Bitcoin (BTC -0.99%), the cryptocurrency that started it all, made some fortunate investors billions. Before it was the leader of a multi-trillion-dollar crypto market, Bitcoin was just an idea described in a white paper. For a better idea of how Bitcoin works and what makes it so special, let's look back at the Bitcoin white paper and why it's important.

What is a white paper?

What is a white paper?

A white paper is a document that provides information about a technology, product, or service. Most white papers are written in an academic style and focus on providing technical information to prospective investors and users. In Bitcoin's case, the white paper explained how it would work and the problems it would solve.

Importance of a white paper

Importance of a white paper

Bitcoin was the first cryptocurrency, and because it was introducing an entirely new concept, the white paper was a crucial part of explaining its plans. The Bitcoin white paper needed to describe the weaknesses in the current electronic payment systems and how it would work as a peer-to-peer digital currency.

Many subsequent cryptocurrencies have followed Bitcoin's lead by publishing their own white papers. The documents are often one of the best ways for people to learn about cryptocurrency projects.

Bitcoin white paper overview

Bitcoin white paper overview

The nine-page Bitcoin white paper is called "Bitcoin: A Peer-to-Peer Electronic Cash System." It was released on Oct. 31, 2008, by an anonymous author who went by the pseudonym Satoshi Nakamoto. To better understand Bitcoin, here's a breakdown of the 12 sections in its white paper:

1. Introduction

Nakamoto starts by describing the electronic payments system and its weaknesses. Since it relies on financial institutions that need to resolve disputes, there's no way to have non-reversible transactions. Businesses must accept a certain percentage of fraud as the cost of doing business and get personal information from their customers for added security.

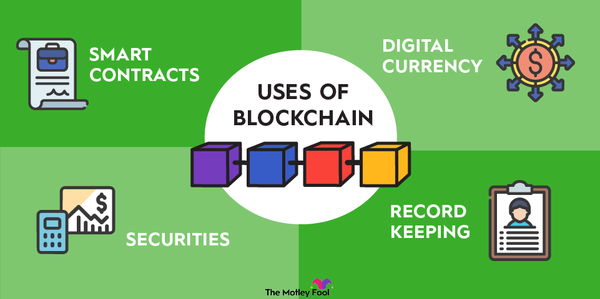

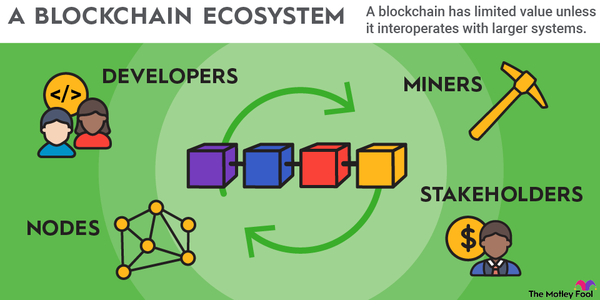

The proposed solution was a distributed timestamp server to record a series of cryptographically signed transactions in a public ledger. The purpose for the Bitcoin network would be to enable secure digital currency transactions without the need for a trusted middleman -- in other words, to create a decentralized, peer-to-peer payment network. In the following sections of the white paper, Nakamoto went into detail on all the system components.

2. Transactions

A major challenge with a digital currency is finding a way to solve the double-spend problem (the possibility of a user spending the same funds twice). The traditional solution has been for a trusted central authority to check transactions. However, this means that the entire system relies on one entity.

To do this without a central authority, Nakamoto's solution was for transactions to be publicly announced. For his solution to work, all the participants needed a way to record the order of transactions and agree on them. Publishing each block of transactions as they are added to the blockchain would allow all distributed Bitcoin nodes to agree on their order and remain synchronized. It also would allow payment recipients to be sure that the funds they received were not previously spent.

3. Timestamp server

The timestamp server is the first part of how Bitcoin solves the double-spend problem by providing verifiable evidence that a particular block existed on the blockchain at a particular time.

A Bitcoin block generally contains multiple transactions. All of the information from a Bitcoin block is crunched into a mathematical hash function, which creates a shorter, unique string of characters called a hash. This hash is a short way of verifying the integrity of the original block data. The bitcoin miner adding a new block to the blockchain will timestamp the block's hash. This hash will include the previous block's timestamp, too, so the hashes form a chain of information, each one reinforcing the ones before it.

How Does Bitcoin Mining Work?4. Proof of work

For Bitcoin to work, it needs a way to validate transactions and timestamp them. It does that with a proof-of-work system.

As mentioned in the section above, every block of transactions has a hash associated with it. In Bitcoin's proof-of-work system, network nodes, or miners, compete to complete a block with a unique number called a nonce in such a way that the block's hashed value is lower than a targeted hash value. The difficulty of guessing a hash that is lower than the targeted hash value is adjustable to achieve the desired number of average blocks per hour. Finding the correct value satisfies the requirements of proof of work because it demonstrates that the nodes have expended computing power.

As the Bitcoin white paper describes it, this is essentially a one-CPU, one-vote system. If honest nodes control a majority of the CPU power, then there will be an accurate, honest blockchain.

5. Network

On the Bitcoin network, transactions are broadcast to every node. Each node collects new transactions into a block. Then it works on finding the correct hash value for the block to satisfy the proof-of-work requirement. Once a node does that, it broadcasts the block to all nodes.

