If you’re running a business, then nailing down a robust accounting software is non-negotiable for keeping your finances in check. Remember, the software you pick should align with the size and demands of your business. Thankfully, today’s market is bursting with options, spanning a wide range of features and price points. So, there’s really no excuse not to find a software solution that fits your needs like a glove.

The good news? When it comes to accounting software for small businesses, you’re spoiled for choice. The not-so-good news? All those options can make your head spin if you’re not sure what you’re looking for. The best way to avoid getting overwhelmed is to pinpoint the features that are non-negotiable for your operations and start your search from there.

Our top ten picks for accounting applications cover a broad spectrum—from streamlined solutions perfect for solo entrepreneurs to comprehensive systems that will scale seamlessly as your business expands. No matter where you are in your business journey, there’s a tool out there that’s just right for you.

| Product | Description | Next Steps |

|---|---|---|

|

Rating image, 4.60 out of 5 stars.

4.60/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

FreshBooks offers invoicing, time and expense tracking, simple project management and a wide range of general accounting applications all in one easy-to-use desktop and mobile interface.

|

|

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Zoho Books is an affordable entry-level accounting application with features to automate workflows and track expenses and a client portal that lets you share estimates and invoices with customers.

|

|

|

QuickBooks Desktop

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

QuickBooks Desktop remains a favorite among small business owners. Read our review of this popular small business accounting application to see why.

|

|

|

AccountEdge Pro

Rating image, 4.70 out of 5 stars.

4.70/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

AccountEdge Pro has all the accounting features a growing business needs, combining the reliability of a desktop application with the flexibility of a mobile app for those needing on-the-go access.

|

|

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management.

|

|

|

AccountingSuite

Rating image, 4.40 out of 5 stars.

4.40/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

AccountingSuite is an excellent accounting software application best suited for small businesses looking for good inventory management capability.

|

|

|

OneUp

Rating image, 4.30 out of 5 stars.

4.30/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

With full-featured accounting, invoicing, CRM, and inventory management capability, OneUp does the work of several applications, all wrapped up in one affordable software package

|

|

|

Rating image, 4.20 out of 5 stars.

4.20/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Xero is an online accounting solution with apps for invoicing, expense management, inventory management, project management, and bill payment. It includes a mobile app and supports unlimited users.

|

|

|

Rating image, 4.20 out of 5 stars.

4.20/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Sage Business Cloud Accounting is a good fit for sole proprietors and freelancers. It uses double-entry accounting and includes tools for tracking sales, expenses, contacts, banking, and reporting.

|

|

|

Rating image, 4.20 out of 5 stars.

4.20/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

QuickBooks Online is the browser-based version of the popular desktop accounting application. It has extensive reporting functions, multi-user plans (for up to 25 users) and an intuitive interface.

|

|

|

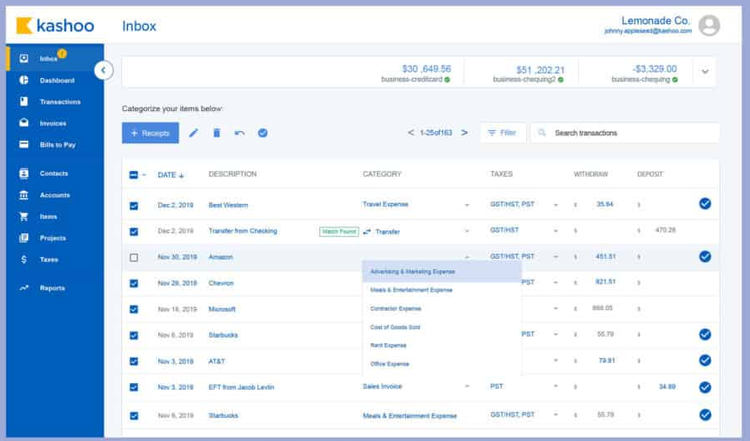

Kashoo

Rating image, 4.10 out of 5 stars.

4.10/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Kashoo is a small business accounting application that combines invoices, banking and credit accounts all into one inbox for simple, one-click invoicing and bill payment.

|

|

|

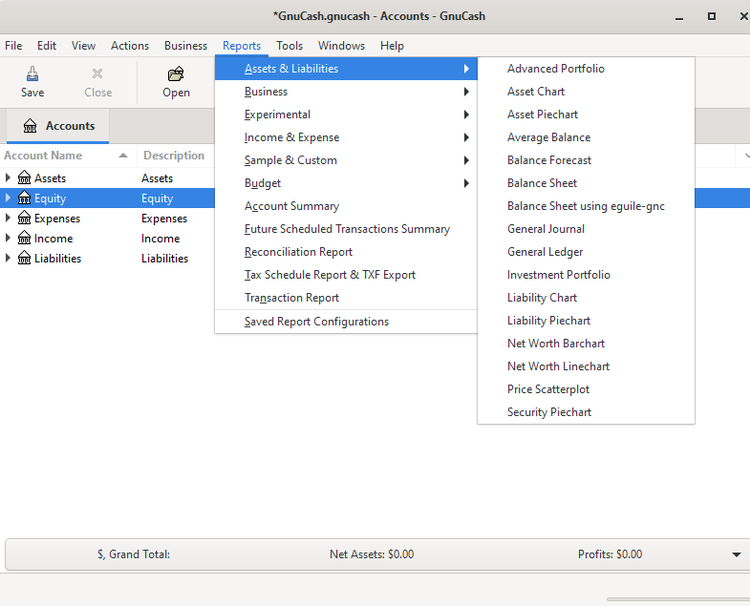

GnuCash

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

GnuCash is an open-source accounting software that's also used to manage personal finances. It features double entry accounting, a checkbook-style register and tools for account reconciliation.

|

|

|

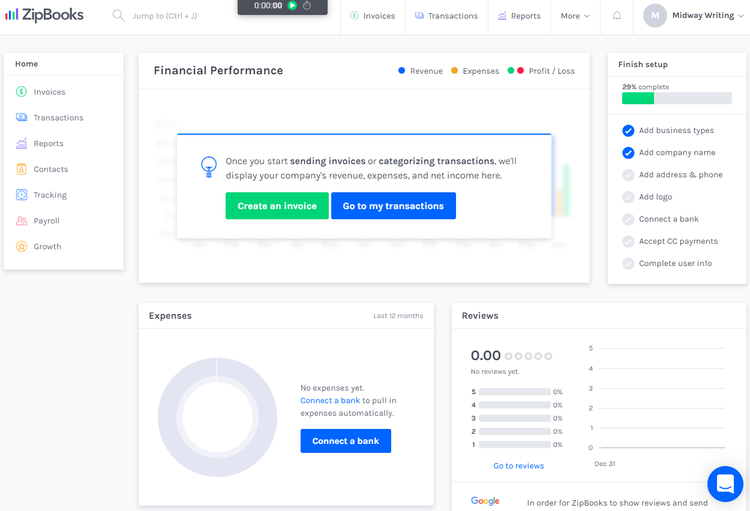

ZipBooks

Rating image, 3.90 out of 5 stars.

