Electric vehicles (EVs) are in the news seemingly every day. Between price drops, safety recalls, trade wars, bombastic executives, and a variety of other issues, EVs are constantly in the public eye.

All types of electric and hybrid vehicle sales are growing

In January of 2025, 132,576 HEVs (46,641 cars and 48,720 light trucks) were sold in the United States, compared to 112,008 plug-in vehicles (92,069 BEVs and 19,939 PHEVs). HEV sales were up 44.2% from January 2024, while plug-in vehicle sales were up 4.26%.

This is especially impressive considering the typical prices of PEVs. According to Kelley Blue Book, the average transaction price for a new non-luxury vehicle in September 2025 was $50,080, while the average for a new electric vehicle was $58,124.

That means the average new EV is almost $8,000 more than the average non-electric vehicle. And that includes trucks and SUVs (which make up about 75% of the car market in the U.S.), so the average increase over a comparable non-electric car is probably significantly more.

New hybrids, however, are much closer in price to their non-electrified equivalents. In September 2025, Kelley Blue Book reported the following averages:

- New compact car: $26,947

- New mid-size car: $33,597

- New hybrid car: $32,944

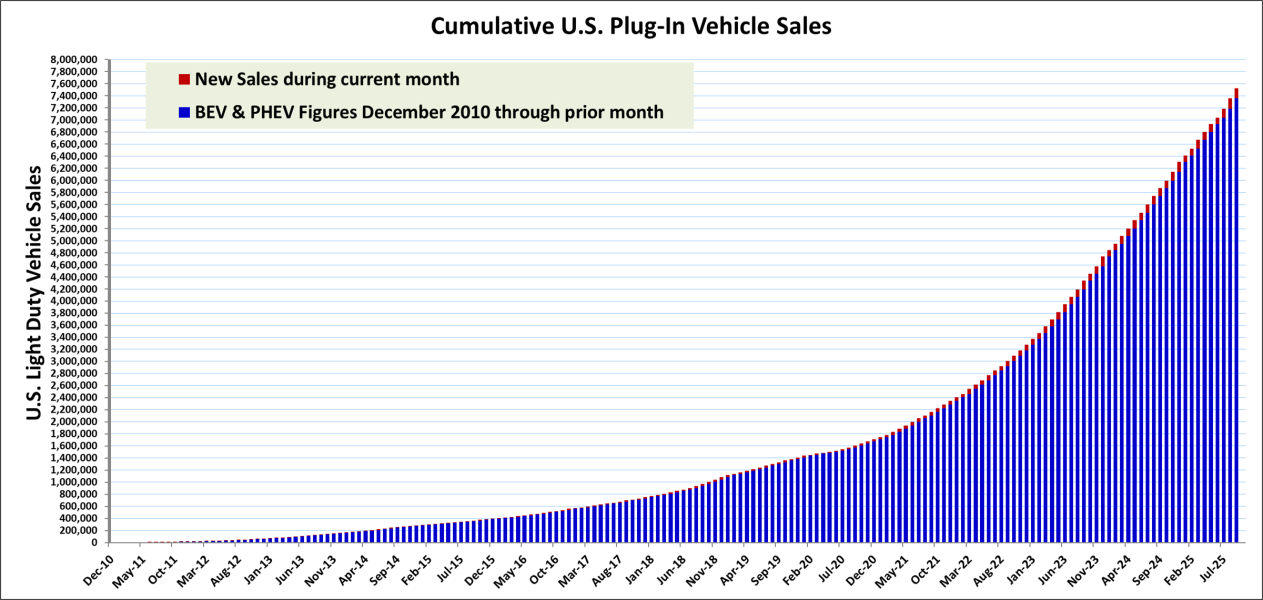

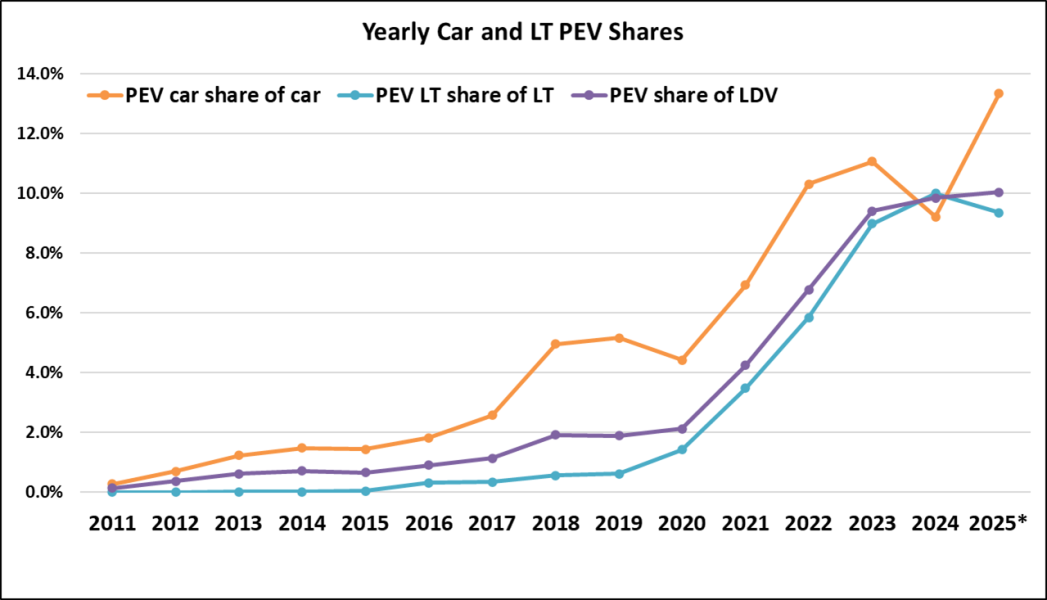

Plug-in vehicles now make up almost 13% of the car market

ANL's monthly reporting shows that PEVs have made up almost 13% of the car market so far in 2025. If trends continue, this number could be much higher within the next five years:

It's important to note that this doesn't include non-plug-in hybrids. Every car in that 13-ish percent needs to be plugged into a wall at some point.

Which brands sell the most electric vehicles in the United States?

Finding exact numbers for PEV sales in the United States is a challenge. But here's what we were able to dig up.

According to the International Council on Clean Transportation, the Stellantis group (STLA -2.68%) dominates the market for Electric Vehicles (over 135,000 sales in total for 2024). This is no surprise with the number of brands Stellantis controls. Ford (F -3.63%) (90,000 sales), Toyota (85,000 sales), Hyundai (OTC:HYMTF) (80,000 sales), and Kia (75,000 sales) were next on the list, but none of them come close to matching Stellantis' dominance.

When it comes to BEVs, though, the story is different. According to a Cox Automotive report, Tesla sold an incredible 48.7% of the EVs bought in the United States in 2024 (that's a total of 633,762 vehicles). Ford came in a distant second with 8.2% (97,865 vehicles sold).

What do consumers think of electric vehicles?

If we're talking about the future of the electric vehicle industry, we need to talk about consumer outlook. Many car manufacturers are committing to significant or even full electrification of their product suite, but how do consumers feel about it?

