Renowned short-selling firm Citron Research came out with a report on December 19th suggesting that Intuitive Surgical's (Nasdaq: ISRG) share price could drop by as much as 50% — not as a result of problems that could "put the company out of business, but rather a tipping point that could break the halo and have Wall Street assign a comparable multiple to other mainstream medical device companies."

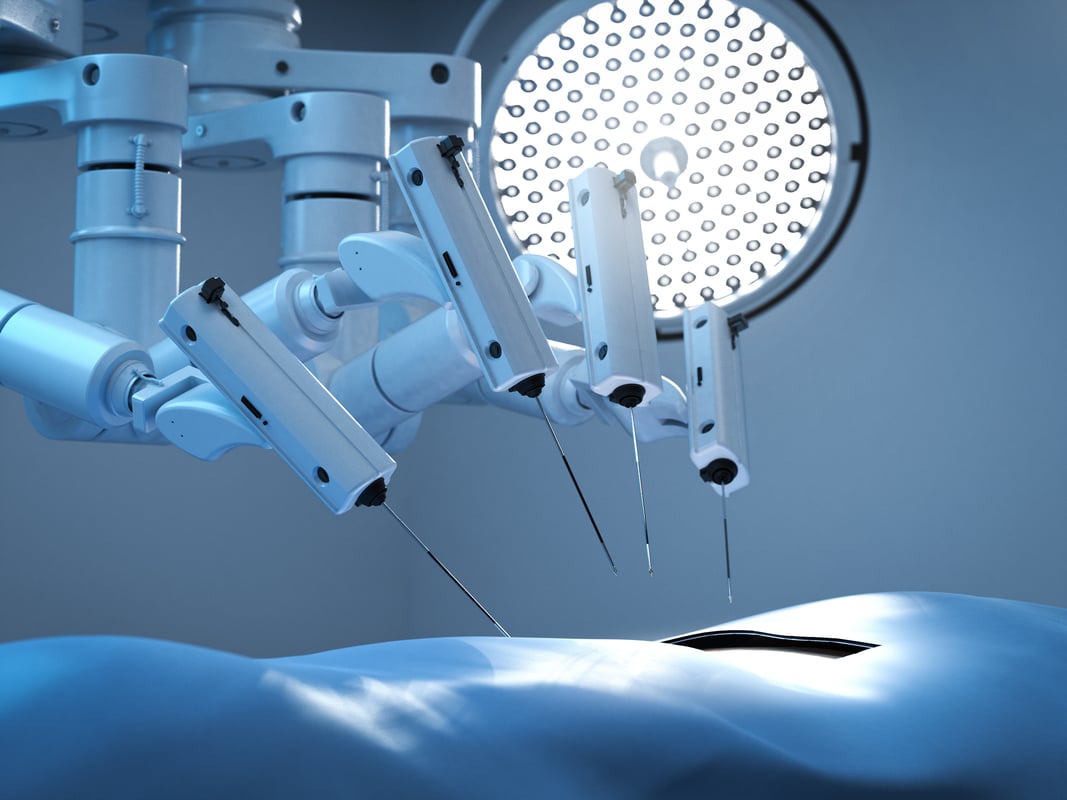

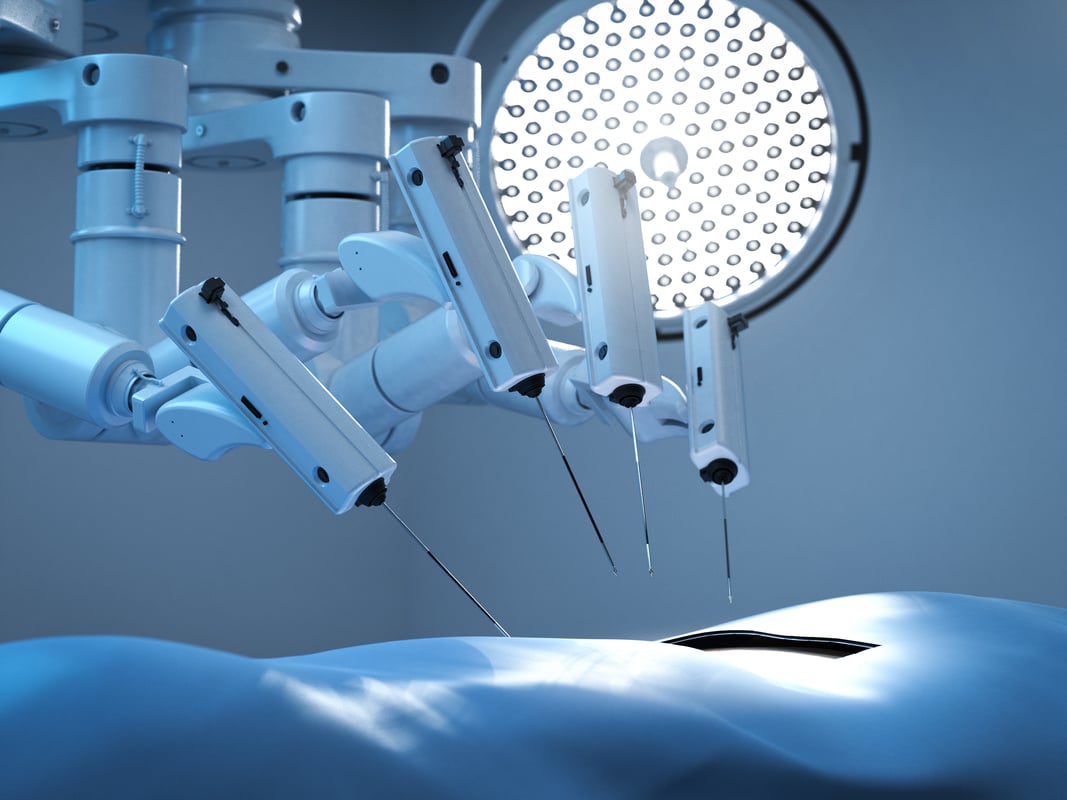

The thrust of their argument is that the da Vinci surgical system has been promoted aggressively with a focus on patient appeal and hospital competitiveness rather than true medical outcomes; that many claims of the advantages of da Vinci surgery are overblown (or non-existent); and that there are a number of lawsuits resulting from problems with the da Vinci that could result in meaningful damages, adverse publicity, and future patients being required to sign a waiver before electing robotic surgery.

While we are not going to address Citron's research point-for-point, we'd like to offer up a few general responses.

- One of the hallmarks of Intuitive's success is the patient appeal of robotic surgery, and the company has always used this in its marketing. Intuitive came seemingly out of nowhere to achieve huge success and is today the gold standard of care in radical prostatectomy — with some 80% of all such procedures using the da Vinci. To suggest that the da Vinci has almost entirely supplanted conventional open surgery solely because hospitals are worried about the competition from across the river or that physicians are duped by shoddy research strains credulity.

Citron's repeated claim that there is "no clinical evidence of better medical outcomes" is simply baffling — and not backed up by the experts they quote. Here's a table from the company's website on numerous peer-reviewed publications on the da Vinci, updated through November.

