What happened

Shares of Allscripts Healthcare Solutions (MDRX +9.15%), an information technology company focused on the healthcare industry, are up 11% as of 11:30 a.m. EDT. The double-digit gain is attributable to its release of mostly positive second-quarter results.

So what

Here's a review of the key takeaways from the quarter:

- Non-GAAP revenue increased 25% to $536 million. That was shy of the $538.2 million in revenue what Wall Street had projected.

- Non-GAAP earnings per share grew 20% to $0.18. That figured matched market watchers' projection.

- Contract revenue backlog increased 16% to $4.8 billion.

- Non-GAAP gross margin fell by 100 basis points to 47%.

- Stock buybacks totaled $44 million in the quarter. The company's board authorized a brand new $250 million buyback program.

Image source: Getty Images.

Mangement also reaffirmed its financial outlook for the year:

- Non-GAAP revenue is expected to climb at least 17% to a range of $2.15 billion to $2.25 billion.

- Adjusted EBITDA is expected to grow at least 12% to a range of $420 million to $460 million.

- Non-GAAP EPS is expected to increase at least 16% to a range of $0.72 to $0.82.

These figures line up well with Wall Street's estimate of $2.18 billion in total revenue and $0.77 in EPS.

Investors are bidding up the stock price in response to the generally positive results.

Now what

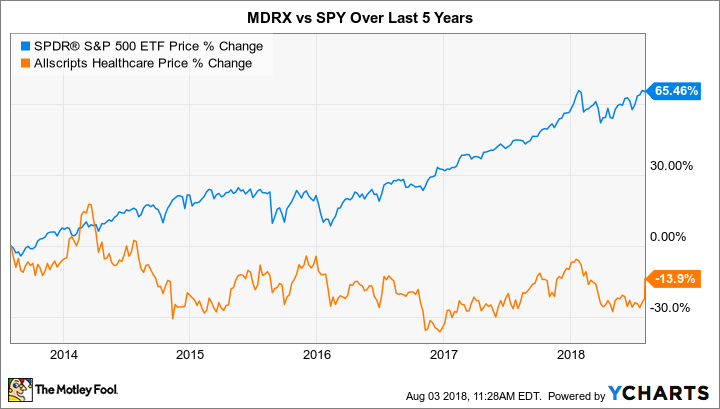

Allscripts Healthcare Solutions has badly underperformed the market over the last several years, so today's pop should come as welcome relief to its shareholders.

Looking ahead, Wall Street projects that the company's profits will grow in excess of 18% annually over the next five years. If that number proves to be anywhere close to reality, then the stock's current valuation of about 16 times next year's earnings estimates could prove to be attractive. However, given the company's poor track record of creating shareholder value, I thinks that approaching this stock with a wait-and-see mind-set makes the most sense. Investors who are interested in the healthcare information service stocks might want to consider looking elsewhere.