3.90/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

f you’re a small business owner looking for an easy to use, free accounting software application, be sure to check out ZipBooks, an online application that offers a free plan.

|

|

|

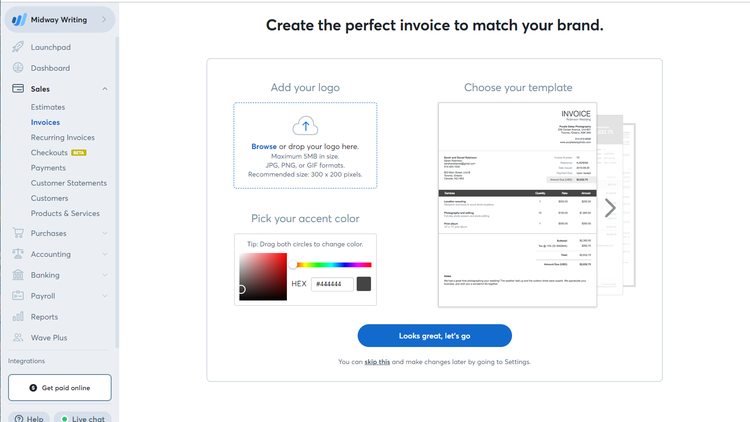

Wave Accounting

Rating image, 3.80 out of 5 stars.

3.80/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Wave helps small businesses and freelancers manage double-entry accounting. It features a simple UI and applications for payroll and online payments and includes 2 months of free chat support.

|

FreshBooks is an online accounting software application that works well for sole proprietors and freelancers.

The Retainers feature in FreshBooks also makes it ideal for attorneys, accountants, or any professional who charges their clients a retainer fee.

Offering a solo version and a team version, you can easily connect with other employees or contractors you work with.

New features in FreshBooks include the ability to automatically capture receipt data, eliminating the need to enter information manually. Users can also now stop and later restart a timer when recording time for any project. Finally, if you work with an accountant, FreshBooks recently introduced the FreshBooks Accounting Partner Program, making it easier to share data with your accountant or CPA.

Freshbooks also offers ACH payment acceptance, solid invoicing capability, and the ability to create and manage projects.

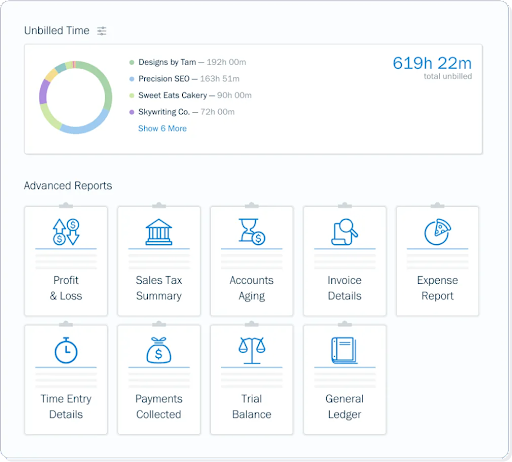

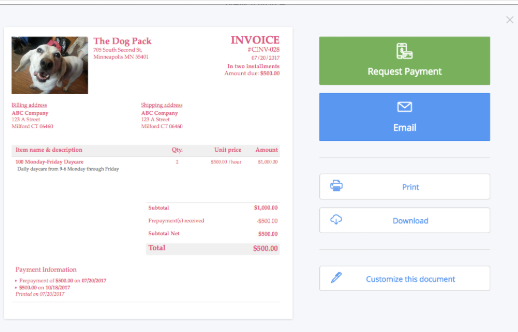

FreshBooks provides an overview of all unbilled time to ensure that clients get billed properly. Image source: FreshBooks.

You can also create estimates and proposals in FreshBooks, and connect the application to your bank accounts for easy expense management.

Payroll is not offered in FreshBooks, though it does integrate with Gusto Payroll, if you have employees to pay. FreshBooks also offers a mobile app for both iOS and Android devices.

FreshBooks offers four plans: Lite, Plus, Premium, and Select. The Lite plan is suitable if you’re self-employed, while the Premium plan is a good fit for small businesses. FreshBooks Lite runs $15 a month, Plus is $25, and Premium is $50, with a 70% discount for the first three months. Select custom pricing is available from the company.

Perhaps the biggest benefit of using FreshBooks is that you’ll actually use it. A lot of freelancers and self-employed folks can remain stubbornly attached to using a spreadsheet to manage their business finances, but FreshBooks is so easy to use that you’ll happily ditch your spreadsheets.

Offering just enough features for small businesses without saddling you with a bunch you’ll never use, but have to pay for, FreshBooks is worth the minimal investment.

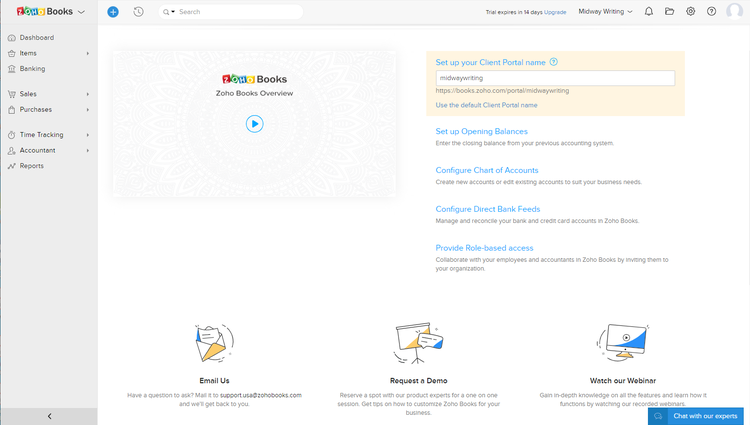

If you’re a sole proprietor, freelancer, or starting a brand new business, Zoho Books is for you.

