What is a Roth IRA?

A Roth IRA is an individual retirement account that enables your money to grow tax-free. What's unique about Roth IRAs is that you can withdraw money without increasing your tax liability if you follow certain rules. Unlike with most other retirement accounts, Roth IRA distributions in retirement are not considered as taxable income.

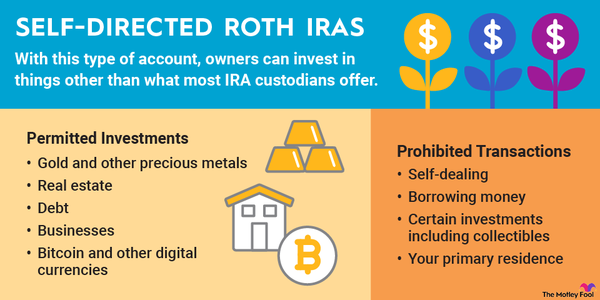

A Roth IRA isn't a specific type of investment, but rather a type of investment account. You still choose which specific securities, such as stocks, bonds, certificates of deposit, mutual funds, and exchange-traded funds (ETFs), to hold in your Roth IRA. Whether your Roth IRA gains or loses money is determined by the overall performance of the securities you choose. (You can invest in things other than what most IRA custodians offer, like cryptocurrency, if you choose a self-directed Roth IRA.)

You cannot deduct Roth IRA contributions from your taxable income as you can with contributions to traditional IRAs and 401(k)s. But once you reach age 59 1/2 and have held your Roth IRA for at least five years, you may withdraw any amount of money from the account completely tax-free. Because Roth IRA contributions are made with after-tax dollars, you can withdraw those contributions (but not their earnings) at any time without being taxed or penalized.

Roth IRA Eligibility

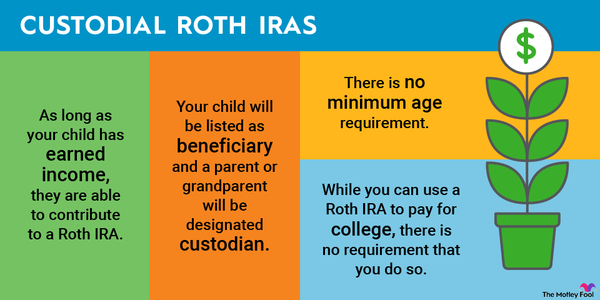

To be eligible to contribute to a Roth IRA, you need to generate earned income. Salary, hourly wages, bonuses, tips, self-employment income, and commissions -- all of which you generate by working -- qualify as earned income. Investment income, Social Security benefits, retirement distributions, unemployment compensation, and alimony do not qualify as earned income.

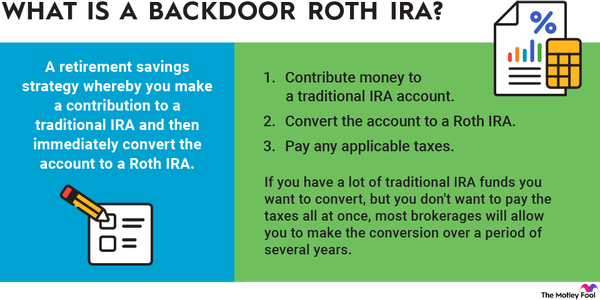

Your eligibility for a Roth IRA also depends on how much money you earn. If your income exceeds a certain amount, which varies based on your tax filing status and living situation, then you are prohibited from contributing to a Roth IRA. The only way for a high earner to still fund a Roth IRA is to use a backdoor Roth IRA strategy, which entails contributing to a traditional IRA and then converting it to a Roth IRA. This workaround, while permissible, requires you to pay tax when you convert the funds.

To determine whether you are eligible to contribute to a Roth IRA, you'll need to know your modified adjusted gross income (MAGI). To calculate your MAGI, you'll first need to know your adjusted gross income (AGI). Your AGI and MAGI will either be identical or very similar. The IRS website states that your MAGI is typically your AGI plus any tax deduction that you receive for making student loan interest payments.

Modified Adjusted Gross Income

Roth IRA income and contribution limits

Roth IRAs are subject to both income and contribution limits. Not only are you prevented from contributing to a Roth IRA if your income exceeds a certain amount, but also, for those eligible to contribute, the amount of money annually that you may invest is capped. (You need to make sure not to make excess contributions.)

The Roth IRA contribution limit is $6,500 for 2023, and $7,000 in 2024, if you are younger than age 50. If you are 50 or older, then the contribution limit increases to $7,500 in 2023, and $8,000 in 2024. That extra $1,000, known as the catch-up contribution, is meant to help older people to "catch up" on investing as they near retirement.

Based on your tax filing status and MAGI, the table below specifies how much -- if anything -- you can contribute to a Roth IRA.

