If you just realized you overcontributed to your 401(k), rest assured that it's all going to be OK.

The big fear everyone has when they find they've overcontributed to their 401(k) is that they'll have to pay taxes and penalties. If you act fast enough, you'll only pay the required taxes on the earnings attributable to the overcontribution. But if you act slowly, you'll end up paying a lot more, including double taxes on the overcontribution and a potential early withdrawal penalty.

What is a 401(k) overcontribution?

An overcontribution happens when you defer more than the maximum allowed by the IRS to a 401(k) plan in any given year. Here are the 401(k) employee contribution limits for 2025 and 2026:

- 2025: $23,500

- 2026: $24,500

If you're 50 or older, the IRS also allows you to make catch-up contributions. For 2026, workers aged 50 to 59 and 64 or older can also make additional catch-up contributions of up to $7,500. For 2026, the catch-up contribution limit for workers in those age ranges is $8,000. Those aged 60 to 63 can make a higher catch-up contribution of up to $11,250 in 2025 and 2026.

Overcontributions often happen when a person contributes to more than one 401(k) plan in a year. This can happen if you switch jobs mid-year, if you work two jobs, or (in rare instances) if you get a substantial raise mid-year while keeping your contributions as a percentage of your paycheck the same.

It's important to differentiate between what is an overcontribution and what isn't. Catch-up contributions aren't overcontributions. Matching contributions from your employer won't push you above the wage deferral limit either. The IRS allows total contributions from both the employee and the employer to reach a much higher limit than the employee's salary deferral.

For 2025, the combined employee and employer limits are $70,000, $77,500 for ages 50-59 or 64 and older, and $81,250 for ages 60-63. For 2026, the limits are $72,000, $80,000 for ages 50-59 or 64 and older, and $83,250 for ages 60-63.

What to do if you've overcontributed to your 401(k)

If you find you've overcontributed to your 401(k), contact your employer or plan administrator as soon as possible. Tell them that you've made an excess deferral and provide the corresponding amount. It's best if you catch this error before Tax Day (April 15 in 2026) in the year following the overcontribution.

Once you've alerted your plan administrator, processing your overcontribution error may take some time. The plan administrator is required to distribute the excess deferral and earnings attributed to those funds by a specific date laid out in the 401(k) plan. Earnings are calculated based on the total change in value of the account since the overcontribution.

It's important that this process be completed before the tax deadline of the year following the overcontribution. Check all your W-2s and records as soon as you get them to make sure you have time to correct the error if you overcontributed.

What overcontributions mean for your taxes

If you overcontribute, you might have to pay extra taxes. Once the mistake has been corrected, you'll get some new tax forms from HR.

The first form is an amended W-2. The new W-2 will show an increase in taxable wages equal to the amount of the overcontribution. That's the number you'll need to report to the IRS on your Form 1040 for the year of the corrected W-2. If you've already filed taxes for that year, you'll have to file an amended return.

You'll also receive a 1099-R for the distribution of earnings tied to your overcontribution. You'll receive this in January of the year following the year in which the overcontribution was repaid.

That 1099-R might be a much higher amount (meaning more taxes) if you don't catch and correct the overcontribution error before Tax Day of the year following the overcontribution. That's because the IRS says that for corrections after the deadline, the overcontribution "is not included in the employee's cost basis in figuring the taxable amount of any eventual benefits or distributions under the plan."

In other words, instead of the 1099-R reflecting just the earnings on the overcontribution, it'll reflect the total distribution, including the initial overcontribution. That means you effectively get taxed twice on that income -- once in the year you earned it and again in the year you corrected the overcontribution.

Another penalty for finding the error late is paying the standard 10% early distribution penalty. This applies to overcontribution distributions corrected after the Tax Day deadline for employees younger than 59 1/2.

