Chipmaker NVIDIA (NVDA 3.50%) has plenty of great qualities -- including a market-leading position in discrete GPUs, a firm foothold in connected cars, and growth opportunities in next-gen markets like machine learning and smart homes. But one area where NVIDIA repeatedly falls short is its dividend.

NVIDIA started paying a dividend in late 2012. Its yield started out at around 2%, but that figure is now well below 1% -- partly due to the stock's 1,140% rally over the past five years. But with the stock currently at all-time highs in a lofty market, investors might be wondering if NVIDIA should hike its dividend to prevent its investors from cashing out during a downturn.

Image source: NVIDIA.

A paltry payout compared to its industry peers

NVIDIA pays a forward yield of 0.4% -- which is much lower than the S&P 500's current yield of 2%. It's also much lower than the yield of comparable peers like Qualcomm (QCOM 0.55%) and Intel (INTC -0.20%), which respectively pay forward yields of 3.9% and 3%.

NVIDIA has hiked its dividend for four straight years, but it doesn't seem interested in raising it to levels comparable to those of its slower-growth semiconductor peers. That attitude isn't surprising, since most tech companies only start paying higher dividends when their growth slows down.

Below-average payout ratios

The sustainability of a dividend is measured by the payout ratio -- the percentage of a company's earnings or free cash flow (FCF) allocated to dividends. If that percentage exceeds 100%, the dividend is in trouble; if it's low, the company can afford to pay more.

Over the past 12 months, NVIDIA only spent 17% of its earnings and 19% of its FCF on dividends. Those are very low ratios compared to Intel, which spent 45% of its earnings and 44% of its FCF on dividends during the same period, or Qualcomm, which paid out 71% of its earnings and 56% of its FCF. Therefore, NVIDIA could easily double or triple its dividend while maintaining fairly low payout ratios.

Above-average free cash flow growth

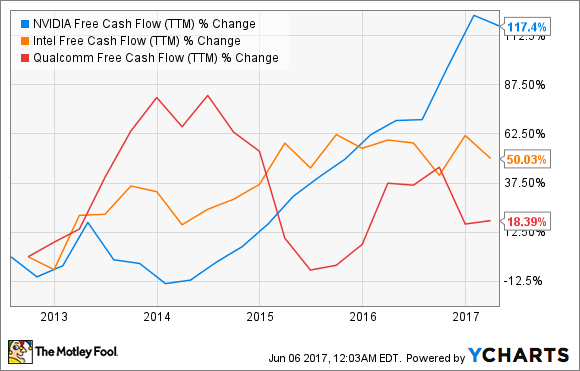

As Intel struggled with sluggish PC and data center chip sales, and Qualcomm faced headwinds in both its chipmaking and patent licensing businesses, NVIDIA's core GPU business thrived on robust demand from gamers, automakers, and data center partners. That's why NVIDIA posted much better FCF growth than both Intel and Qualcomm over the past five years.

Source: YCharts

That FCF growth supports the notion that NVIDIA should raise its dividend. But NVIDIA, like many other growing tech companies, likely prefers to keep more cash available for R&D and acquisitions.

Rosy top and bottom line growth ahead

Therefore, NVIDIA probably won't significantly raise its dividend unless its growth peaks or it runs out of ways to expand its business. That doesn't seem likely, with analysts anticipating 19% sales growth and 20% earnings growth this year.

By comparison, Intel's revenue and earnings are expected to respectively grow just 1% and 5% this year. Analysts expect Qualcomm's revenue and earnings to respectively fall 3% and 4%.

Should NVIDIA pay a higher dividend?

NVIDIA is still classified as a growth stock, which usually doesn't come with generous dividends. Investors probably don't care that NVIDIA doesn't pay higher dividends, since the stock more than tripled over the past 12 months.

But NVIDIA isn't unstoppable. Qualcomm's upcoming takeover of NXP will make it the biggest automotive chipmaker in the world, and a major threat to NVIDIA's automotive business. AMD's next-gen Vega cards could dent sales of NVIDIA's current-gen Pascal cards this year, and it's also expanding into the data center GPU market.

Yet that's precisely why NVIDIA doesn't pay a higher dividend. The less cash it pays out as dividends, the more cash it has to counter these potentially disruptive threats.