Blockchain technology and the cryptocurrencies based on it received lots of attention in 2020, led by the more than 300% increase in bitcoin's value. As assets with finite supplies, cryptocurrencies go through cycles since price swings result from fluctuating supply and demand. Businesses that make use of blockchain technology and cryptocurrencies may also be cyclical; however, since revenue-generating organizations are not the same as a raw asset like currency, they have different cycles from crypto assets such as bitcoin.

Here are some companies that use blockchain tech or are otherwise connected to crypto, along with explanations of how their business models are cyclical (or not) and when may be the best times to buy their stocks.

How blockchain stocks are cyclical

How blockchain stocks are cyclical

We need an understanding of what makes a company (as distinct from cryptocurrency prices) go through cycles before we can dive into the companies themselves. On one end of the spectrum are companies that sell physical products. This landscape can comprise a diverse group of companies, even within a relatively narrow sector such as the tech hardware industry. Revenue for such companies may depend on consumer demand (like for smartphones) or be tied to innovation that drives a hardware upgrade cycle among customers (like for GPU makers NVIDIA (NVDA 1.27%) and AMD (AMD -0.31%) -- more on them in a minute).

Then there are those sectors and companies that go through longer cycles based on the health of the overall economy. Three examples are airlines, automakers, and oil and energy firms. When money is flowing through the economy at a healthy pace, demand for these core goods and services is strong. But during times of recession, revenues for companies in these same sectors can begin to contract. Retail sales are similarly cyclical, and a company such as the payment processor Square (SQ -2.58%), discussed more below, is directly affected due to its relationship to the retail landscape.

On the opposite end of the spectrum are those technology companies that sell stable and predictable subscriptions in accordance with the software-as-a-service (SaaS) business model. These companies exhibit little to no correlation with market cycles, although the stocks of such companies can be very volatile and subject to rapid change due to factors like number of subscribers and revenues generated. DocuSign (DOCU 1.31%) is a blockchain stock that falls in this camp.

Four cyclical blockchain stocks

Four cyclical blockchain stocks

Different cycles govern each crypto-related business. Let's go over how these cycles work.

NVIDIA and AMD: The tech hardware cycle

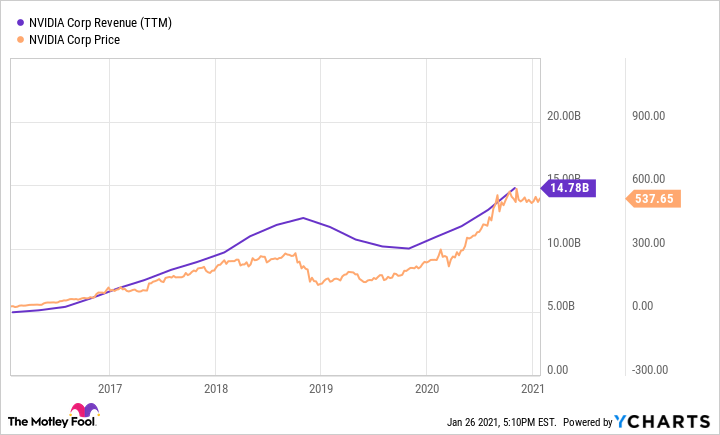

During the Bitcoin boom of 2017, shares of NVIDIA and AMD were also off to the races. Both companies make graphics processing units (GPUs), a type of semiconductor historically associated with cutting-edge video game graphics. More recently, the GPU has found new uses as a computing accelerator for complex functions such as cloud computing, artificial intelligence, and cryptocurrency mining.

NVIDIA and AMD experienced surges in sales as many customers scooped up high-end GPUs to mine bitcoin and other cryptocurrencies. By the end of 2017, though, the wave of purchasing had started to subside, sending both chipmakers into a cyclical sales slump. Since then, many new cryptocurrencies have moved away from mining (a process organized around proof of work, whereby a computer needs to solve an equation to create a new "block" of crypto assets) to proof of stake (a process by which new crypto assets are created not through processing power but rather based on how many units of the asset an owner possesses).

Thus, NVIDIA and AMD's most recent growth isn't being dictated by a resumption of demand for GPUs to create crypto assets. Instead, the companies' growth is being driven by demand for upgrades to data center hardware. The crypto industry and most other technologies require ever greater computational power and benefit from increasingly powerful data center computing. And, even during the current recession, demand for GPUs is still rising and may continue to rise for another couple of years.

Square: The consumer spending cycle

Consumer spending is a standard measure of the health of the U.S. economy. After a decade of consumer spending increasing by low- to mid-single-digit percentages, COVID-19 has disrupted this trend. Many segments (department stores, clothing and accessory chains, restaurants) of the retail landscape have been decimated by the pandemic and the resulting lockdowns, while other sectors (grocery stores, online merchants) have experienced demand increases. Payment processor Square's performance is tightly correlated with the health of its merchants, but, luckily for Square, many of them have been transitioning to conducting more business online, which has mitigated much of the revenue decline Square otherwise would have experienced.

As consumer spending begins to normalize again, Square's growth in digital payments is likely to resume apace. Square also generates income by allowing bitcoin trading in its subsidiary Cash App. Since Square's income generated from bitcoin trading could fluctuate with the price of the token, the cryptocurrency cycle could dictate Square's fortunes. But, as a digital payments specialist, this e-commerce company could incorporate blockchain and related tech into many facets of its operations, enabling blockchain technology to grow in importance in the retail industry.

DocuSign: The SaaS supercycle

Cloud computing was one of the best sectors in which to invest during the 2010s, and the trend is far from over in the 2020s. The world is continuing to go digital, and subscription-based access to services is helping businesses and consumers alike to make the transition. DocuSign is a platform that facilitates electronic signatures and agreement processes, and it uses blockchain technology to help secure signer identity and contract evidence.

Supercycle

As subscription models go, SaaS firms such as DocuSign are as cycle-free as they come. SaaS businesses generate stable and predictable revenues, and many are disrupting the industry status quo and growing rapidly as a result. As SaaS businesses age, they could become more cyclical since their stability depends on retaining subscribers and staving off competition from similar services. (The mobile phone industry has matured and evolved in a similar fashion in recent years.)

But, for now, any cyclicality for a blockchain stock like DocuSign comes primarily from the stock itself. If growth exceeds investor expectations, then the share price can spike. If growth is lower than expected, then the opposite often occurs.

When to buy cyclical blockchain stocks

When to buy cyclical blockchain stocks

As with all attempts at market timing, consistently pinpointing the bottom or top of the market is close to impossible. However, purchasing stock in increments over time -- perhaps by accumulating shares of a company in smaller batches over the course of a few months or quarters -- can help to alleviate pressure to get the timing right.

But at what point should an investor start accumulating a cyclical crypto or blockchain stock? Assuming that the long-term outlook for a company is positive, beginning to accumulate shares during a cyclical slump is preferable to waiting for the slump to end. For example, after NVIDIA's cyclical peak in 2018, the stock lost nearly half of its value (dropping to less than $150 from a peak of nearly $300) by the end of the year and remained down for much of 2019. Accumulating shares during this period, when most investors had a negative view of the company, would have yielded a hefty return through the end of 2020, when demand for GPUs soared again and NVIDIA's stock price increased well past $500 per share.

A similar story can be told of the cycles affecting other business sectors. When parsing crypto and blockchain stocks, consider accumulating shares in batches during cyclical downturns and scaling back on purchases once the slump gives way to renewed demand.