Level Description New in Nov. Total Level 1 Randomized control trial 1 31 Level 2a Non-randomized prospective study

including a comparison cohort4 127 Level 2b Non-randomized retrospective study

including a comparison cohort18 646 Lower-level publications: Level 3 Single cohort (non-comparison) studies 39 -- Level 4 Case studies 38 4920 Level 5 Opinion publications 36 -- TOTAL 136 5,731 - Most of the false or misleading claims Citron alleges are from hospital websites. Some of these are indeed pretty glib, using – as Citron points out – "splashy ads" and "stock text and images" without a full discussion of underlying research. But this also isn't the responsibility of the company, nor is it the only information a patient will receive before undergoing surgery. These are advertisements — and not advertisements from Intuitive.

- It should come as little surprise that Intuitive has been the subject of some lawsuits. Surgery is risky business; outcomes are not uniformly positive. That a company with a nearly $20 billion market cap and over $1 billion in the bank should capture the primary interest of lawyers in liability cases is simply the reality of how our legal system works. We don't have details on any of the specific cases; there may be instances where a faulty accessory or system leaves the company liable to legitimate damage claims. That's unfortunate, particularly for the patients involved, but it doesn't change the broader value of robotic surgery.

Citron has a reputation for solid research, and investors pay attention to its reports. We don't take it lightly either, and we'll continue to watch the situation and the claims Citron makes. But right now, we see only smoke and no fire.