The 401(k) is one of the most popular retirement plans out there, and a big reason is that companies often offer matching contributions if employees contribute money to their accounts. But if your employer doesn't do this, you may wonder whether your 401(k) is the best home for your retirement savings. Here's a closer look at some of the factors you should weigh when deciding whether to keep using your 401(k) or try another retirement account.

Access to investment products

A 401(k) usually limits you to investment options your employer selects. This isn't always a bad thing. If you're not sure how to choose the right investments for yourself, a few preselected options can make your decision a lot easier. But a 401(k) isn't worth it if none of the investments appeal to you.

Before you jump ship, you can try talking to your employer to see if it will offer a wider range of investment options for you to choose from. It's probably worth sticking with your 401(k) because of the higher contribution limits compared to IRAs. You can contribute up to $23,000 to a 401(k) in 2024 ($22,500 in 2023), or $30,500 ($30,000 in 2023) if you're 50 or older.

The annual contribution limit for IRAs is just $7,000 in 2024 ($6,500 in 2023). Those who are 50 and older can contribute $8,000 in 2024 ($7,500 in 2023).

Pay attention to fees

When considering whether your 401(k)'s investment options are a good fit for you, look into what they charge in fees. Mutual funds have an expense ratio -- an annual fee usually written as a percentage of your assets -- that you'll pay to cover the costs of operating the fund. You can find this in your prospectus. Ideally, you want to keep your investment fees under 1% of your assets so you can hold on to more of your savings.

Index funds are an affordable option you should look for. These are mutual funds that track a market index. They're designed to match the performance of the index, so if the index rises, your savings do, too. And because the assets in the fund tend to remain the same over time, there's less work for fund managers to do, and they can charge you lower expense ratios.

Your 401(k) may also have administrative costs, and there isn't much you can do about these. A 401(k) is worth it if your employer covers some or all of these costs, but it might not be if it puts all the administrative fees on you, in addition to offering poor investment options and no employer match. Talk to your company's HR department or your plan administrator if you're not sure how much you're paying in fees.

Related Retirement Topics

Consider an IRA instead

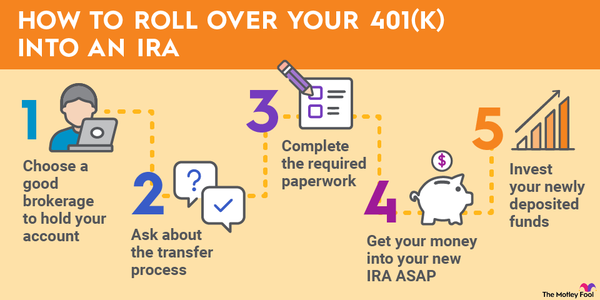

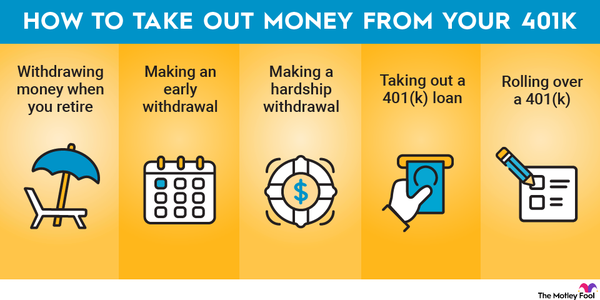

Consider opening an IRA if your 401(k) doesn't match your contributions, charges high fees, and doesn't offer appealing investments. Anyone who earns income this year can open and contribute to an IRA, and you may be able to roll your existing 401(k) funds into the IRA if your plan permits this. Talk to your plan administrator about doing a direct rollover. This is where you send your funds from your 401(k) to your IRA without handling the money yourself at all. It's the best way to avoid problems with the IRS.

You can choose between a traditional IRA and a Roth IRA depending on when you want to pay taxes. Traditional IRAs give you a tax break this year, but you owe taxes on your distributions, whereas you pay taxes on Roth IRA contributions in exchange for tax-free withdrawals. Usually traditional IRAs are best if you believe you're earning a lot more than you'll spend annually in retirement, while Roth IRAs are better if you think you're earning less or about the same as you'll spend annually in retirement.

You may open an IRA with any broker that appeals to you, and you'll have a much wider variety of investment options. This also gives you a lot of control over the fees you're paying. You can select your investments carefully to keep your costs low and change them as often as needed to match your goals and risk tolerance.

The biggest downside to IRAs is their low contribution limits. If you end up bumping into these, you can always go back to your 401(k) after maxing out your IRA. Even if it isn't the best place for your savings, it still offers tax advantages that can help you save money while saving for your future.

Don't assume your 401(k) is your best option just because it's there. Delve into the details of the plan and decide whether the returns you're getting are worth the fees you're paying. If not, you may be better off saving for retirement on your own with an IRA.