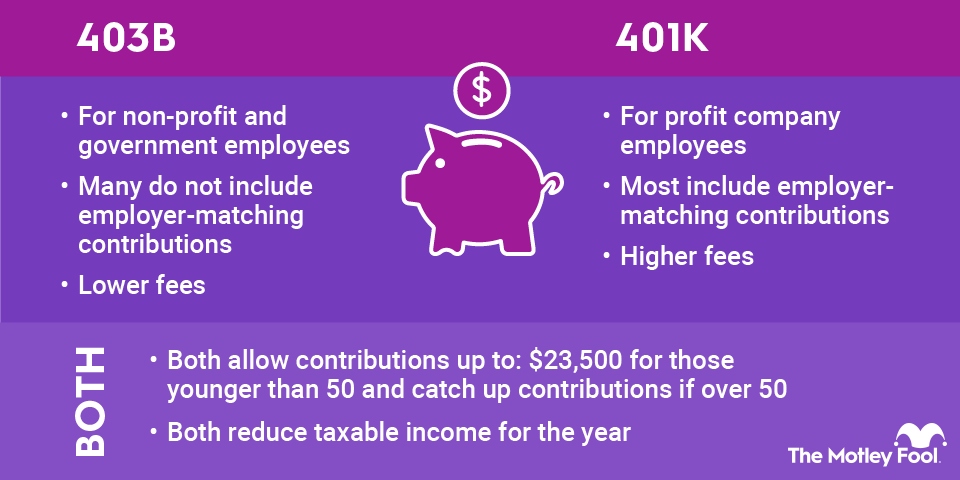

The 401(k) and 403(b) are both tax-advantaged retirement accounts named after different sections of the tax code. While similar in many ways, 403(b)s are offered only to public school employees, certain ministers, and employees of tax-exempt organizations, while 401(k)s are available to employees of for-profit companies.

Here's a closer look at the key similarities and differences between the two retirement accounts.

401(k) vs. 403(b): The differences

Some of the key differences between 401(k)s and 403(b)s are:

- Eligibility requirements: Only nonprofit and government employees may have a 403(b). Employees of for-profit companies typically have 401(k)s.

- Investment options: The 403(b) plan used to be limited to annuities, but they often offer some mutual funds as well. If you have a 401(k), you'll usually choose between whatever mutual funds and exchange-traded funds (ETFs) your employer selects.

- Catch-up contributions: Both plans allow $7,500 in catch-up contributions for adults 50 and older in 2025, which increases to $8,000 in 2026. For both accounts, workers aged 60 to 63 will have a higher catch-up contribution of $11,250 in both 2025 and 2026. 403(b)s offer additional catch-up contributions of up to $3,000 per year for employees who have been with their employer for at least 15 years.

- Employer matching: While 403(b) plans can include employer-matching contributions, many do not. Matching is fairly common with 401(k)s.

- Vesting schedule: When 403(b)s do offer matching contributions, their vesting schedules are typically shorter than 401(k) vesting schedules, and some organizations offering 403(b)s may allow immediate vesting.

- Profit sharing: A 403(b) plan cannot accept profit sharing from the sponsoring employee because companies offering 403(b)s are nonprofit by definition. Some 401(k)s may enable participants to share in company profits.

- Fees: A 403(b) plan usually has less-stringent reporting requirements than a 401(k) because it's only subject to Employee Retirement Income Security Act (ERISA) guidelines in certain circumstances, such as when the employer matches employee contributions. ERISA sets minimum standards that qualified retirement plan administrators must adhere to. This often means 403(b) plans have lower fees than 401(k)s.

- Nondiscrimination testing: When 403(b)s aren't subject to ERISA guidelines, they don't have to do annual nondiscrimination testing to make sure highly paid employees aren't receiving disproportionate benefits from the plan. All 401(k)s must do this testing, which can limit how much the highest-earning employees may contribute.

The similarities

Here are some of the key features 401(k)s and 403(b)s have in common:

- Contribution limits: You may contribute up to $23,500 to a 401(k) or a 403(b) in 2025 and $24,500 in 2026 if you're younger than 50. Adults 50 and older have higher contribution limits due to catch-up contributions, as mentioned above.

- Tax deferral: Traditional 401(k) and 403(b) contributions reduce your taxable income for the year, and, in exchange, you pay taxes on your distributions in retirement.

- Roth options: Both 401(k)s and 403(b)s are available as Roth accounts as well, although these are less common. You pay taxes on Roth contributions in the year you make them, and your money grows tax-free afterward.

- Loans: Some 401(k) and 403(b) plans allow participants to take loans, which they can pay back with interest over time.

- Penalties on early distributions: You'll pay a 10% early withdrawal penalty if you take a distribution from your 401(k) or 403(b) when you're younger than 59 1/2.

- Required minimum distributions (RMDs): You must begin taking RMDs from your 401(k) or 403(b) in the year you turn 73, though RMDs are no longer required for Roth accounts.

Which is better?

A 401(k) isn't necessarily better or worse than a 403(b). Each account has its pros and cons, but many of its core features are the same. You likely won't get a choice between the two plans since your employer will probably offer only one.

In rare cases, you may have the opportunity to contribute to both plans at the same time. If so, you can choose to contribute more to the one you believe will offer you the better deal. For example, you may prefer a 401(k) if it includes a company match and your 403(b) doesn't. You might prefer a 403(b) if you've been with your company for at least 15 years and want to take advantage of extra catch-up contributions.

Weigh all the key differences listed above to decide which plan is right for you. Remember that your annual contribution limit applies to money you put in both accounts, so if you are contributing to a 401(k) and a 403(b) at the same time, you're allowed only up to $24,500 in combined contributions to both, or $32,000 if you're 50 or older, in 2026. If you're between the ages of 60 and 63, your maximum contribution is $35,750 in 2026. If you run into any questions about your plan, reach out to your plan administrator for more information.