Affordable for even the tightest budget, Zoho Books includes a solid inventory management feature and provides new users with step-by-step directions for everything from general setup to writing an invoice, making it easy to get your new business set up and running quickly.

Zoho Books offers a long list of features, though most are in the Professional plan. These features include automated workflows, good expense tracking, recurring transactions, project management, and the ability to create custom invoices. New in Zoho Books, users can add tax preferences directly to existing customers and vendors. Users can now save custom reports in the system for future use, and a new bank account overview has also been added.

The Zoho Overview takes new users through the entire setup process step by step. Image source: Zoho Books.

A client portal is available that allows you to share invoices with your customers, and has been updated to allow customers to sign up from the portal on their own. Zoho Books includes an accountant version that lets you share your business details with your CPA or accountant.

Zoho Books also offers easy online payment options for your customers, with a mobile app available for both iOS and Android devices.

Perhaps the biggest drawback to Zoho Books is its limited integration with third-party apps, along with the lack of a payroll option.

Zoho Books offers six different plans, ranging from a free plan for those with revenue less than $50,000 per year, to the Ultimate plan, which supports up to 15 users and includes 25 custom modules. The Standard plan is $10/month, Professional $20/month, Premium $30/month, Elite $100/month, and Ultimate $200/month when billed annually.

One of the biggest benefits of Zoho Books is the amount of resources devoted to non-accountant users. Zoho Books takes the time to explain everything, providing a greater comfort level for new users.

QuickBooks Desktop 2022 includes several new features that are designed to streamline various processes. These new features include:

- Scheduled bill payment

- Automatic bill entry using the mobile app

- Ability to attach documents via a mobile devicey

- Up to 38% faster than previous versions

In addition, all QuickBooks editions offer the following features:

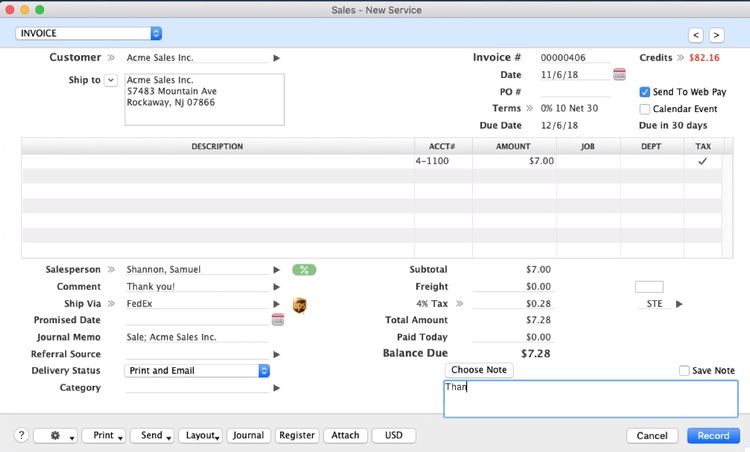

Invoicing

QuickBooks Desktop offers top notch invoicing software capability, allowing users to create a professional invoice for their customers. The Premier edition offers users a variety of industry-specific invoice templates including professional, product, and service invoice templates.

You also have the option to use QuickBooks Payments in order to get paid faster, including the ability to add a ”Pay Now” button to customer invoices for easy payment.

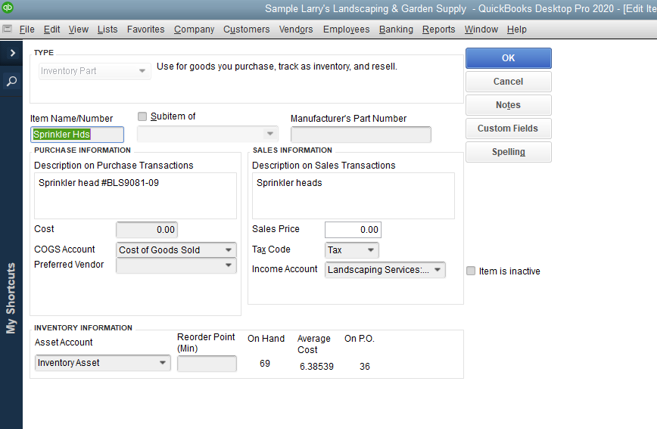

Inventory

Good inventory tracking capability is available in all QuickBooks Desktop editions, with the ability to track all products sold, cost of goods, and inventory management, including inventory adjustments.

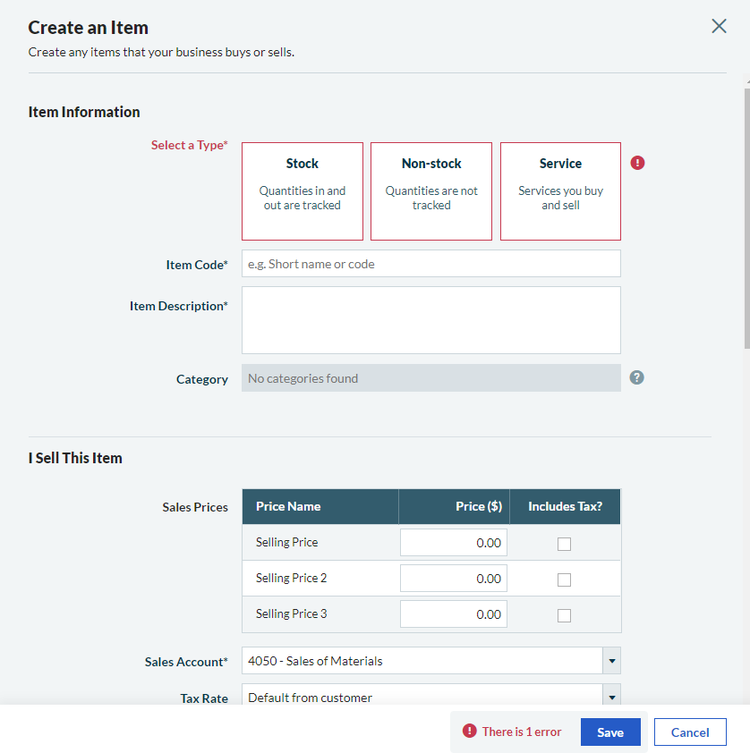

You can easily add inventory items to QuickBooks Desktop, with custom fields available for tracking additional details. Image source: QuickBooks.