2023 and 2024 Roth IRA income and contribution limits

| Tax filing status | 2023 MAGI | 2024 MAGI | Contribution limit |

|---|---|---|---|

| Single, head of household, or married person filing separately who did not live with spouse during the tax year | Less than $138,000 | Less than $146,000 | $6,500 ($7,500 for ages 50 and older) in 2023; $7,000 ($8,000 for ages 50 and older) in 2024. |

| $138,000-$153,000 | $146,000-$161,000 | Reduced in proportion to amount of income over MAGI limit | |

| $153,000 or more | $161,000 or more | $0 (no contribution allowed) | |

|

Married couple filing jointly or qualifying widow/widower |

Less than $218,000 | Less than $230,000 | $6,500 ($7,500 for ages 50 and older) in 2023; $7,000 ($8,000 for ages 50 and older) in 2024. |

|---|---|---|---|

| $218,000-$228,000 | $230,000-$240,000 | Reduced in proportion to amount of income over MAGI limit | |

| $228,000 or more | $240,000 or more | $0 (no contribution allowed) |

Benefits of a Roth IRA

The way that Roth IRAs work, they confer many benefits, including:

- Tax-free income in retirement: Depending on how much you contribute to a Roth IRA and how well the investments in the account perform, being able to withdraw money tax-free in retirement from your Roth IRA could result in enormous income tax savings. In addition, if you are retired and use money from your Roth IRA to make a large purchase one year, then you don't have to worry about an abnormally high income tax bill or the possibility of being bumped into a higher tax bracket for that year.

- Tax- and penalty-free withdrawals for first-time homebuyers: If you purchase a home, and you and your spouse haven’t owned a home within the past two years, then you are considered as a first-time homebuyer. This enables you to withdraw up to $10,000 of earnings from your Roth IRA without paying income tax or the early withdrawal penalty. The $10,000 limit, however, is a lifetime cap that does not reset each year.

- Unrestricted withdrawals of contributions: You can withdraw your original contributions to a Roth IRA at any time without paying a penalty or tax. Because you paid income tax on the money in the year that you earned it, you may withdraw that same money without restriction, regardless of your age or when you opened the Roth IRA.

- No required minimum distributions: Also known as RMDs, required minimum distributions are specific dollar amounts that owners of other types of retirement accounts must accept starting at age 73 (previously age 72). Roth IRAs are exempt from RMDs because receiving distributions from this type of account doesn't change how much you owe in taxes.

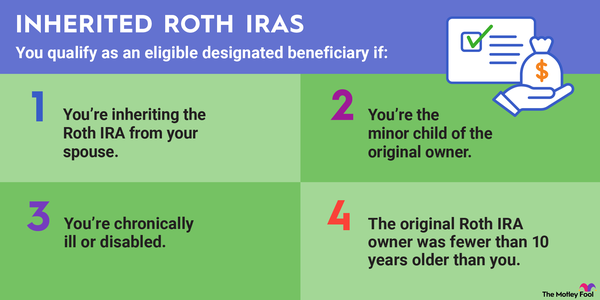

- Tax-efficient inheritance strategy: A Roth IRA can be willed to your heirs, who can receive the account's balance tax-free.

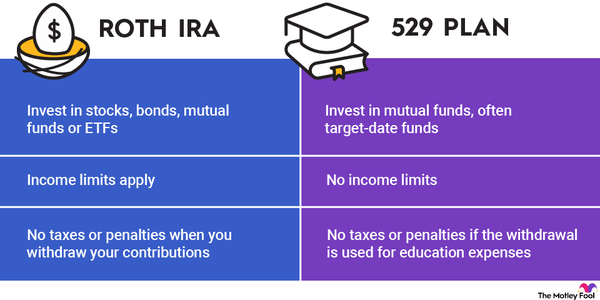

- Education: Some account holders leverage a Roth IRA instead of a 529 for education savings.

Related Retirement Topics

Roth IRA vs. traditional IRA

The Roth IRA and traditional IRA have many features in common and a few important differences. You can generally use both types of accounts to invest in the same types of securities like stocks, bonds, mutual funds, and ETFs. Additionally, with both types of accounts, your investments grow tax-free.

The key differences between Roth and traditional IRAs include:

- Tax deductions: With a traditional IRA, you may be able to deduct your contributions from your taxable income, although traditional IRAs have income limits that could affect how much you are allowed to deduct. Contributing to a traditional IRA lowers your income tax liability now, while contributing to a Roth IRA helps you to avoid income taxes in retirement.

- Retirement withdrawals: Roth IRA withdrawals in retirement are not taxed because the contributions were already taxed in the years in which they occurred. Traditional IRA contributions are not taxed in the years that they occur; instead, withdrawals from traditional IRAs are taxed as income in retirement.

- Required minimum distributions: With a traditional IRA, once you turn age 73, you are required to accept a minimum amount of money as a distribution every year. You are also required to pay income tax on that distribution. Roth IRAs, for which the distributions in retirement are tax-free, do not have RMDs.