You can buy, sell, and otherwise trade in cryptocurrencies in a couple of different ways. In many cases, the tax man wants his cut of these money-moving actions. Here are the basics of virtual currency transactions and how you report them for tax purposes.

What are virtual currency transactions?

The Internal Revenue Service (IRS) has a clear definition of virtual currencies, also known as cryptocurrencies or digital currencies.

“Virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value,” according to the agency. More specifically, the IRS only looks at so-called convertible virtual currencies for taxation purposes because they are cryptocurrencies that can be exchanged for traditional currencies such as the dollar or euro.

The IRS knows that people may use virtual currencies in different ways. Some buy them as a long-term investment; others use cryptocurrencies to pay for goods and services. Either way, any transaction that involves a taxable virtual currency may be subject to taxation.

Virtual currency transactions explained

The IRS issued its first guidance on virtual currency transactions in 2014. In the agency’s bulletin, virtual currency was classified as a type of property subject to the same property transaction rules as real estate holdings or stocks.

The 2014 guidance also carved out provisions for paying or getting paid in the form of virtual currencies “to the same extent as any other payment made in property.”

The IRS guidance was clarified in a 2019 revision. The update added rules for reporting cryptocurrencies received in hard forks, which is where a new digital currency is created and tokens are given to the holders of the original cryptocurrency. The rest of the 2014 guidance remains unchanged, and the IRS still refers to that document in its official cryptocurrency guidance documents.

The framework may change in the near future since Congress and several agencies of the U.S. government are exploring how to regulate cryptocurrencies in the long term.

How virtual currency transactions work

There are several distinct types of virtual currency transactions:

- Buying a cryptocurrency on the open market in exchange for fiat currency creates a virtual currency asset on your part, and you should record the original investment as the cost basis for future transactions.

- Selling your cryptocurrency on the open market is the reverse of the crypto-buying event. Here you may be subject to taxation on the capital gains realized between the purchase and the sale.

- You can purchase cryptocurrencies by exchanging them for other cryptocurrencies. For example, you may trade some of your Bitcoin (BTC 1.69%) holdings for some Ethereum (ETH 1.17%) tokens. In this case, you should record the transaction as the basis for your new Ethereum holdings while reporting the capital gains you realized on the Bitcoin you used.

- Virtual currencies can undergo a hard fork from time to time, creating a new cryptocurrency that is a tweaked version of the original. This is the method developers use for improving a digital currency over time. Typically, the old code remains under one name while the updated code moves on under a different name. Holders of the original cryptocurrency receive tokens of the new one. Hard forks from the Bitcoin code base have created well-known altcoins such as Bitcoin Cash (BCH 2.25%), Litecoin (LTC 5.74%), and Bitcoin Gold (CRYPTO:BTG). The taxable cost basis of coins received in a hard fork is equal to their fair market value on the day you received them.

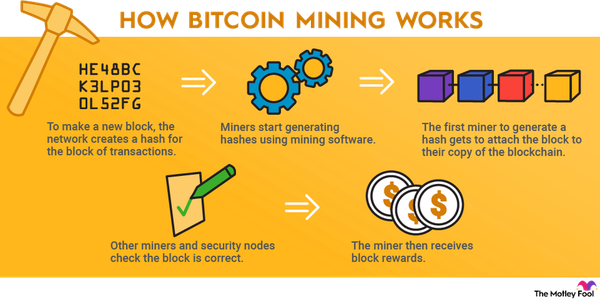

- You can also receive cryptocurrencies from your own crypto mining activities, giving you ownership of digital coins that never had a previous owner. These coins are taxable when you sell them, and your capital gains will be equal to the price you received in the final sale. The IRS considers your cost basis to be zero.

Pros and cons of virtual currency transactions

Cryptocurrencies are different from ordinary dollars in many ways. They are a high-risk, high-reward type of investable asset comparable to the riskiest parts of the stock market, such as penny stocks.