The Premier edition’s inventory module offers more advanced inventory features, including low stock alerts, the ability to track any product by manufacturer’s part number, the option to add product cost, and the ability to set reorder points. In addition, there are custom fields that can be used to track additional information for any inventory item.

Pricing for QuickBooks Desktop starts at $349.99/year for Pro Plus 2022, with Premier Plus running $549.99/year, and Enterprise coming in at $1,206/year, with special pricing for the first year.

AccountEdge Pro has the honor of being our top-rated accounting application and with good reason.

A good fit for small and growing businesses, AccountEdge Pro is an on-premise application that also offers the convenience of remote access, taking you easily through the entire accounting cycle. A hosted version of AccountEdge Pro is also available for those that need anytime/anywhere access to the application.

Easy integration with Shopify and UPS Shipping makes AccountEdge Pro a particularly good fit for online retailers, as does the recently added integration with Square, allowing you to directly import Square transactions into AccountEdge Pro.

AccountEdge Pro offers solid invoicing capability, along with excellent time and billing functionality that can track both billable and non-billable hours. Self-service and full-service payroll is also available, and a solid inventory module lets you easily manage your stock. AccountEdge Pro recently added an automatic bank feed option, allowing you to connect both bank and credit card accounts to the application. A $5 subscription fee is required to use the bank feed option.

AccountEdge Pro offers top-notch invoicing capability for small and growing businesses. Image source: AccountEdge Pro.

As an added bonus, AccountEdge Pro also includes a Contacts feature for tracking customers, vendors, and employees using a single database. And with the new integration with Zapier, AccountEdge Pro can now connect with thousands of web apps.

Reporting options are excellent in AccountEdge Pro, including an audit trail report. A mobile app for both iOS and Android devices is also available.

AccountEdge Pro offers two plans: AccountEdge Pro and Priority ERP. Pricing for Pro is a la carte style, with a single user license starting at $15/month, with additional licenses $10/month. A payroll subscription is $15/month, with phone support costing $15/month as well. Pricing for Priority ERP is customized for each company. . As for add-ons, a subscription to AccountEdge Connect currently runs $25/month for up to five users, while AccountEdge Pro Hosted is available for $40/user per month.

One major benefit of using AccountEdge Pro is the stability it brings as an on-premise application that also offers remote access. With options available for a single user all the way up to an enterprise-level business, you will never outgrow AccountEdge Pro.

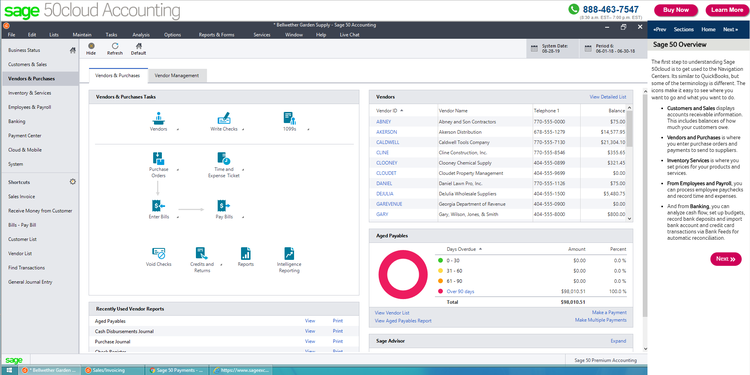

Previously known as Peachtree Software, Sage 50cloud Accounting is a hybrid solution that is installed on-premise, but also includes an option to connect to the application remotely if necessary.

Sage 50cloud Accounting is a good choice for small and growing businesses, with multiple plans available. Sage 50cloud Accounting includes a solid inventory module and offers integration with multiple point-of-sale (POS) applications, which makes it particularly suitable for retailers.

Sage 50cloud Accounting offers excellent vendor management capability. Image source: Sage 50cloud Accounting

Sage 50cloud Accounting allows you to connect your bank accounts or track your business expenses in a more traditional fashion. The application also includes excellent customer management and sales management, including the ability to accept online payments. You also have the option to pay your vendors electronically, or by printing checks for mailing.

The Inventory module in Sage 50cloud Accounting includes multiple pricing levels along with user-defined fields for tracking additional information. Two payroll options, Essentials and Full-Service, are available, and reporting options are top-notch.

Sage 50cloud Accounting also includes a mobile app for both iOS and Android devices.

Sage 50cloud Accounting offers three plans: Pro, Premium, and Quantum, with yearly pricing starting at $340 for the Pro plan. The Premium plan, which most small businesses would likely benefit from, costs $554/year, while Quantum pricing runs $919/year. All pricing is for a single user system, with additional users extra.

A scalable application with three plans available, Sage 50cloud Accounting can be beneficial to growing businesses.

Integration with Microsoft 365 offers easy online accessibility, and access to POS and inventory features makes this application particularly useful for both brick-and-mortar retailers as well as those who sell products online.

AccountingSuite offers the features that small businesses have come to expect from any software application, including cloud accessibility and solid accounting capability. Bank connectivity is also offered in AccountingSuite, with the application able to connect to over 9,000 financial institutions.

You can manage your invoicing in the Sales module, and process and pay bills in the Purchases module. Both project and time tracking capability are offered in the application as well, so you can track projects and profitability, while the time-tracking feature allows you to record the time spent on each individual project.

But AccountingSuite also has some outstanding features not always available in small business accounting software.

