Trading in cryptocurrencies will always come with some transaction fees. The crypto exchange you’re using probably charges some fees of its own, and you can’t get around the fee structures that are built into the cryptocurrencies themselves. But what are these fees, and how big can they get? Let’s have a look.

What are they?

What are cryptocurrency transaction fees?

A transaction fee is a charge that is attached when you’re buying or selling something. As the saying goes, there’s no such thing as a free lunch.

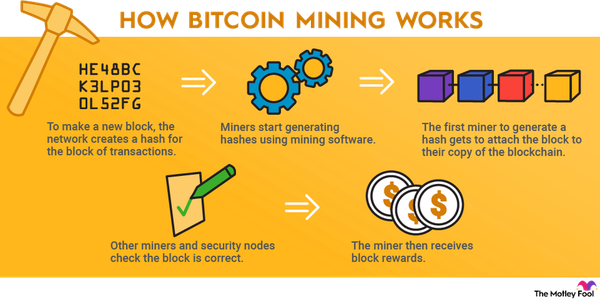

For cryptocurrencies, that means charging fees at a couple of different levels to keep the blockchain networks running and to incentivize the people providing transaction validation services.

The existence of fees also lowers the risk of pointless or harmful transactions overwhelming the cryptocurrency platforms. Any system for payments and data transfers without transaction fees would quickly be flooded by spam.

Cryptocurrency transaction fees explained

Cryptocurrency transaction fees explained

These fees come in different varieties:What is an NFT?What is an NFT?What is an NFT?

- Crypto exchanges and trading services charge trading fees whenever you’re buying, selling, or exchanging digital currencies on their platforms. This is a key money-making strategy for the exchanges on top of ancillary revenue streams such as advertising, listing fees, and premium services.

- Blockchain wallets that aren’t part of a crypto exchange’s standard service usually charge their own fees for each deposit or withdrawal. These fees typically support the wallet’s development and maintenance.

- Every cryptocurrency has transaction fees built into their basic operating structure. Bitcoin (BTC -0.7%) calls it a network fee, Ethereum (ETH -0.38%) transactions result in gas fees, and the Solana (SOL -2.56%) platform simply refers to processing costs as transaction fees. The costs are automatically baked into the transaction price so they’re largely invisible to the buyer and seller, but you can rest assured that some additional value is changing hands behind the scenes. The names may vary, but they all boil down to the same idea of attaching a small expense to each transaction.

How big are network fees?

How big are network fees?

Generally speaking, network fees tend to be small. For example, the median Bitcoin transaction moved approximately $700,000 per trade in late 2021 and early 2022. The median network fee over the same period was roughly $0.50. Given Bitcoin’s tendency to change prices at the drop of a hat, the network fee amounts to a rounding error under normal circumstances.

However, the fees can skyrocket when the blockchain network is unusually busy. For example, Ethereum’s gas fees skyrocketed to thousands of dollars per transaction in May 2022. Massive demand for a coveted series of Ethereum-based non-fungible tokens (NFTs) threw the network off-kilter for a few hours, and then the gas prices cooled down again.

As you can see, transaction fees are a crucial component of the business model for many different players in the crypto world. You can’t avoid these transaction fees entirely, but you can minimize them by choosing cryptocurrencies, trading services, and digital wallets with care.

Fee schedule

Cryptocurrency exchange fee schedule

The rules and fee structures for cryptocurrency transactions are unique to each trading platform. To highlight the common concepts and differences, let’s compare and contrast some of the most popular crypto exchanges.

Binance.us

Binance is the largest cryptocurrency trading platform in the world. The trading platform offers a few different trading methods, similar to a stock brokerage.

Transaction fees are higher for “Takers,” who use market orders that fill immediately at the current market price. “Makers” rely on limit orders that set a specific target price and may take longer to execute but at a lower transaction fee. Makers provide liquidity for other traders, while Takers consume assets from the same liquidity pool.

Binance’s transaction fees are based on your trading volume in the past 30 days, and you also need to hold an increasing number of the Binance Coin (BNB -2.69%) stablecoin to qualify for lower fees.

Here are the requirements and the effective trading fees for Makers (limit orders) and Takers (market orders):

| Binance Level | Minimum 30-Day Trade Volume | Minimum Binance Coin Balance | Maker Fee | Taker Fee |

|---|---|---|---|---|

| VIP 0 | $0 | 0 | 0.10% | 0.10% |

| VIP 1 | $50,000 | 50 | 0.09% | 0.09% |

| VIP 2 | $100,000 | 100 | 0.08% | 0.09% |

| VIP 3 | $500,000 | 200 | 0.07% | 0.08% |

| VIP 4 | $1,000,000 | 400 | 0.05% | 0.07% |

| VIP 5 | $5,000,000 | 800 | 0.04% | 0.06% |

| VIP 6 | $10,000,000 | 1,500 | 0% | 0.06% |

| VIP 7 | $25,000,000 | 2,500 | 0% | 0.05% |

| VIP 8 | $100,000,000 | 4,000 | 0% | 0.04% |

| VIP 9 | $250,000,000 | 6,000 | 0% | 0.03% |

| VIP 10 | $500,000,000 | 6,000 | 0% | 0.02% |

On top of this structure, Binance gives you a 25% discount on fees when you pay them from your Binance Coin holdings.