On the upside, cryptocurrencies can be sent across long distances and international borders much faster and with lower fees than traditional bank transfers. Trading is available 24/7/365 because the crypto market never sleeps -- the automated computing processes that run the show are always active. Some cryptocurrencies have gained in value against the dollar over time, so the sector has attracted interest from investors who don’t mind the additional risks.

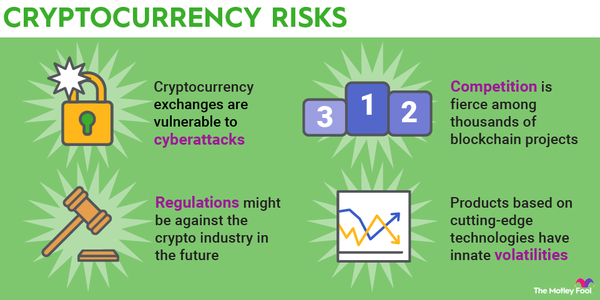

However, the potential rewards also come with lots of risk. Only a handful of cryptocurrencies have delivered game-changing returns while hundreds of failed altcoins only destroyed the capital that was invested there. Even on a good day, they are prone to wild and unpredictable price swings.

An all-digital investment or currency is also subject to hacking risks that don’t apply to stocks, bonds, gold bullion, or dollar bills. Many investors are uncomfortable with the risks, and absolute beginners should learn the ropes of investing in the stock market first. You can invest in cryptocurrency ETFs or companies with direct business ties to the crypto market, which allow you to invest in this perilous sector without directly owning any cryptocurrencies.

As for the transactions involved in buying and selling digital currencies, they only differ from traditional investments in the underlying investment vehicles. You still have to report your sales to the IRS and pay taxes on the capital gains.

How to report virtual currency transactions

The ins and outs of reporting your crypto-related capital gains and losses to the IRS can be tricky. However, for most of us, the issue isn’t terribly complicated.

The standard Form 1040 has added a question about your “financial interest in any virtual currency.” You can leave this checkbox blank if all you did was buy or mine cryptocurrencies or kept your portfolio unchanged. But if you sold, traded, sent, or otherwise made any profit from cryptocurrencies in the past tax year, you’ll need to check this box.

In the simplest possible case, you’ll then use Form 1040, Schedule D to report your capital gains and losses from cryptocurrency transactions. Your crypto exchange may have sent you a Form 1099-B with the numbers you need, which are entered on the Form 8949 worksheet.

The grand total from that form is entered on lines 1a through 3 (for short-term trades) and lines 8a through 10 (long-term trades where you held the asset for at least one year) of Schedule D. That’s it -- you’re done reporting your cryptocurrency gains.

Related Investing Topics

It’s a little bit more complicated if you mined the crypto you sold. Since you didn’t buy those tokens in the first place, the gains should be reported as “Other income” on line 8z of another document, Form 1040, Schedule 1. The form is used to account for personal income that did not come from your day job, and it is the proper way to enter earnings from a hobbyist-level engagement in cryptocurrency mining.

If you report taxes through a business entity, you have some tax deductions available under a more complex filing system. In this case, the gains earned from cryptocurrency mining should be reported among other revenue streams on Form 1040, Schedule C. Here you can also deduct mining expenses such as the hardware used, the electric power consumed, repairs on the equipment, and rental fees for the space you’re using.

You’ll need to keep detailed records of the expenses you’re planning to deduct, to the point where it’s recommended to install a separate electric meter just for your crypto mining needs. If you ever run into an audit, you want to have ironclad proof of every penny you’re holding back from the tax collector.

The deductions can make your mining business much more profitable, but there are many forms involved, and you should really talk to a tax professional before taking this route.

Whatever reporting method you use, you must be prepared to pay taxes on your cryptocurrency earnings. You are making taxable financial transactions in a new kind of market, and virtual currencies are not immune to taxation.