If you recently left an employer, you may have to decide whether or how your 401(k) should come along with you. A 401(k) rollover can help you consolidate your retirement savings into fewer accounts, open up additional investment options, and even save you money in certain circumstances.

What is a 401(k) rollover?

A 401(k) rollover is when you transfer the account balance in your old 401(k) to a new or existing 401(k) or individual retirement account (IRA).

You'll usually face the decision of what to do with your 401(k) when you leave a job, but you might even have an old 401(k) that you've forgotten about hanging around from a previous employer. It's never too late to review your holdings and decide whether to roll your assets into your current employer's 401(k) plan or an IRA, or choose another option instead.

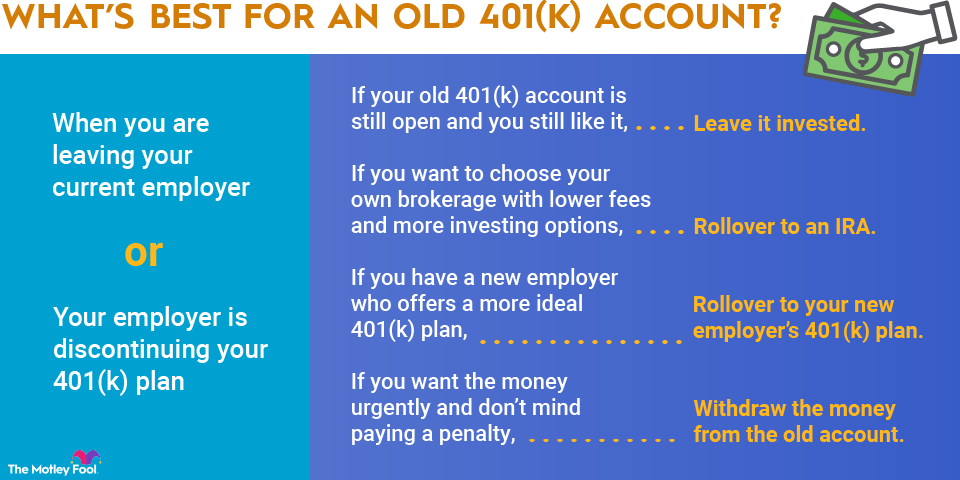

There are four main possibilities when considering a potential 401(k) rollover:

- Leave your old 401(k) account as is.

- Roll over the account into an IRA.

- Roll over the account into your new employer's 401(k).

- Cash out the account (and pay the taxes and penalties for early withdrawal).

How to roll over your 401(k)

Rolling over your 401(k) typically involves a few basic steps. However, there are various ways to approach the process, so it's best to first clearly understand your priorities and any special circumstances or considerations that may apply to you.

1. Decide where you want your money to go

You have a few destination options to choose from when you roll over a 401(k):

Use a rollover IRA: The most commonly used is a rollover IRA. This is a traditional IRA, except it houses funds rolled over from another retirement account, like a 401(k).

Investors typically roll over funds into similar accounts -- a traditional 401(k) into a traditional IRA and a Roth 401(k) into a Roth IRA. You may also roll over funds from a traditional account into a Roth account, but you'll owe taxes at your current income tax rate on the amount converted. If you expect a year of low income, perhaps from an extended gap between jobs, then this conversion may be advantageous.

Transfer to a new 401(k): The other option is to roll over funds from an old 401(k) into your new employer's 401(k) plan. This consolidates all your retirement investments, making them easier to manage. For high-income earners, another reason to transfer to a new 401(k) may be to keep the backdoor Roth IRA option available by sidestepping (legally) the IRA aggregation rule. As long as the fees are reasonable for the current 401(k) plan, this isn't a bad option.

2. Open a new account or use an existing one

You may need to open a new 401(k) or establish an IRA before initiating a rollover. After all, you need an account to roll your funds into. If you already have a 401(k) or IRA you want to use, then you don't need to open a new account. However, if you prefer to keep your rollover funds separate from an existing account, then opening a new account is still an option.

Opening an IRA is a simple and straightforward process with most online brokers. You can do it entirely online with just a few forms and clicks.

3. Contact your old 401(k) plan administrator to begin the rollover process

To transfer funds from your old 401(k), you'll need to get in touch with your former employer's plan administrator and indicate that you want to roll over your account.

There are two ways for administrators to transfer your funds to your rollover destination: direct and indirect rollover.

Direct rollover: A direct rollover is the easiest way to roll over your 401(k). If this is available to you, it's the best option to avoid any pitfalls that could result in taxes and penalties.

With a direct rollover, you provide the administrator of the prior 401(k) plan with the information for the receiving account for your funds, and they (usually) transfer the funds to the new 401(k) account directly.

You may receive a check made out to your new IRA or 401(k) plan, and it's your responsibility to forward the check to the designated recipient. If you have any questions about where to send the check, you can contact your new 401(k) plan administrator or your IRA brokerage for clarification.

Indirect rollover: The other option is an indirect rollover. Instead of transferring funds directly from your old 401(k) to your rollover destination, the plan administrator sends the funds to you. You are then responsible for depositing the funds from your old 401(k) into your rollover account.

The major downside with indirect rollovers is that 401(k) plan administrators are required to withhold 20% of the taxable funds for the IRS. You'll receive the amount back on your tax return if you complete the rollover, but in the meantime, you will be short by 20% for your new 401(k).

4. Remember the 60-day rule

You have only 60 days from the date that funds are distributed from your old 401(k) to deposit them into your rollover account. This applies to indirect rollovers as well as direct rollovers for which the administrator sends you a check to forward.

If you do not deposit the funds within 60 days, it will be considered a 401(k) distribution and is subject to taxes at your current income tax rate. There's also a 10% penalty for withdrawing funds from your 401(k) if you're younger than 59 1/2. Additionally, after the 60-day window closes, you cannot avoid the flat penalty and taxation by depositing these same funds again into an IRA or 401(k).

5. Invest the funds in your rollover account

Finally, once the funds hit your rollover account, you'll want to invest them. It's very uncommon for 401(k) rollovers to transfer in-kind. Instead, the prior administrator will liquidate your investments and deposit cash into your new 401(k). You'll then need to pick new investments for your retirement account.

While rolling over an existing 401(k) into an IRA or a new employer's 401(k) is by far the most common, there may be additional options for you to consider if you qualify.

Related investing topics

Other options to roll over your 401(k)

Keep your old 401(k): If your new employer's 401(k) plan charges unreasonably high fees, but you want to keep your IRA accounts empty to preserve the backdoor Roth IRA option, your best alternative may be to keep the funds in your old 401(k) account. However, not all ex-employees are eligible to maintain their old 401(k) accounts. At some point, the plan administrator may require you to take a cash distribution (resulting in taxes and possible penalties) or roll over the funds into another IRA or 401(k).

Open a solo 401(k): Another option available to some is to open a solo 401(k). A solo 401(k) is only available to small business owners who have no other full-time employees besides themselves and their spouse. While owning a business might sound daunting, you likely qualify if you have a small side hustle and file a Schedule C when you pay your taxes. Your side hustle could be any number of activities, such as driving for ridesharing services or reselling used items online.

While your contributions to your solo 401(k) are limited by your small business income, you can still roll over any amount from another 401(k) or IRA. Compared with most employer-sponsored plans, solo 401(k)s are typically associated with lower fees and more investment options. The primary downside of a solo 401(k) versus an IRA is that solo 401(k)s require additional reporting to the IRS when the account exceeds $250,000.

While a solo 401(k) may not be an option for everyone, it's a great strategy for those who qualify.