As an income-focused investor, I'm like a moth to a flame when it comes to big, fat yields. Which is why Sunoco LP (SUN 0.65%) and its incredible 13% distribution yield caught my eye. But when you get into double digit yields, even in the midstream partnership space, you have to step back, take a deep breath, and think about the risks you are taking on. I've learned the hard way that not all that glitters is gold. For me, the big question right now is whether or not Sunoco LP is a yield trap...

Complete corporate overhaul

Today Sunoco LP is largely a distributor of gasoline, a business that the partnership projects will account for 70% of gross profit in 2018. The remaining 30% comes from leasing out owned gas stations, convenience store sales, and various services. Most of its business is backed by long-term, take or pay contracts for the delivery of gasoline that provides the partnership with a stable revenue stream. So far this sounds exactly like the kind of partnership that can support a high yield.

Image source: Getty Images

But the current makeup of the partnership came about from the sale of most of its owned gas stations to 7-Eleven in January of 2018. Sunoco LP is still making some portfolio adjustments, including the sale of more gas stations, but the big changes are largely complete. It has, essentially, just embarked on a new course. Which isn't a bad thing, noting that retail sales at the convenience stores attached to gas stations can be fairly volatile. The takeaway for investors, however, is that the partnership's past isn't a great guide to the future because the future is going to look vastly different.

In other words, there's a good deal of uncertainty here. Which partly explains the 13% distribution yield. That uncertainty includes the fact that the partnership has chosen to maintain its distribution at the same level that it was prior to the sale of over 1,100 gas stations to 7-Eleven. That was a big chunk of the business. While Sunoco LP got a long-term take or pay contract from 7-Eleven in the deal, a new business direction and the same unitholder distribution means that this deal has to work out as expected or there could be problems for income investors.

Spotty reputation

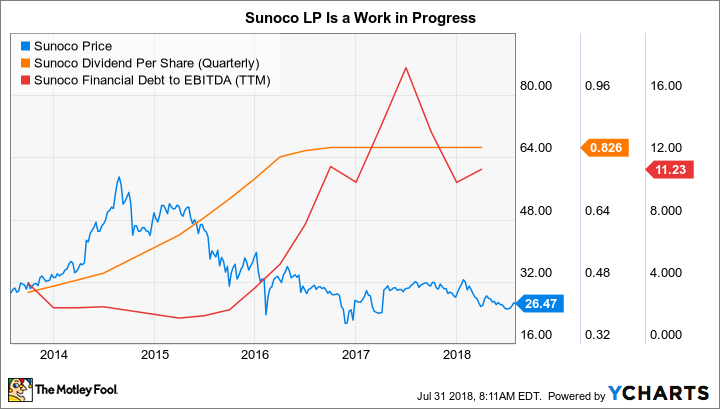

You can't forget the past here, even though it isn't a clear indicator of the future. One of the reasons for the gas station sale was that Sunoco LP was laboring under a heavy debt load. Debt to EBITDA spiked higher in 2016 and peaked at over 15 times in 2017 -- an unsustainable figure. In fact, distribution coverage was below one for a long stretch, too, which is why the distribution hasn't increased since mid-2016. This isn't a great backstory for investors concerned about the safety of their income stream.

But that's the past, the new Sunoco LP is already looking a little different. For example, the first quarter's coverage ratio was 1.0, not great but a notable improvement over not being able to cover the distribution. Debt to EBITDA has also fallen to around 11 times. That's still really high, but there were a lot of moving parts in the quarter. Management reports that debt to adjusted EBITDA was 3.8 times at the end of the first quarter. That's a much more manageable number helped along by the repayment of debt following the gas station sale (long-term debt fell by 35% in the first three months of the year).

Sunoco LP's business and ability to support its distribution (and that hefty yield) appear to be on more solid ground now that the 7-Eleven deal is complete. But one or two quarters in what is really a transition year isn't enough to signal the all clear. A key part of the partnership's growth plan includes acquisitions (it has already inked one deal), which will likely mean additional debt over the long-term. Having gotten into a debt hole once already, investors would be unwise to give Sunoco LP a lot of leeway on the leverage front. In the end, there are so many moving parts right now that it's hard to get a good read on Sunoco LP as a business.

Wait and see

The partnership is targeting distribution coverage of 1.1 times and debt to adjusted EBITDA of around 4.5 times on an ongoing basis. With so much change taking place in 2018, it's probably best to err on the side of caution here and waiting for management to prove that it can actually hit those targets on a sustained basis. The yield is great, but the uncertainty is just too high right now. Sunoco LP doesn't appear to be a yield trap, but most investors would be better off avoiding the partnership until it proves the new business model can sustain such a large distribution over a much longer period of time.