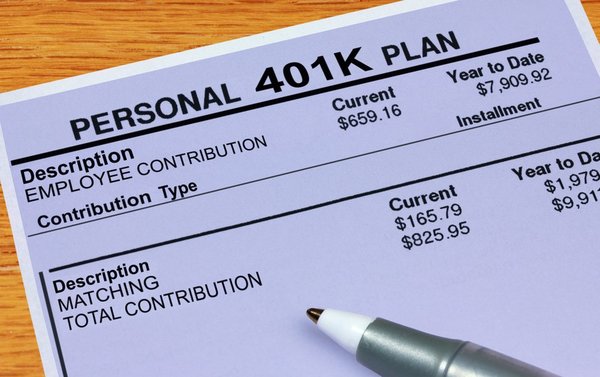

If you invest in a 401(k), your employer may contribute money to it on your behalf.

If that's the case, you may not be fully vested in your employer's contributions immediately. When you aren't fully vested and you leave your job, you don't get to keep all of the money your employer contributed on your behalf. The unvested funds will go into a 401(k) forfeiture account.

As an employee, you don't have anything to do with that money anymore. You simply get to keep your vested funds, and the employer has to manage the rest of the unvested cash in the forfeiture account.

What are 401(k) forfeiture accounts?

When employees leave their job before their employer's contributions fully vest, the unvested portion of the funds goes into 401(k) forfeiture accounts. These aren't actually separate physical accounts but are record-keeping accounts so employers know how much money has been forfeited.

Employers are required to use forfeiture accounts within a limited time period and can only use the forfeited funds for certain purposes.

What is the 401k forfeiture limit in 2023 and 2024?

The rules for how much employees can forfeit if they leave their jobs before they are fully vested don't change annually -- unlike the limits on 401(k) contributions made by employees and employers, which can move up over time.

As you'll learn below, the amount that employees end up forfeiting is based on the vesting schedule and the amount of unvested contributions. Any employer contributions that are not vested, along with gains from those contributions, can be forfeited.

What are the 401(k) forfeiture account rules?

Most 401(k) forfeiture rules apply to employers. For example, the money in the forfeiture account can only be used for specific expenditures, such as paying costs associated with managing a 401(k) plan for employees or funding future contributions for employees.

The only rule that really matters to workers is when their money goes into the forfeiture account, and that varies based on your plan's vesting schedule plan document.

Some employers provide for immediate vesting of matching contributions as soon as they're made, and, in that case, no 401(k) forfeiture can ever take place. Other vesting options open the door to potential forfeiture of 401(k) funds.

- With graded vesting, an employer gradually allows a portion of employer contributions to become vested over time. For instance, a vesting schedule could provide for you to become 20% vested in employer contributions after you've worked in your job for two years, with additional boosts of 20 percentage points each year until you reach your six-year work anniversary. At that point, you'd become fully vested.

- With cliff vesting, none of your employer contributions become vested until a specific date on which all of those contributions vest. There's no gradual release of portions of those employer contributions; it's an all-or-nothing proposition that can happen as late as three years after you begin work.

Make sure you understand your employee benefit plan rules.

How much can you forfeit?

If you leave work before you've become fully vested, you can lose all or a portion of the contributions your employer made on your behalf.

If you're 20% vested under a graded vesting schedule, then you'd forfeit the remaining 80%. If you haven't reached the appropriate length of service under a cliff vesting schedule, then you'll lose all of your employer contributions.

The forfeiture amount is based on what your employer holds in the employer contribution portion of your retirement account. Accordingly, you'll end up forfeiting not only the original contribution but also any earnings those contributions have generated over time.

One thing to be absolutely clear about is that your own employee contributions that you've made from your own pay are always 100% vested and never subject to forfeiture. Any employer who suggests you need to forfeit your own employee contributions is mistaken.

How to avoid 401(k) forfeiture

The easiest way to make sure you won't have to forfeit employer contributions in your 401(k) plan account is to stay employed long enough to become fully vested in your plan account.

If you're considering voluntarily leaving your job, staying an extra week or two can make a big difference if you're near your work anniversary date and will see an increase in the percentage of employer contributions that become vested.

Unfortunately, if you're being laid off or let go involuntarily, there's not much you can do to protect your account from 401(k) forfeiture. Trying to negotiate the timing of a layoff might be an option if you're close to a work anniversary, but don't count on employers working with you to make that happen.

How to allocate forfeitures in a 401(k) plan

Workers do not have any input over what happens to the funds they forfeit. Employers can decide what eligible expenses they wish to use the money for.

However, there are rules employers must follow. They must use the money in the time allotted by the 401(k) plan. They're also required to use the funds only for eligible expenses, such as future employee contributions or covering plan administration costs.