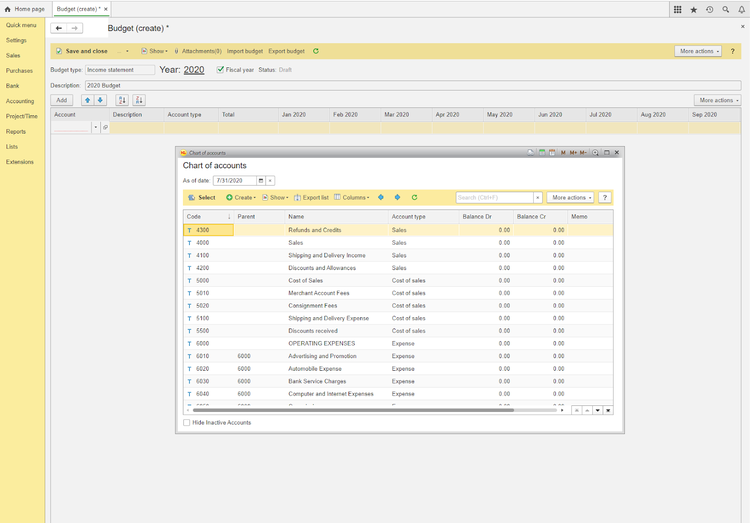

Budgeting

Not all small businesses need a budget tool, but if you can get one with your software application, why not take advantage of it? AccountingSuite offers a surprisingly robust budget tool that lets you create budgets for each account in your general ledger.

The budget tool lets you create budgets for the current fiscal year or for any year in the future, and you can choose the account types you wish to include in the budget.

AccountingSuite offers easy budget creation, with quick access to your chart of accounts. Image source: AccountingSuite.

There is also a pre-fill option, which can be used to automatically pre-fill the budget with actual data from the application or from an imported file. If you want to see how close you come to budget, run the Budget Report, which calculates actual income and expenses and compares the actual to budgeted totals.

AccountingSuite offers four plans. Its Start Up plan supports a single-user, and runs $19/month. Also available is the Business Plan, which supports two users for $25/month, the Professional plan, which supports up to five users and costs $55/month, and the Pro Plan with E-Commerce, which supports up to 10 users and runs $129/month.

Be sure to read the full review for a full discussion of all of AccountingSuite's features.

OneUp is the best small business accounting application you’ve probably never heard of. Ideal for sole proprietors and freelancers, with its robust inventory management module, OneUp is a great option for retail businesses.

OneUp is also suitable for growing businesses, with pricing based solely on number of users rather than features, with the Self plan, for a single user, including the same features as the Unlimited plan.

OneUp offers a good selection of features, including the option to connect your bank accounts or enter transactions manually.

Other features include the ability to process vendor and sales quotes, purchase orders, and credit memos, and the Opportunities feature lets you track and manage all potential sales directly to a product.

OneUp offers a terrific invoicing option, with the ability to request payment immediately. Image source: OneUp.

OneUp does not offer the option to process checks for vendor payments, though you can pay your vendors electronically or enter payment information directly in the application. A mobile app is also available for both iOS and Android devices.

OneUp pricing starts at $9/month for the Self plan, and goes all the way up to $169/month for the Unlimited plan, with all plans including the same features, so you’ll only need to scale up if you add additional users, not to gain access to more powerful features. The biggest drawback to OneUp is the lack of a payroll option.

By far, the biggest benefit of using OneUp is having access to all of the application’s features and functions from day one, whichever plan you choose.

Xero is online accounting software that offers the convenience of running your business from anywhere. It’s designed for the small business owner who doesn't want to spend a lot of time learning accounting but wants to stay on top of business performance. Xero works great for a variety of niche markets, including retail, IT, legal, e-commerce, and start-ups, and its ability to deal with multiple currencies makes it a good fit if you conduct business globally.

Xero offers double-entry accounting, with a default chart of accounts that can be customized if needed included in the application. Recurring journal entries are available in the application, and you can easily connect your bank accounts to Xero for automatic import of all bank transactions.

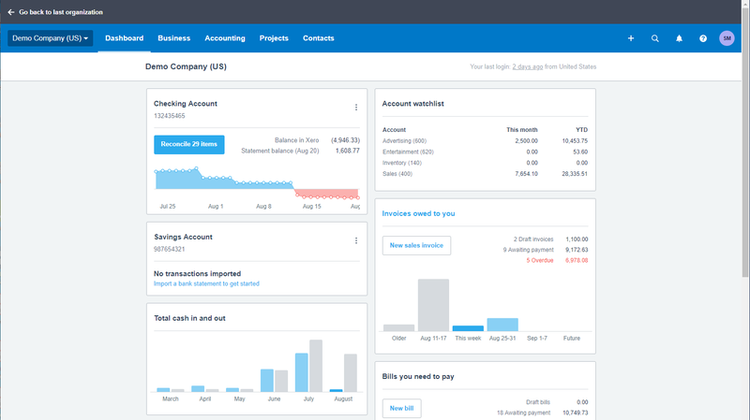

Xero’s dashboard offers a summary view of your business finances. Image source: Xero.

Xero also offers enhanced invoicing, so you can create a more professional invoice. In addition, you can create invoices from a mobile device and email them directly to your customers.

Basic inventory management, bill payment, and newly updated reporting options are also available in Xero. And, if you’re dealing with multiple projects, Xero lets you manage them simultaneously, create multiple invoices, and track performance throughout the life of the project.

Xero is nicely scalable and has three plans available. If you're just starting out, you can subscribe to the Early plan, which runs $12/month, and scale up to the more robust Growing plan at $34/month, or the Established Plan, which runs $65/month.

While Xero does not offer payroll, it does offer integration with Gusto, starting at $39/month.

Xero also includes accounting apps for both iOS and Android devices, with dozens of enhancements and updates made in the last 18 months. If you want an application that offers easy integration with hundreds of apps, Xero is for you. It integrates with more than 700 third-party applications in a variety of categories, including payroll, point-of-sale, practice management, time-tracking, CRM, and e-commerce.

Ideal for sole proprietors and freelancers, Sage Business Cloud Accounting also includes solid inventory management, making it a good option for retailers, particularly online sellers.

There is no payroll feature available in Sage Business Cloud Accounting, nor in the third-party apps the application integrates with, so it’s probably not the best choice for your business if you have employees to pay.

Sage Business Cloud Accounting includes numerous sales features such as quotes and estimate creation, credit notes, and the ability to customize invoices as needed.

Sage Business Cloud Accounting offers good inventory management capability. Image source: Sage Business Cloud Accounting.