In a January 2023 survey, The Motley Fool asked 2,000 American citizens whether they owned a hybrid or fully electric vehicle. Only 20% said yes:

Do you currently own a hybrid or electric vehicle? | Percentage of respondents |

|---|---|

No | 80% |

Yes, a non-plug-in hybrid | 7% |

Yes, a plug-in hybrid | 7% |

Yes, a fully electric vehicle | 6% |

However, 57% of our respondents also said they're somewhat or very likely to buy a hybrid or electric car or truck for their next vehicle.

How likely are you to buy a hybrid or electric car/truck for your next vehicle? | Percentage of respondents |

|---|---|

Very likely | 23% |

Somewhat likely | 34% |

Somewhat unlikely | 18% |

Very unlikely | 25% |

Consumer divisions on electric vehicles largely fall along political party lines

As with the results of our survey on renewable energy investing, our respondents were split along party lines when it came to electric vehicles.

For example, when asked about how likely they are to buy a hybrid or electric vehicle car or truck for their next vehicle, about 66% of Democrat-leaning respondents were at least somewhat likely, while about 50% of Republican-leaning respondents said the same.

Similarly, when we asked those who were very unlikely to buy an EV why that was the case, most people said that they're too expensive. This was also true of left-leaning respondents. But those who tend to vote Republican were most likely to say that they'd rather drive a gas vehicle (this is also true of male respondents, regardless of political affiliation).

Consumers oppose legislation phasing out the sale of gas-powered vehicles

Another party split is obvious when it comes to states passing legislation that requires the phasing out of gas-powered vehicles.

Should state governments pass legislation to phase out the sale of gas-powered vehicles? | Percentage of respondents |

|---|---|

No | 65.35% |

Yes | 34.65% |

About two-thirds of our respondents said that states shouldn't pass these kinds of laws. But only 51% percent of Democrat-voting respondents said states shouldn't require the phasing out of gas-powered vehicles (76% of Republican-voting respondents said the same).

The future of hybrid and electric vehicle manufacturing

Consumers are warming up to EVs -- but what about manufacturers? What are their plans for their EV fleets?

In general, car makers are looking to amp up their electric vehicle production. A few have even committed to releasing only EVs within the next decade. Here are seven companies' goals, as reported by the ICCT:

- BMW (OTC:BMWYY) (BAMXF -5.76%): Half of vehicles sold to be fully electric by 2030 or earlier.

- Ford: One-third of sales to be fully electric by 2026 and half by 2030. All European sales will be electric by 2030.