Where to put your money instead of overcontributing

If you have lots of room in your budget for additional retirement savings, here are a few options to consider:

IRA

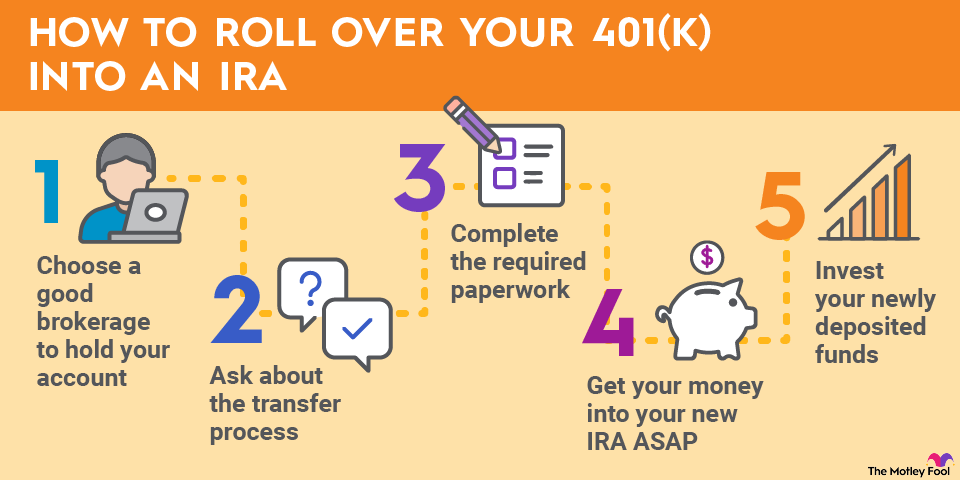

An individual retirement account offers very similar benefits to a 401(k). In fact, an IRA can give you more control over your investment options and usually has lower fees. While a 401(k) usually limits your investment choices to a few mutual funds and ETFs, you can invest in practically anything your broker offers with an IRA.

Since you have a 401(k) at work, you'll have to be conscious of income limits that can affect your eligibility to deduct your contribution on your tax return, or, in the case of a Roth IRA, to contribute at all. For 2025, the contribution limit is $7,000, and catch-up contributions of up to $1,000 are allowed for those 50 or older. For 2026, the contribution limit is $7,500 with catch-up contributions of up to $1,100.

HSA

A health savings account (HSA) is a hybrid savings and investment account that lets you set aside funds to cover healthcare expenses. The money you contribute goes in tax-free, at which point you can invest it and enjoy tax-free growth on it. Your withdrawals are also tax-free, provided they're used to pay for qualified medical expenses.

HSAs require you to hold a qualifying health insurance plan, so check your plan details to make sure you're eligible. For 2025, you can contribute up to $4,300 as an individual or $8,550 as a family. In 2026, the limits are $4,400 for individuals and $8,750 for families. Those 55 and older who aren't enrolled in Medicare can make an additional $1,000 contribution in both 2025 and 2026.

A traditional (non-tax-advantaged) brokerage account

The downside of putting money into a traditional brokerage account is that you won't get a tax break out of it, and you'll be liable for taxes on your investment gains year after year.

The upside? You'll have the opportunity to use that money for whatever purpose you'd like. You can save all of it for retirement, or you can earmark much of it for your golden years while also accessing that cash for other needs or wants that pop up along the way, such as home improvements, vacations, or your kids' college tuition.

Related retirement topics

Annuity

An annuity is a contract between you and an insurance company. In exchange for a lump sum up front, the issuer of your annuity agrees to pay you a certain amount of money -- either a lump sum in the future or a series of payments over time.

Because annuities are complex and can sometimes come with high fees, they're often regarded as a last-resort option for retirement savings, especially since there's no tax break involved in funding one. But if you're looking for another dedicated source of retirement income and you've already maxed out your 401(k), an annuity is worth considering.

If you're fortunate enough to be in a position where you've maxed out a 401(k) and still have money to save, it pays to put that cash to good use. IRAs, HSAs, traditional brokerage accounts, and annuities are all reasonable options for socking away extra funds to use in retirement one way or another.