A built-in tracking feature lets you view invoice status, including invoices sent, invoices due, and those past due. You can connect Sage Business Cloud Accounting with your bank, and the products and services option lets you manage both stock and non-stock items in your inventory. A mobile app is also available for both iOS and Android devices.

Sage Business Cloud Accounting offers two plans: Accounting Start and Accounting. Accounting Start is $10/month, with Sage temporarily reducing the cost of the Sage Accounting plan to $7.50/month for the first six months, after which it reverts to the regular price of $25/month. Accounting Start is really only suitable for freelancers and sole proprietors, while almost any other type of business will need the Accounting plan, which offers more robust features.

One of the biggest benefits of using Sage Business Cloud Accounting is access to Sage Marketplace, which offers connectivity to more than 100 third-party apps, all designed to integrate with Sage applications.

QuickBooks Online is perhaps the most recognized of all of the small business accounting applications. Designed exclusively for small businesses, QuickBooks Online offers easy anytime/anywhere access that was lacking in their more robust desktop version.

A good fit for small and growing businesses, QuickBooks Online is often compared to FreshBooks. It integrates with hundreds of third-party applications, making the application suitable for all types of businesses.

QuickBooks Online features vary widely from plan to plan, with many of the more robust features found only in the more expensive plans.

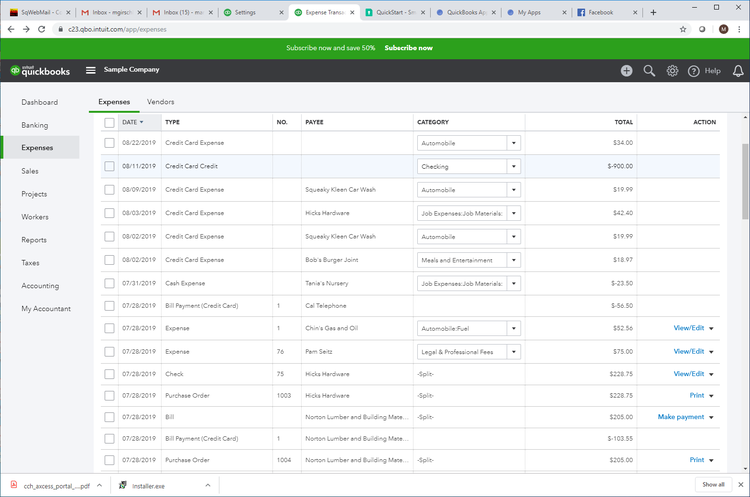

Features available in all plans include online banking connectivity, including the ability to now connect to third-party payment processing applications such as PayPal and Square. QuickBooks Online also includes receipt capture capability for preparing expense reports, as well as a good expense management feature.

QuickBooks Online offers easy expense management, including numerous bill payment options. Image source: Intuit QuickBooks Online.

Excellent sales tracking and inventory management capability are also available, and you can easily download the mobile app for both iOS and Android devices.

QuickBooks Online does not include payroll, but does include the option to add Intuit payroll services directly to its current plan.

In addition, QuickBooks also offers integration with other third-party payroll applications.

QuickBooks Online’s pricing can be confusing, with posted prices reflecting an initial discount, and regular pricing kicking in after the first three months. Pricing starts at $15/month for the Simple Start plan for a single user, rising to $30/month after three months.

Other plans include Essential, which supports up to three users and starts at $27.50/month, then rises to $55/month; Plus, which is designed for five users and runs $42.50/month for the first three months and then doubles to $85; and the Advanced plan, which can handle up to 25 users and starts at $100/month, rising to $200/month after three months.

One of the biggest benefits of using QuickBooks Online is its integration with hundreds of apps in a variety of categories which include payroll, inventory, HR, and project management.

Originally designed for consultants, sole proprietors, and freelancers, Kashoo continues to offer good bookkeeping basics along with expanded options that make it suitable for consultants looking for an invoicing solution to small businesses looking for a complete accounting solution.

Kashoo does offer integration with SurePayroll for those that need to pay employees, though you may want to consider a more robust application if you need to pay more than a few employees. Kashoo offers a streamlined user interface, making it easy to navigate, even for less tech-savvy users.

Kashoo offers easy invoicing, with the ability to add a credit card payment to any invoice for quicker payment. You can also create recurring invoices for customers that are billed a set amount each month.

Kashoo's new Inbox feature provides access to all current tasks. Image source: Kashoo.

Kashoo lets you track incoming bills, with the option to pay vendors electronically, though there is no option to process checks for payment.

The Lists feature lets you manage all of your customers and vendors, and the Add-ons area provides you with easy access to any third-party applications you’ve linked to Kashoo.

The application offers a mobile app for both iOS and Android devices that can be used in conjunction with its web app. It includes features such as dashboards, expense capture and receipt upload, invoice creation and tracking, and payment acceptance.

Kashoo has completely restructured its plans, offering a plan for those who want to generate invoices, one for very small businesses, and one that offers complete accounting capability. The Truly Small Invoices plan lets you get started at no cost, while the Truly Small Accounting plan is $20/month. For those interested in complete accounting capability including advanced reporting, multiple users, and payroll, the Kashoo Accounting plan runs $30/month.

If you’ve been holding out on moving to accounting software, Kashoo may be a great first step, providing you with solid accounting features at a price that any small business can afford.

GnuCash is a free, open-source accounting software that offers both financial management and accounting functionality.

An on-premise application which will need to be downloaded and installed on your computer, GnuCash is ideal for start-ups, sole proprietors, and freelancers. Designed as a single-user application, GnuCash is not a good option for small businesses in a growth phase.

GnuCash offers a variety of solid accounting features including complete accounts payable, accounts receivable, and business budgeting capability.

You can also track vendors and customers in GnuCash, although you can only add a limited amount of detail. GnuCash offers excellent budgeting capability with a good selection of financial statements, management, and accounting reports available.

GnuCash includes an excellent selection of financial and management reports. Image source: GnuCash.

A depreciation management feature is also available in the application, and payroll tracking is available, but there is no full-service payroll feature available.

An Android app offers limited functionality, with no iOS app available at this time.

As open-source software, GnuCash is completely free, which can be beneficial to small businesses that do not have the budget to pay for accounting software.

