Investor interest in marijuana stocks soared last year, thanks largely to several huge events, including cannabis becoming legal for recreational use in California (January) and Canada (October).

We're going to examine KushCo Holdings (KSHB +0.00%) -- which provides packaging solutions and other ancillary products and services to the legal cannabis industry -- to see whether its stock is a buy.

Image source: Getty Images.

Stock performance: The short and longer term

One of the first things a potential investor in KushCo probably wants to know is how the stock has performed over the short and longer terms, including how it's stacked up against other cannabis stocks.

A one-year loser

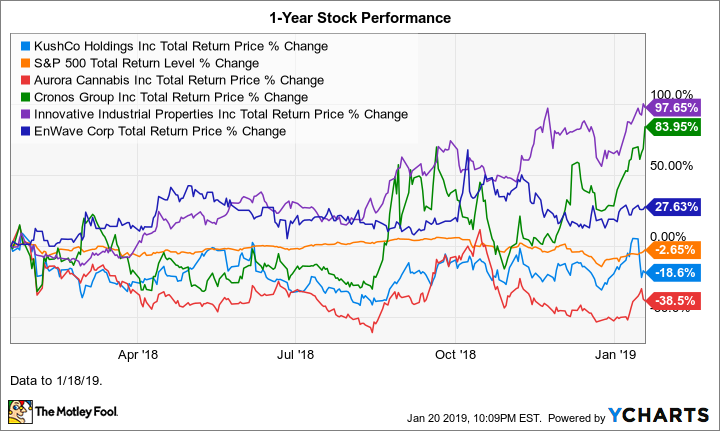

KushCo stock declined 18.6% over the one-year period through Friday, Jan. 18. By comparison, the S&P 500 (including dividends) edged down 2.7%.

The stocks of the Canadian marijuana growers are a mixed bag over this same period. The best and worst performing of the four largest ones (by market cap), Cronos and Aurora Cannabis, respectively, are shown in the chart below. (Tilray is actually the best performer of the larger players, but it's only been traded in the U.S. since July.) Shares of ancillary cannabis companies Innovative Industrial Properties (IIPR +1.48%) and EnWave have performed wonderfully and solidly, respectively. Innovative Industrial Properties (IIP) is a San Diego-based, cannabis-focused real estate investment trust that's profitable and pays a dividend yielding 2.6%; EnWave is a Canadian company that launched its dehydration technology into the cannabis industry last year.

Data by YCharts.

A winner since its IPO three years ago

Since its initial public offering in early January 2016, KushCo stock has surged 171% -- more than four times the S&P 500's 40.9% return. Aurora Cannabis has rocketed 1,370% higher over this period, while EnWave has gained 90.2%. (However, EnWave only became a "cannabis stock" last year.) Cronos and IIP aren't shown because they have not traded in the U.S. (not traded, period, for IIP) for this entire period.

Data by YCharts.

KushCo's business

KushCo Holdings, which is based in California, was founded in 2010 by Nick Kovacevich, the company's CEO and chairman of the board, and Dallas Imbimbo, who serves on the board. The company started life as Kush Bottles and changed its name last year to reflect its expansion beyond its packaging roots. It's very close to a pure play, with only its acquired creative-design business having clients outside the cannabis realm. In short, the company's aim is to be a one-stop shop for customers.

KushCo has sales and distribution facilities across the U.S. and Canada, and opened an office in China last fall.

KushCo's businesses include:

- Kush Supply: The largest distributor in the U.S. of vaporizer products, packaging, supplies, and accessories to cannabis growers, processors, extractors, manufacturers, and retailers.

- Kush Energy: Provider of pure hydrocarbon gases and solvents to the cannabis sector. These products are used to produce cannabis extracts, such as hemp-derived cannabidiol (CBD) oils. So this business should benefit from the December passage of the Farm Bill, which legalized hemp across the U.S. effective Jan. 1, 2019. (CBD is a nonpsychoactive chemical found in the cannabis plant that has been linked to various wellness benefits.)

- The Hybrid Creative: A creative design agency providing services for cannabis and noncannabis brands.

- Koleto: The company's research and development arm.

KushCo's leadership

As previously noted, Kovacevich leads the company. It's generally a plus to have a founder running the business, since these folks know their companies intimately, and often have much skin in the game. Studies suggest that founder-led companies outperform in the stock market.

Kovacevich owned 11,035,000 KushCo shares, valued at about $59.9 million based on the closing price of $5.43 per share, as of his most recently reported transaction on Jan. 8. (This was a sale at prices ranging from $5.98 to $6.15 per share for a total of $1.21 million.) Kovacevich has a 13.8% stake in the company, with Imbimbo not far behind at about 13%.

