Social Security is a vital piece of the retirement puzzle, but not the only piece. If you are looking for safe and reliable dividend payers that can supplement the monthly checks you get from Social Security, you'll want to take a look at high yielders Duke Energy Corp (DUK +0.10%) and Magellan Midstream Partners, L.P. (MMP +0.00%). Not only do both offer big yields, but they have long histories of annual dividend increases too.

A power giant

Duke Energy is one of the largest electric utilities in the United States, serving 7.4 million electric customers and 1.5 million natural gas customers. The stock yields around 4.1% today, pretty enticing when an S&P 500 Index fund will only get you a yield of around 2%. Even more exciting, Duke has paid a dividend for over 90 consecutive years, with an annual dividend increase in each of the last 13 years.

Image source: Getty Images

The bigger question, however, is what can you expect from here? The answer is more slow and steady increases. Right now Duke is projecting earnings and dividends to grow in the 4% to 6% range through 2021. That beats the historical rate of inflation, which is around 3%, and means that the buying power of your dividends will grow over time.

Duke believes it can achieve this goal by investing in its diversified utility business. Over the last few years, Duke has repositioned its portfolio to include regulated electric and natural gas assets, fee-based natural gas pipelines, and a merchant renewable power business built on long-term contracts. It's a very stable portfolio, and the current plan is to spend $37 billion dollars through 2021 across its asset base. Most of that spending will be for infrastructure in its regulated businesses, but expansion in pipelines and merchant power will also be notable contributors to results.

Duke Energy's spending plans over the next few years backs up its dividend growth projections. Image source: Duke Energy Corp

Duke probably won't be a company you brag about at cocktail parties, but it should provide you with a steady and growing dividend check to bolster the check you get from Social Security.

A little more excitement, but not too much

The next name up is Magellan Midstream Partners, a large oil and natural gas midstream company that helps get these vital fuels from where they are drilled to where they get used. Its business is largely fee-based, focusing on transporting oil and refined products via its pipeline network and providing storage at marine terminals located on the Gulf Coast and in the Mid-Atlantic region.

The partnership has an enviable track record, with distribution increases in each of the last 17 years. Within that streak is another: over 60 consecutive quarterly hikes. That's like getting a pay raise every quarter! The yield, meanwhile, is a robust 5.3% today. The partnership expects to increase its distribution 8% over the next couple of years.

Once again, however, the big question is how will Magellan keep that quarterly streak alive.

Like Duke, the answer is spending money to expand assets. At the start of year, Magellan had plans to spend around $1 billion between 2017 and 2018. But it's always on the lookout for new opportunities, and today that number is up to $1.6 billion, with spending reaching out to 2019. It has another $500 million of projects it's looking at that could be added to that total, too.

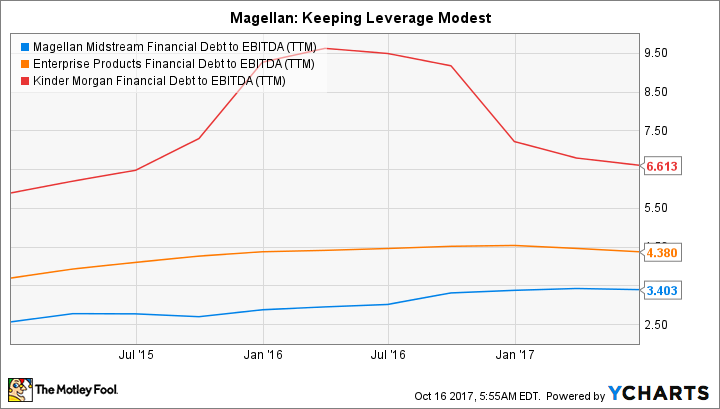

MMP Financial Debt to EBITDA (TTM) data by YCharts

The best part about Magellan, however, is that it is one of the most conservatively run pipeline partnerships around. Magellan's leverage is among the lowest in the midstream industry. Moreover, it expects to cover its distribution over the next couple of years by a solid 1.2 times, which provides a margin of safety and room to keep upping the disbursement. There's probably a little more risk at Magellan than at Duke, but the extra yield and faster distribution growth should more than makeup for that.

Enhancing Social Security

Both Duke and Magellan are solid investment options even if you don't receive Social Security. But adding their quarterly dividends (distributions in the case of Magellan) to that monthly check can really enhance your financial future by helping your income keep up with, and hopefully outpace, inflation. Both have sizable yields today, well-planned growth ahead of them, and the clear intention of upping their distributions as they grow.