Frisch Financial Group, Inc. disclosed a sale of 45,311 shares of Direxion NASDAQ-100 Equal Weighted Index Shares (QQQE 1.86%), reducing exposure by an estimated $3.89 million, per its November 7, 2025, SEC filing.

What Happened

According to a filing with the Securities and Exchange Commission dated November 7, 2025, Frisch Financial Group, Inc. trimmed its stake in Direxion NASDAQ-100 Equal Weighted Index Shares by 45,311 shares during the third quarter. The estimated position value dropped by $3.89 million, reflecting both trading activity and market price movements. The fund reported holding 180,506 shares at quarter-end, worth $18.34 million.

What Else to Know

The sale reduced QQQE’s representation in the portfolio to 4.27% of reportable assets under management as of September 30, 2025.

Top five holdings after the filing:

- JPST: $29,977,641 (7.0% of AUM)

- RSP: $29,767,030 (6.9% of AUM)

- VTV: $26,725,126 (6.2% of AUM)

- BINC: $24,644,031 (5.7% of AUM)

- GOOGL: $23,925,141 (5.6% of AUM)

As of November 7, 2025, shares were priced at $101.08, up 8.12% over the past year; this lagged the S&P 500 by 3.88 percentage points over the same period.

Dividend yield stood at 0.58% as of November 10, 2025.

Company Overview

| Metric | Value |

|---|---|

| AUM | N/A |

| Dividend Yield | 0.58% |

| Price (as of market close 11/07/25) | $101.08 |

| 1-Year Total Return | 8.12% |

Company Snapshot

- Investment strategy seeks to replicate the performance of the NASDAQ-100 Equal Weighted Index, allocating assets equally across approximately 100 of the largest non-financial companies listed on NASDAQ.

- The fund's portfolio composition provides exposure to a basket of large-cap equities, with each constituent receiving equal weight regardless of market capitalization.

- Structured as a non-diversified ETF, it is designed to track the NASDAQ-100 Equal Weighted Index.

Direxion NASDAQ-100 Equal Weighted Index Shares (QQQE) is an exchange-traded fund with a market capitalization of $1.21 billion, offering investors equal-weighted access to the NASDAQ-100 Index. The fund's strategy mitigates single-stock risk by distributing capital evenly across all holdings, appealing to those seeking diversification within the technology-driven large-cap growth segment. Its structure and disciplined methodology position it as a core satellite holding for institutional portfolios requiring reduced concentration in mega-cap names.

Foolish Take

In a recent regulatory filing, Frisch Financial, a New York-based investment management firm, disclosed the sale of approximately 45,000 shares of QQQE, a Nasdaq-100 equal-weighted index ETF. Here's what retail investors need to know.

To begin, the QQQE seeks to replicate the performance of the equal-weighted Nasdaq 100. This differs from the QQQs, which are more heavily weighted towards megacap tech stocks like Nvidia, Microsoft, and Apple. Similarly, since the QQQE gives equal weighting to every member of the index, the QQQE gives greater weighting to the smaller stocks in the Nasdaq-100, such as Biogen, Lululemon, and ARM Holdings.

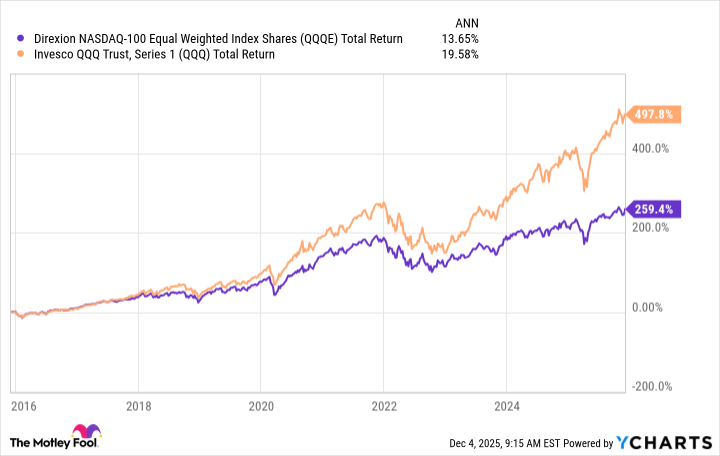

While this approach may seem more stable, it hasn't necessarily delivered better results than the megacap-heavy QQQ. Indeed, over the last ten years, the QQQ has generated a total return of 498%, equating to a compound annual growth rate (CAGR) of 19.6%. Meanwhile, the QQQE, with its equal-weight portfolio, has delivered a total return of just 259%, with a CAGR of 13.7%.

QQQE Total Return Level data by YCharts

In summary, equal-weighted portfolios (or ETFs) aren't always the best ones. In the case of the Nasdaq-100, history shows there is a real benefit from tilting towards megacap stocks. Retail investors should take note.

Glossary

Exchange-Traded Fund (ETF): An investment fund traded on stock exchanges, holding a basket of assets like stocks or bonds.

Equal Weighted Index: An index where each constituent stock is assigned the same weight, regardless of its market size.

13F Reportable Assets: Securities that institutional investment managers must disclose quarterly to the SEC if managing over $100 million.

Assets Under Management (AUM): The total market value of assets an investment firm manages on behalf of clients.

Non-diversified ETF: A fund that invests in fewer securities, potentially increasing exposure to specific sectors or companies.

Core Satellite Holding: An investment strategy combining a main "core" holding with smaller, diversified "satellite" positions to enhance returns or manage risk.

Dividend Yield: A financial ratio showing how much a company pays out in dividends each year relative to its share price.

Total Return: The investment's price change plus all dividends and distributions, assuming those payouts are reinvested.

Large-Cap Equities: Stocks of companies with large market capitalizations, typically considered more stable and established.

Constituent: An individual stock or security that is part of an index or fund.

Single-Stock Risk: The risk associated with holding a large position in one company, increasing potential volatility.

Reportable Assets: Investments that must be disclosed in regulatory filings, such as those required by the SEC for institutional managers.