For example, let’s say your first Binance order is worth slightly more than $100,000 of your favorite cryptocurrency, skipping the Binance Coin discount. This will set you back $100 in transaction fees, whether you placed a market order or a limit order. A second order of the same size will have qualified for the VIP 2 pricing tier (assuming you have at least 100 Binance Coin in your portfolio). A limit order with the Binance Coin discount would reduce the fees for this transaction to $60.

Coinbase

One of the best-known crypto platforms in the U.S. is Coinbase (COIN 5.68%). Like Binance, Coinbase offers lower transaction fees for people with higher 30-day trading volumes, and Takers pay more than Makers. However, this platform doesn’t have discounts based on a native stablecoin, so Coinbase’s fee schedule is a little bit simpler:

| Minimum 30-Day Trade Volume | Maker Fee | Taker Fee |

|---|---|---|

| $0 | 0.40% | 0.60% |

| $10,000 | 0.25% | 0.40% |

| $50,000 | 0.15% | 0.25% |

| $100,000 | 0.10% | 0.20% |

| $1,000,000 | 0.08% | 0.18% |

| $20,000,000 | 0.05% | 0.15% |

| $100,000,000 | 0.02% | 0.10% |

| $300,000,000 | 0% | 0.08% |

| $500,000,000 | 0% | 0.05% |

Coinbase charges far lower fees for a handful of specific trading pairs. When exchanging stablecoins against other stablecoins, or stablecoins against fiat currencies, Takers see a transaction fee of 0.01% while Makers aren’t charged any fee at all. The same discount applies when you’re exchanging Bitcoin for Wrapped Bitcoin (WBTC -0.9%) or the other way around.

Going back to the trades from our Binance example, you’ll find that Coinbase tends to be a bit more costly. The first $100,000 trade with no volume-based rebates triggers a $600 fee for liquidity Takers and $400 for a limit-order Maker. The second order drops down to a fee of $200, or $100 for Takers and Makers, respectively. Binance’s Maker fees fade out to zero after a $10 million monthly trade volume, and Coinbase’s fee-free tier starts at $300 million.

Coinbase is easy to use and packed with customer-friendly features, but you can find significantly lower transaction fees elsewhere.

Robinhood

The popular stock broker Robinhood (HOOD 4.44%) also offers trading services for a handful of cryptocurrencies. The company says that your crypto trades are commission-free on Robinhood, with a 0% fee for any type of order.

While Coinbase and Binance earn revenue and profits from their transaction fees, Robinhood makes money in other ways. First, it doesn’t actually execute crypto trades on its own. Instead, the company routes its incoming cryptocurrency orders to market makers in exchange for transaction rebates that are not passed on to the customer.

Furthermore, crypto orders are not executed at the current market price. Instead, you’ll buy crypto tokens from Robinhood at a slightly inflated price, while selling them at a lower price. The difference between effective transaction prices and current quotes tends to sit near 0.4%, which is comparable to the fees charged by Coinbase or Binance.

Related investing topics

Cryptocurrency exchanges with low transaction fees

You’ll never be able to avoid cryptocurrency transaction fees entirely, but you can choose to use services with lighter fee structures. Those fees can add up if you do a lot of trading in the crypto market.

Fee-free options include Robinhood, eToro, ShakePay, and BlockFi. Exchanges such as BitMEX and FTX charge transaction fees below 0.1% for both Makers and Takers. However, as noted above, every trading service will make some money on your crypto orders.

The difference between the cheapest and most expensive option worked out to as much as 2% in some test runs, while dropping down to a rounding error in other cases.

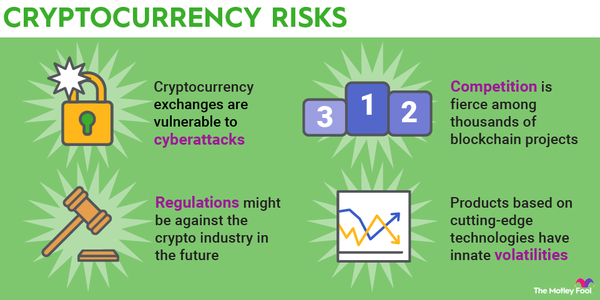

Overall, smaller investors have more to gain from picking the right service than well-heeled traders do. Just as you should take care to stick with reputable and trustworthy cryptocurrencies, your trading platform should back up their affordable transaction fees with ironclad data security, powerful cryptocurrency screening tools, and an unshakeable financial platform.

While looking for the right combination of these crucial features, you should consider investing in safer asset classes such as stocks instead. When well-respected corporations dip their toes in the crypto opportunity, you can gain exposure to the same thrilling but dangerous market by investing in these companies instead.