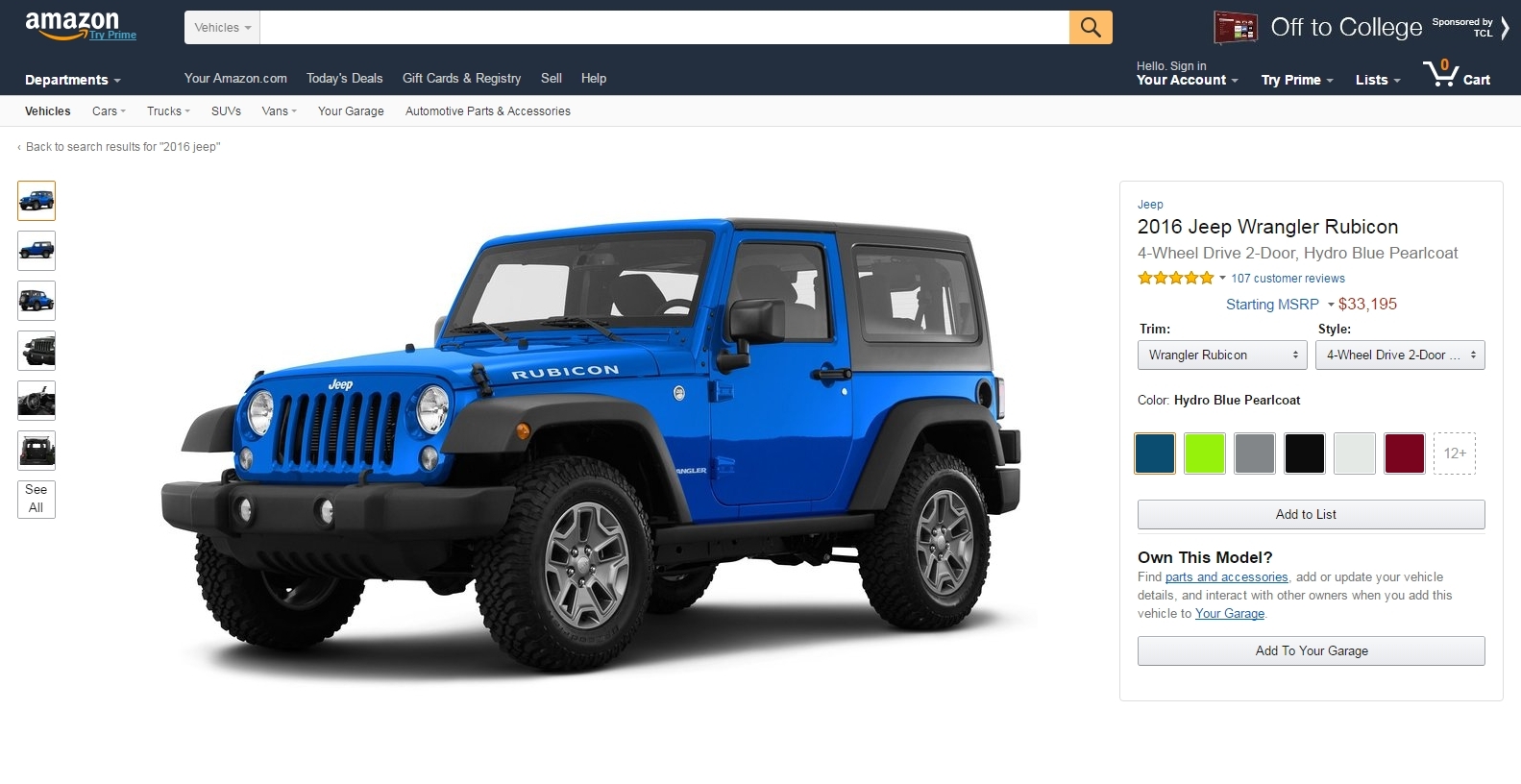

Image source: Amazon

Amazon.com's (AMZN +0.49%) stellar online retail presence has allowed the company to continually jump into new markets (think fashion and even partnering with banks for student loans). Amazon ventured out once again last week when it launched its new Amazon Vehicles hub.

The company calls Amazon Vehicles "a car research destination and automotive community" where its users can find specifications, images, videos, and customer reviews of both new and used cars. Amazon users can also ask car-related questions to other users.

If you're thinking that websites like this already exist, you're right. Edmunds.com, Kelley Blue Book, and a host of others already do this. But a recent research note from Morgan Stanley's Brian Nowak (republished on Barron's) says Amazon Vehicles might also steal away some thunder from TrueCar's (TRUE 1.86%) website and could eventually start eating into eBay's (EBAY 3.16%) lucrative auto parts sales.

Here's why:

First, Amazon's extensive user base surpasses TrueCar's. Amazon has about 300 million active users right now, with an estimated 30 million U.S. Prime members, and already has 35 million users who have added their vehicles into the Amazon Garage (where users can store details of their vehicle and find related auto parts and accessories).

Nowak notes that Amazon has already convinced about 11% of its overall users to add their vehicle to its Amazon Garage, and now it's giving them even more of a reason to go to its site for car research and auto parts.

Meanwhile, TrueCar specializes in providing comprehensive vehicle data and pricing information for new and used cars from dealerships, and has about 7 million monthly visitors.

While the 35 million vehicles in Amazon's Garage and its 300 million users aren't exactly an apples-to-apples comparison to True Car's 7 million users, it's easy to see how Amazon could easily steal away some of TrueCar's influence in the automotive research space simply by its sheer size.

To make matters worse for TrueCar, Amazon launched a test-drive partnership with Hyundai recently that brings new cars to a potential buyer's location, lets them drive the vehicle, and then recommends a local dealership to finish the buying process.

It's only in the preliminary stages right now, but when you add together Amazon Vehicles' research information, online community, Amazon Garage, and the ability to buy car parts, you have a recipe for a serious online automotive powerhouse.

The second part to this is how Amazon Vehicles could hurt eBay. Nowak mentioned that eBay makes about 11% of its total gross merchandises volume (GMV) from sales of auto parts on its site. The online parts and accessories market is estimated to be worth about $67 billion right now. Amazon is already selling auto parts on its site (I've purchased a brake caliper myself) and Amazon Vehicles should help the company tap this market even more.

The new automotive research tools should encourage more users to add their vehicles to the Amazon Garage, which should in turn lead to more sales of auto parts.

Of course, it's still a big unknown if Amazon can ramp up sales of auto parts on its site through Amazon Vehicles, or if the company will eventually add some sort of online car purchase service by partnering with dealers.

Amazon has previously stepped into new online markets that didn't exactly pan out (I'm looking at you, hotel booking site Amazon Destinations), but the automotive market is certainly worth pursuing.

TrueCar estimates the new and used automative market is worth about $1.2 trillion right now. Amazon certainly has the customer clout to turn car researchers into buyers (of both vehicles and parts), and if it can do so through Amazon Vehicles then investors could be looking at another huge growth market for the company in the coming years.