If all the transactions in that block are valid, then nodes accept it and move on to start trying to mine the following block on that chain. They show they've accepted it by adding it to the system and beginning work on the next block of transactions. Nodes always consider the longest chain to be the correct one. This is important because in the rare event of a "tie," miners could end up working on two alternate forks. However, as soon as one of them is successful at adding the next block, it will become the longest chain, and all nodes will then recognize it as the definitive blockchain.

6. Incentive

Nodes are the backbone of the Bitcoin network. To encourage honest participation, the system has a built-in reward for the creator of each block. The creator is the node that first solved a block's proof-of-work requirement and broadcast it to the other nodes.

The first transaction in a new block issues a new coin to the creator of that block. The block reward can be funded by newly minted coins, making it a way to introduce more coins into circulation. It can also be funded with transaction fees. In fact, after the full supply of Bitcoin has been mined in the future, mining rewards will come solely from transaction fees.

7. Reclaiming disk space

Older Bitcoin transactions can be hashed into a Merkle Tree. A Merkle Tree saves space by using a summary hash of multiple transaction hashes and freeing nodes from having to refer to them all individually to validate past transactions. Simply put, this allows older blocks of transactions to be compacted, reducing the amount of storage required for the blockchain.

8. Simplified payment verification

Users don't need to have a copy of the entire blockchain to verify payments. They can link a transaction to a block using the timestamp. Although they can't check the transaction themselves, they can confirm it was accepted by network nodes. This is reliable as long as honest nodes control the network.

9. Combining and splitting value

Transactions consist of inputs and outputs, which allows values to be split and combined. Each transaction can have either a single input (matching the output of another transaction) or multiple smaller inputs. A transaction can have up to two outputs -- one for sending a payment and another (if necessary) for returning change to the sender.

10. Privacy

In the traditional banking system, only the financial institutions and the parties involved have access to information about a transaction. For example, if you transfer $50 to a friend, that information is only available to you, your friend, and your respective banks.

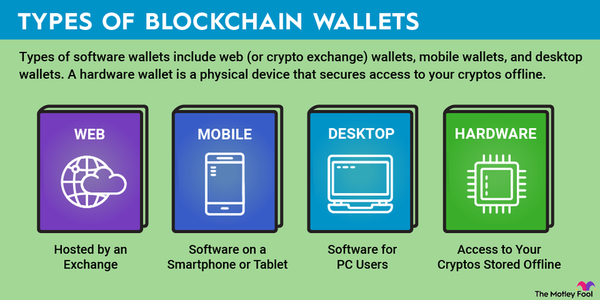

Since Bitcoin transactions are broadcast to nodes and recorded on a public ledger, privacy is maintained using anonymous public keys. The public key is an address to a Bitcoin wallet, which doesn't contain any information about the owner of the wallet. The white paper notes that a new key pair (with a new address) should be used for each transaction to preserve privacy.

11. Calculations

The only way for an attacker to steal Bitcoin would be to change one of their own transactions and take back funds they recently spent. To do this, they would need to wait until the transaction was confirmed on the blockchain so the recipient sees it. Then the attacker would need to change that transaction and build their own "attacker chain" that catches up to and exceeds the correct blockchain.

The probability of success is very low, and the longer an attacker waits to start their own chain, the more the chances of success fall. In this section, Nakamoto provides calculations to consider how many blocks would need to be added before a recipient could be confident the sender can't change the transaction.

12. Conclusion

Nakamoto concludes with a recap of the white paper and summarizing all the different components of Bitcoin and how they work together to create a secure electronic payment system that doesn't rely on trust between parties.

Changes to Bitcoin since 2008

Changes to Bitcoin since 2008

Although Bitcoin has largely followed the blueprint Nakamoto created, there have been changes to what was described in the white paper:

- Nakamoto inserted a 1MB block size limit into the Bitcoin code in 2010. Without a block size limit, miners may not have agreed on block sizes, causing the blockchain to split.

- While Nakamoto described proof of work as "one-CPU, one-vote," miners progressed to using ASICs, which are more powerful devices designed for Bitcoin mining. They also began working together in mining pools. This has made mining more centralized and energy-intensive than originally envisioned.

- Bitcoin can now be used with the Lightning Network, a protocol designed to offer small, instant Bitcoin payments, improving scalability.

- Bitcoin has gone through multiple hard forks, which is when a new blockchain splits from the current blockchain. The most famous Bitcoin fork is Bitcoin Cash (BCH 1.71%), created when some members of the Bitcoin community wanted to increase its block size limit for more efficient transactions.

The biggest change to Bitcoin wasn't any technical update but in how it's used. It was designed as electronic cash, but it's now widely considered closer to digital gold. Instead of being a currency that people use regularly, it's more a store of value.

Related investing topics

The future of Bitcoin

The future of Bitcoin

Due to its popularity, Bitcoin adoption has been steadily increasing. It's legal tender in multiple countries, and more than 15,000 businesses worldwide accept it. It's also one of the most popular choices for those investing in cryptocurrency. However, it has attracted criticism for its mining process, which uses as much energy as a medium-sized country.

To their credit, many Bitcoin miners have been seeking out renewable energy sources. Since lower energy prices drastically increase the profitability of Bitcoin mining, the move toward renewable energy will likely be an important next step in Bitcoin's development.