However, as open-source software, that also means that support is limited to online documentation, which includes an in-depth help manual, along with the GnuCash Wiki.

Free accounting software is never a bad thing, but aside from being free, one of the biggest benefits to using GnuCash is its ability to be installed on a variety of operating systems, including Windows, MacOS, Linux, FreeBSD, and Solaris.

Though a relative newcomer to the small business accounting scene, ZipBooks can be the ideal solution for small business owners, including freelancers, consultants, and sole proprietors, though it’s best used by those with some familiarity with the accounting process.

ZipBooks also includes a free plan that’s ideal for those with a limited accounting software budget.

ZipBooks offers two plans, with the free Starter plan offering a good selection of features, such as bank account connectivity for one account, unlimited customer tracking, and sales management, including accounts receivable management.

ZipBooks tracks the financial performance of your business. Image source: ZipBooks.

The Smarter plan also includes features such as custom invoicing, the ability to connect to multiple bank accounts, and an auto-billing option great for those that bill the same amount monthly.

ZipBooks previously offered a mobile app for iOS, but it has been discontinued, with the company stating that it is working on an updated app for both iOS and Android devices.

ZipBooks offers three plans along with an Accountant plan. Though the free plan offers limited features, it does include unlimited invoicing, online payment acceptance, unlimited customer and vendor management, and the ability to connect one bank account..

Both the Smarter plan, at $15/month, and the Sophisticated plan, at $35/month, offer advanced features such as time-tracking, document sharing, and more robust reporting options. Those interested in the Accountant plan will need to contact ZipBooks for a custom quote.

One of ZipBooks’ biggest benefits is the availability of a free plan, which allows small businesses to start using the application and easily scale up to a paid plan if necessary.

Wave helps small businesses and freelancers manage double-entry accounting. It features a simple UI and applications for payroll and online payments and includes 2 months of free chat support.

All Wave Accounting features are free, although there are costs if you need to process credit card payments, run payroll, or wish to utilize their bookkeeping support option.

Wave offers customizable invoicing options. Source: Wave Software.

A completely free application, Wave offers invoicing, payment acceptance, accounting, banking, and in some states, payroll.

Best for freelancers, those working solo, or contractors, Wave offers solid accounting capability, including complete income and expense tracking, with the ability to connect unlimited bank and credit card accounts to the application.

Wave also tracks cash flow, flags overdue invoices, and even offers the option to accept online payments, although there is a charge for this service. Wave also offers an optional payroll feature though tax services are only available in a handful of states.

Of course, the biggest benefit to using Wave is that it’s free, but the product offers a surprising level of features and functions.

Who uses accounting software?

Who really needs accounting software? Ideally, it would be anyone and everyone who's running a business. Unfortunately, it's not as widespread as it should be. Yet, the truth is, every business owner—regardless of their industry—could benefit from using accounting software. This includes the contractor you hired to craft that snappy press release, the property management company that cashes your rent checks each month, the bank holding your mortgage, your family doctor, and even your attorney.

In essence, if you're in business, you should be tapping into the power of accounting software. Why? Because accurately tracking and managing your financial information is non-negotiable when it comes to understanding the fiscal health of your enterprise. Without such tools, it’s a challenge to get a clear picture of where your business stands financially. Whether it's sorting expenses, managing invoices, or preparing for tax season, accounting software is a game-changer for maintaining your financial well-being.

Why use accounting software?

Smart business owners use accounting software for a variety of reasons. Some use it because it simplifies the entire record-keeping process. Entering a customer into a software application and creating an invoice is much easier than entering that same information into a spreadsheet, and then having to create an invoice in another application. Others use it because they want to know how much money they're making, or in some cases, not making. Still others use it to keep a better handle on their business expense categories.

How will you know how healthy your business is if you have no idea who owes you money or how much money you've spent in the last six months? How will you convince a bank to give you a credit line if you can't show them that your business is financially healthy? Perhaps most important, how will you keep track of your various tax obligations if you're not adequately tracking sales tax, use tax, employment tax, and employee withholding tax?

Below are some of the benefits of using accounting software.

You'll always know the financial status of your business

Instead of consulting multiple files to see how much you're spending, how much you've been paid, or how much is still owed, you can view all this information from one central dashboard.

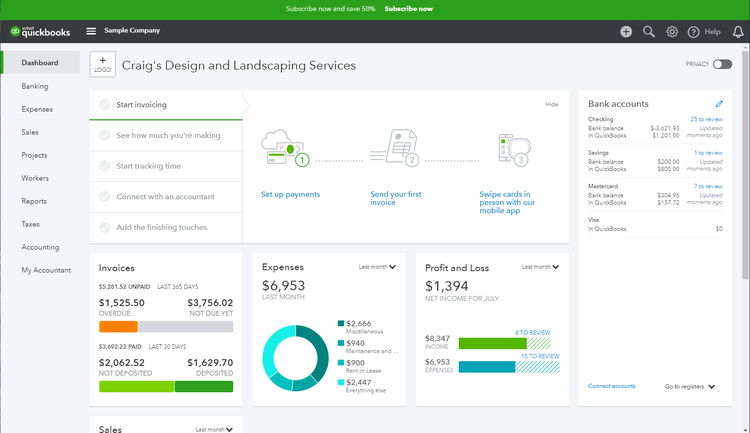

The QuickBooks Online dashboard provides all the details you need to stay on top of your business. Source: Intuit QuickBooks.

This dashboard view from QuickBooks Online (above) gives you the information you need in one convenient location, including paid and outstanding invoices, where you've spent your money, and even the current balances of your bank accounts. So, stop looking at multiple spreadsheets and start using accounting software.

It's a faster way to get paid

We all want to get paid, otherwise, there's really no reason to be in business. But one of the ways to get paid faster is to make it easy for your customers to pay you. Accounting software helps with everything from including payment links in invoices to accepting electronic payments through your bank to accepting credit cards through a merchant account. Making it easier for them to pay a bill will likely mean that they'll pay you faster, or at the very least, on time.

Taxes, taxes, taxes

If you use accounting software for anything, use it to remain tax compliant. If you sell anything, you will owe taxes. If you pay employees, you will owe taxes. If you live in a large, metropolitan area, or sell in multiple states, you will owe taxes to several different agencies.

