Andeavor Logistics LP (ANDX) had a big year in 2017, including an acquisition, a name change, and a notable decline in its cost of capital. As all of the moving parts begin to settle, the big question for income investors right now should be about Andeavor Logistics' ability to keep increasing its distribution. Here's what you need to know about the streak that's going right now.

A pretty good run

First a little background, here. Andeavor Logistics LP is controlled by refiner Andeavor (ANDV), its general partner. That means Andeavor gets paid management fees, receives distributions related to the Andeavor Logistics units it owns and, until recently, incentive distribution rights as a reward for the partnership's distribution growth (more on this below). Andeavor has historically helped its controlled partnership grow by selling, or dropping down, assets to Andeavor Logistics. This is all typical stuff in the midstream limited partnership space.

Image source: Getty Images.

Andeavor Logistics' assets, meanwhile, are largely fee based. So, demand for its collection of midstream oil and natural gas assets is more important than the price of the commodities that flow through its system. It's a pretty stable business that has allowed for distribution increases every quarter since the partnership's IPO in 2011.

At last count, the streak was up to 27 quarters, or roughly eight consecutive years worth of quarterly distribution increases. Although some investors don't get interested until a company has hit at least a decade of annual increases, the impressive quarterly streak makes this story stand out.

Despite the attractive backstory here, 2017 was a very active year for Andeavor Logistics and its parent structurally speaking. It makes sense to step back and understand the material changes that were made and their implications before you jump aboard.

Two, or more, to tango

For starters, "Andeavor" used to be "Tesoro," for both the general partner and the partnership. That name change took place after Tesoro bought competitor Western Refining. That merger left Tesoro, now Andeavor, as the general partner of both its own midstream partnership and Western Refining Logistics Partners. To simplify things, it merged Western Refining Logistics Partners into Andeavor Logistics LP. That's a lot of moving parts, but the end result is a nicely streamlined business: A larger Andeavor is now the general partner of a larger Andeavor Logistics LP.

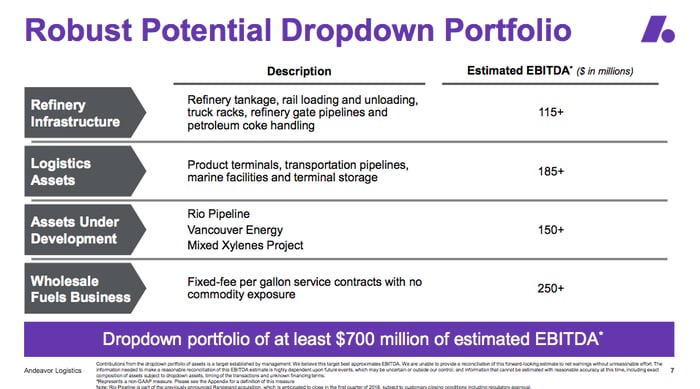

Andeavor Logistics has plenty of assets that it could buy from its parent. Image source: Andeavor Logistics LP.

But wait, there's more. Along the way, Andeavor Logistics bought the incentive distribution rights owned by Andeavor. That will help to reduce the partnership's cost of equity capital from around 13.5% to 7.9%, making accretive acquisitions and capital projects much easier to fund. That said, finding deals shouldn't be all that hard. The partnership expects to spend roughly $1 billion a year between 2018 and 2020, split roughly evenly between organic growth projects and acquisitions/dropdowns. The Western Refining acquisition, meanwhile, should help to keep the dropdown pipeline full.

The near-term problem is that Andeavor Logistics' coverage ratio fell below 1 in 2017, hitting 0.92 times in the fourth quarter. The full-year number was a little better, at 0.96 times, but the partnership still didn't cover its distribution. This is part of the reason the yield is a relatively high 8.2%. But there was a lot of noise in 2017, as noted above, and a short-term drop here isn't necessarily something to worry about. Management expects coverage of roughly 1.1 times in 2018, with around 6% distribution growth. In other words, 2017 was a transition year, and Andeavor Logistics should grow its way out of the coverage shortfall.

Worth a deep dive

If you are looking for a high-yield midstream investment with a strong history of regular distribution increases, Andeavor Logistics LP should be on your watchlist. Although it hasn't been around as long as some peers, it has amassed an impressive enough quarterly streak of increases to merit a closer look. More importantly, the partnership's youth could be a net benefit since it means there's still plenty of opportunity for accretive asset dropdowns from its parent, Andeavor. And that list of opportunities increased in 2017 because of the Western Refining acquisition. Don't get too caught up in the weak coverage ratio; the future looks far brighter than the recent past on that score.