- GM: Offer 30 EV models and have 50% of all sales be electric by 2030.

- Daimler's (MBGY.Y -2.80%) Mercedes: All newly launched vehicles to be fully electric by 2035.

- Toyota: Sell 3.5 million electric cars annually by 2030. Offer 30 BEV models by 2030.

- Volkswagen (VWAGY -2.34%): All-electric vehicles to exceed 50% of Chinese sales, 55% of American sales, and 80% of European sales by 2030.

- Volvo, owned by Geely Automobile Holdings Limited (GELYF +0.00%): Become a fully electric car company by 2030.

Car and Driver also provides a detailed breakdown of the major manufacturers and their plans, goals, and projections when it comes to EVs.

While it remains to be seen whether these companies will hit their goals, it's clear that a large portion of the auto industry will be electrified by 2030. It's worth noting that none of these plans are binding -- GM has already announced a slight delay in its goals because of slower-than-expected production of batteries.

While increasing demand for EVs undoubtedly plays a role in these electrification goals, governmental priorities have also likely encouraged companies to electrify.

Governments continue to push for electric vehicles

Governments around the world, from individual states in the U.S. to multinational declaration signatories, have pledged to shift the balance of vehicles toward electric.

For example, California is investing $10 billion to eliminate all non-zero-emission vehicle sales by 2035. Almost all states have some form of policy promoting electric vehicles. These can include tax credits, rebates, and registration fee reductions. However, in May of 2025, the U.S. Senate voted to block the policy. California Governor Gavin Newsom has pledged to fight this in court.

And according to the National Conference of State Legislatures, at least 13 states (California, Colorado, Connecticut, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island, Virginia, Vermont, and Washington), as well as the District of Columbia, have followed California in requiring manufacturers to sell a certain number of zero-emission vehicles annually.

Related EV and automotive topics

The Biden White House has set a national goal for 50% of all vehicles sold to be electric by 2030. However, the Trump white house has walked this pledge back to pre-Biden era standards.

A recent piece of legislation also earmarked $7.5 billion to build a national network of 500,000 charging stations (at the time of this writing, the Alternative Fuels Data Center reports 78,122 locations and 236,142 ports).

Globally, other countries are following suit. Both Canada and the United Kingdom have made moves to ensure that all cars sold will be electric by 2035. China has required manufacturers to sell 40% EVs by 2030.

And at the United Nations' Climate Change Conference in 2021, 100 stakeholders, including governments, auto manufacturers, investors, and others signed a declaration to hasten the electrification of the entire global auto market to 100% by 2040.

The future of electric vehicles looks good for consumers and investors

A constellation of factors paint a bright picture for the future of electric vehicles.

Consumers want them. Falling prices of battery production will make them more easily available to those who find them too expensive. Manufacturers are committed to increasing production -- including some, like Volvo, even planning on becoming electric-only. And governments are passing legislation to support this process.

This is all good news for investors in the auto industry, consumers and advocates of the environment. However, it's worth noting that the production process of battery-powered vehicles is still quite problematic, and its cost largely falls on developing countries. For a very detailed look at the battery production process as well as its environmental and economic costs, see this special issue from the United Nations Conference on Trade and Development.

However, as we've seen with GM, just because an EV shift is planned doesn't mean it happens on time. So we'll continue watching the trends in the hybrid and electric vehicle industry to see if lofty goals are translated into reality.

Sources

- Alternative Fuels Data Center (2023). "Alternative Fueling Station Counts by State."

- Isenstadt, Aaron | Slowik, Peter (2025). ICCT. "U.S. passenger electric vehicle sales and model availability through 2024."

- Igleheart, Austin (2022). National Conference of State Legislatures. "State Policies Promoting Hybrid and Electric Vehicles."

- International Energy Agency (2022). "Global EV Outlook 2022."

- Kelley Blue Book (2025). "Kelley Blue Book Report: New-Vehicle Average Transaction Price Hits Record High in September, Surges Past $50,000 for the First Time Ever."

- Miller, Caleb (2025). Car and Driver. "Future Electric Vehicles: The EVs You'll Soon Be Able to Buy."

- Paoli, Leonardo (2022). International Energy Agency. "Electric vehicles: technology deep dive."

- U.N. Conference on Trade and Development (2020). "Developing countries pay environmental cost of electric car batteries."

- U.S. Bureau of Transportation Statistics (2024). "Electric Vehicle Types."

Methodology

The Motley Fool distributed this survey to 2,000 U.S. adults via Pollfish on Jan. 24, 2023.

Respondents were 57% female and 43% male. Age breakdowns were approximately 11% ages 18 to 24, 23% ages 25 to 34, 28% ages 35 to 44, 19% ages 45 to 54, and 18% older than 54. 40% of respondents reported generally voting for Democrats, 30% for Republicans, and 30% for independent/other.