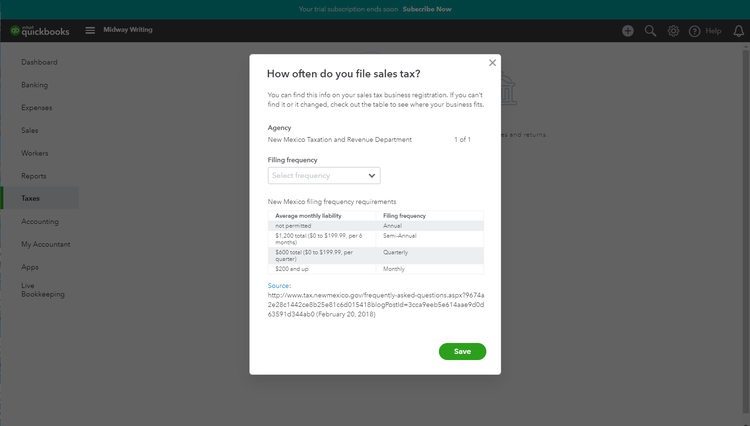

QuickBooks Online offers easy sales tax setup in the application. Source: Intuit QuickBooks Online

As the QuickBooks Online screen (above) asks, how often do you file sales tax? Using the appropriate accounting software will enable you to remain compliant with all tax agencies. You'll be able to charge your customers the correct tax rate while also running reports that show how much tax is owed to each tax agency.

If you have employees, you'll have payroll taxes that need to be paid on time, such as federal withholding, state withholding, Social Security and Medicare taxes, and unemployment taxes. Let your accounting software do the heavy lifting and provide you with the tools you need to always be compliant.

Your reports are accurate

Transposition errors, extra decimals, decimals in the wrong place, extra zeros, not enough zeros; these are all things that can happen when you use spreadsheet programs to create reports manually. Professionally prepared reports give your business credibility. When you use accounting software, your reports are prepared using information you've already entered into the system. If that information is accurate, so are your reports.

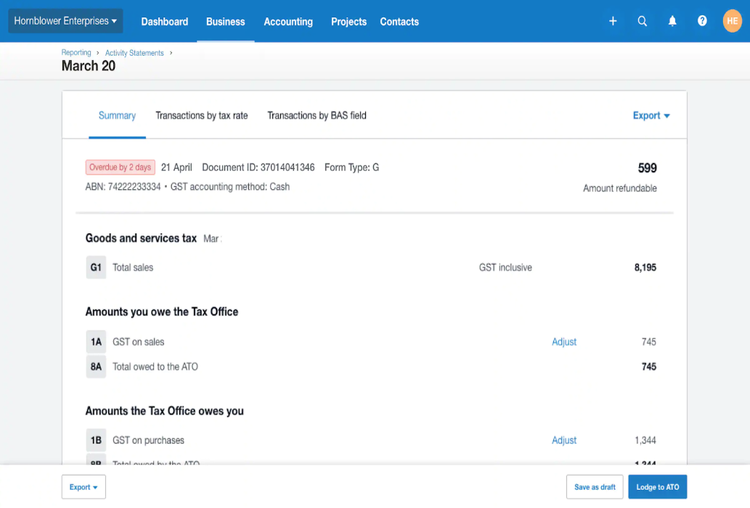

This report from Xero provides detailed sales tax information. Source: Xero.

Microsoft Excel lovers shouldn't feel too bad. Most accounting software applications allow you to export your reports to Excel, where you can customize them if you wish; the difference being that you're starting with the correct numbers.

What are the different types of accounting software?

There are three types of accounting software applications that are typically used.

- Commercial accounting software: This ranges from simple applications that offer bare-bones features to full-service applications that offer complete accounting functionality. There are also a variety of add-on modules to choose from. Commercial software is usually available as a downloadable application delivered via subscription as SaaS (Software as a Service) or from the cloud.

- Enterprise resource planning (ERP) software: This is typically only used by the very largest companies. ERP software is notoriously expensive, and unless you're a billion-dollar company, it's likely much more than you will ever need.

- Custom accounting software applications: These were popular about twenty years ago, but have mostly disappeared from offices simply because of the scope of features now found in commercial accounting software. Custom packages can also prove to be more trouble than they're worth and typically don't integrate with any other applications.

Key accounting software functionality

Accounting software applications should offer most, if not all, of the following features.

Core accounting features:

- Double-entry accounting

- Invoicing (A/R)

- Bill payment (A/P)

- Customer & vendor management

- Banking

- Budgeting

- Management reporting

Additional modules:

- Inventory management

- Purchase orders

- Payroll

- Sales/point-of-sale

You may not get every module in every product, but you should get the modules that are necessary for you to run your business.

What to consider when buying accounting software

What features are most important for your business?

Is easy invoice creation important to you? Then you need an application that makes creating an invoice quick and painless. Do you offer a variety of products to your customers? If so, you need a way to manage your inventory properly. What about banking? Do you always forget to record your expenses when you use your credit card? If that's you, then you'll want an application that will import all of your banking transactions, and record them to the proper expense account.

If you have employees, you need a way to pay them, as well as a way to make sure that your tax obligations are taken care of. While most accounting software does many, if not all, of these things, you need to decide what features are a must-have, and look accordingly.

Your budget

While it's important to purchase the accounting software that will work best for you, your organization's budget considerations can also play a role in your final decision. If you're a sole proprietor or freelancer on a very strict budget, you may have to choose from the applications that are within your reach. But don't panic, many of the best applications available today are under $25 per month.

Your business niche

The type of business you run may play as much of a role in your final decision as cost and features. If you sell hair products online, you will have different needs than a graphic artist that provides a design service. But what if you sell products and services? Simple. Just make sure that the product you purchase is suited to both.

Support

While most people don't think about support when comparing accounting applications, you may want to spend a few minutes looking at the available support options. I guarantee that nothing will be more frustrating than trying to figure out the answer to a problem without a good support structure in place. Knowledge bases are great, but they are no substitute for an actual human being.

Our Small Business Expert

Portions of this page have been refreshed by ChatGPT. These portions are reviewed by internal Motley Fool editors to ensure accuracy and validity. All data and metrics are sourced and verified by human editors without ChatGPT involvement.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.