Haugen and A. James Heins in the 1970s found stocks that are less volatile (i.e., those with a lower beta) outperformed more volatile stocks in the long run.

Other factors have since been uncovered by researchers, including value, size, momentum, and quality. Filtering stock selection with these characteristics can help investors put together a portfolio that produces superior risk-adjusted returns compared to simple passive investing strategies.

Monitoring the overall factors present in an existing portfolio can also ensure investors remain properly diversified within asset classes. It's one thing to diversify across asset classes -- think stocks versus bonds. It's another to diversify within the asset class -- think a mix of small-cap and large-cap stocks. Diversification across factors has shown to reduce portfolio volatility more than asset class diversification.

Ultimately, implementing a good factor investing strategy will allow investors to reduce risk and enhance returns.

Factors to consider

Researchers have identified several factors that produce meaningful outperformance.

Size

One of the simplest factors to understand and implement as part of your portfolio is size. The size factor is based on market capitalization. Stocks with smaller market caps historically outperform large-cap stocks in the long run.

This could be due to the greater risk associated with small-cap stocks. Their stock prices are generally more volatile. A sizable investment from an institutional investor could move the stock price much more than the same investment in a large-cap stock. Consider that $10 million invested in a stock with a $1 billion market cap is 1%. But $10 million in a stock with a $1 trillion market cap is just 0.001%.

Additionally, small-cap stocks have a higher risk of bankruptcy since they can't borrow money as easily as big companies. Investors should expect to be compensated for those risks.

Value

Value investing has a long history of outperformance. Benjamin Graham wrote the book on value investing along with David Dodd, and the strategy has been successfully implemented by several famous investors, including Graham's protege Warren Buffett.

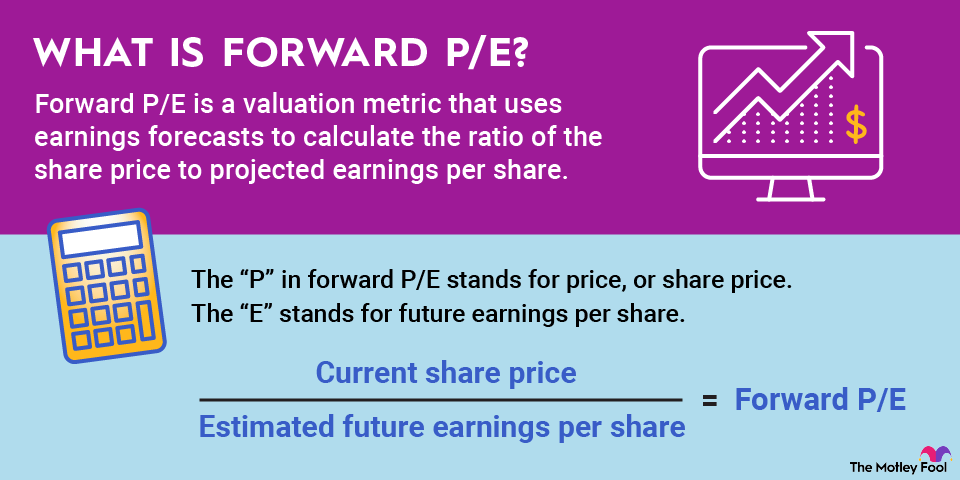

Value stocks are those that trade at low valuations based on metrics such as price-to-earnings, price-to-book, or price-to-cash flow. When the market has beaten down these stocks, it can be because the market has turned overly pessimistic about the future of those companies.

With depressed earnings expectations, these stocks will consistently produce earnings results above the Wall Street consensus. Since the stock price reflects earnings over time, the stock price climbs. The valuation multiple moves to reflect more normalized earnings expectations in the future.

Momentum

Research has found that a stock's performance over the medium term can forecast its performance in the future. Stocks that have performed well tend to continue to perform well and vice versa.

Momentum investing appears to be a quirk of market behavior. Investors may not give credence to a company's improving fundamentals or trends until it's already started to outperform the market. But once it's outperformed and has started getting the attention of investors, investors will pile into the stock, building further momentum in the stock price. That cycle can continue indefinitely as long as the company continues to outperform and produce strong financial results.

The momentum factor also carries a higher risk than other factor-based strategies. That's because an earnings miss on a momentum stock can completely kill the momentum built up over time, immediately putting the momentum in reverse.

Quality

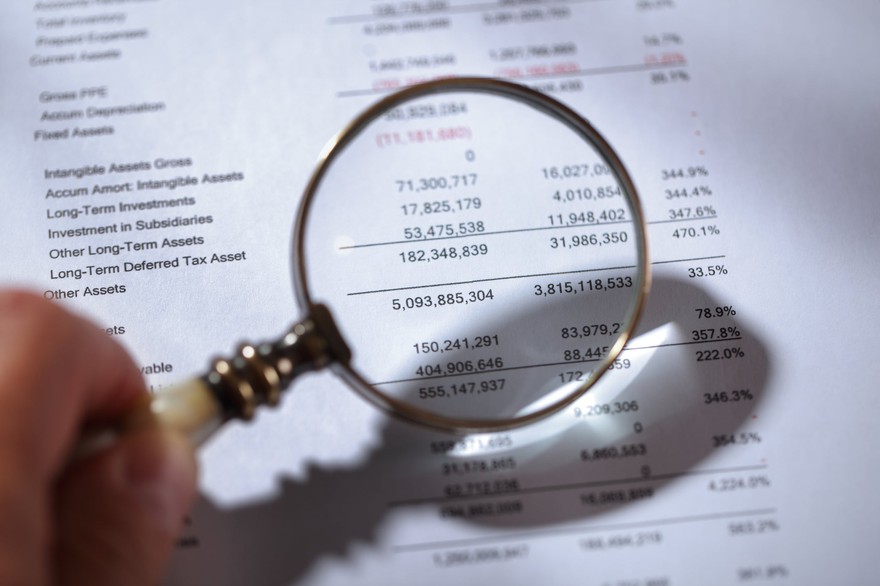

Everyone wants to invest in "quality" companies. For the purposes of factor investing, a quality company is one with stable income and cash flow and a strong balance sheet without excessive debt, producing high earnings relative to its peers. If a company has those characteristics, it's a good sign it has a durable competitive advantage.

Competitive advantages come in all forms, but the results of those competitive advantages are the same. A company with a competitive advantage can produce higher profit margins than its competitors. Furthermore, those advantages are very tough to overcome, which means the company will likely remain more profitable than the competition for years. As a result, it should produce better earnings results and outperform the market over the long run.

Volatility

Stocks with less volatile prices tend to outperform more volatile stocks over time when adjusted for risk. By investing solely in low-volatility stocks, investors can match market returns but reduce the variance in portfolio value.

The outperformance of low-volatility stocks could be attributed to certain other factors. For example, value stocks tend to have lower price volatility. Regardless, finding stocks with less volatility than the overall market should help investors find stocks that outperform when adjusted for risk. That can lead to a less bumpy ride for investors looking to live off their portfolios.

Factor investing in the real world

Factor investing has grown in popularity over the past decade or so, and financial institutions have developed products to facilitate factor investing. It's now possible to buy an exchange-traded fund (ETF) or mutual fund that focuses on a specific factor or a combination of multiple factors.

Exchange-Traded Fund (ETF)

The factor investing checkup

Understanding factor investing can help investors determine whether their portfolio is properly diversified and if they're maximizing their risk-adjusted expected return. It may be worth performing a checkup to see where your portfolio falls on each of the factors outlined in this article and if you're overexposed or underexposed to factors that could help you outperform the market.