KushCo's financial performance

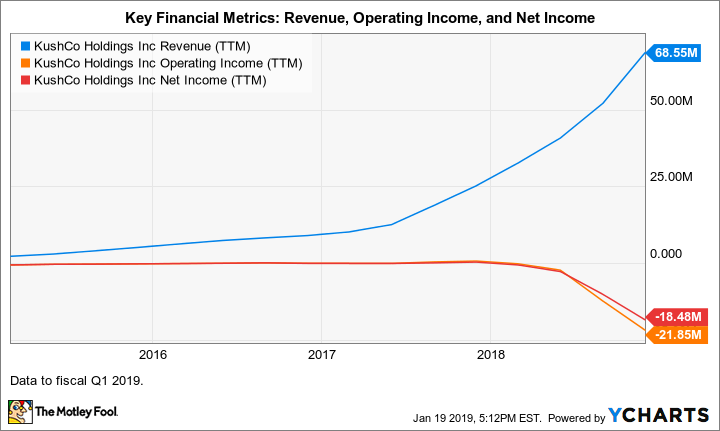

Like many in the sector, KushCo has revenue that's been increasing rapidly, while its losses on both an operational and a net basis have been growing. The company is rapidly scaling up its business and investing to fuel long-term growth.

Data by YCharts.

KushCo's gross and operating margins have declined rather sharply since late 2017. Investors shouldn't be overly concerned with operating margin at this point, given that the company is opening new facilities and otherwise spending to fuel long-term growth. (Operating margin will at least partly improve along with an improvement in gross margin.) But gross margin (total revenue minus cost of goods sold, divided by total revenue) is another matter.

In its fiscal Q1 earnings release, the company addressed this issue: "While we are confident in the Company's upward trajectory, we acknowledge the impact that our dramatic growth has had on our gross margins, in particular, the utilization of air freight and additional cost incurring quality control measures at our receiving warehouse to meet demand. We have implemented a number of strategic operational initiatives that will drive our gross margins back toward 30% as we scale the business, with improvements in margins expected in the second half of fiscal 2019."

Data by YCharts.

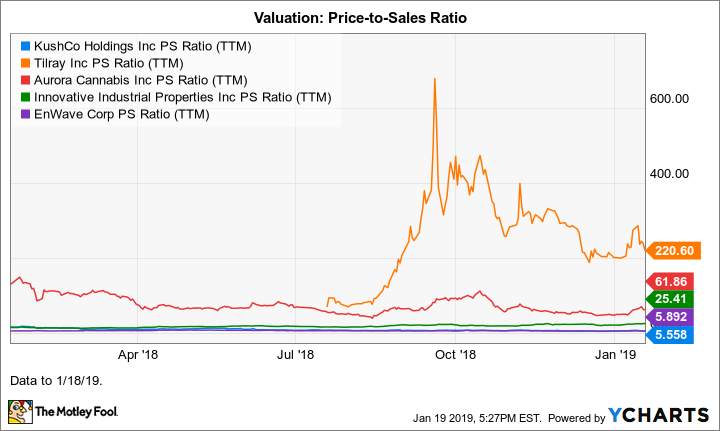

As to valuation, KushCo stock's price-to-sales (P/S) ratio is 5.6, which is quite high in general, but reasonable relative to other cannabis stocks.

Data by YCharts.

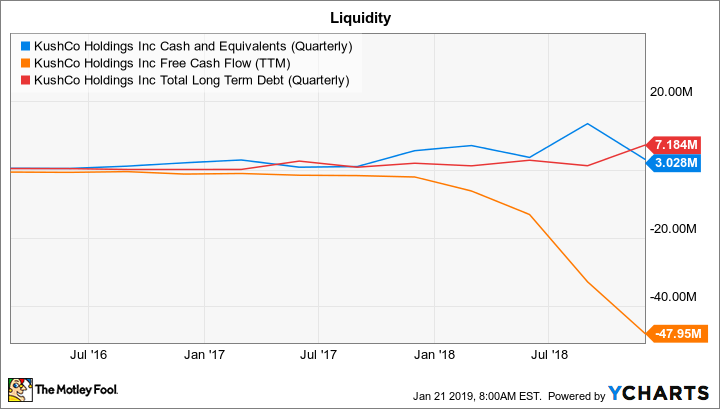

Investors need to keep an eye on liquidity and shareholder dilution. At the end of its most recently reported quarter, KushCo had cash and equivalents of just over $3 million and long-term debt of $7.2 million on its balance sheet. The company burned through $48 million in cash over the last year, financing its ramped-up spending through increasing its debt load and issuing significantly more shares of stock. (Over the last one and two years, the number of shares has increased about 27% and 62%, respectively.) Increasing the number of shares of stock has a dilutive effect on the ownership stakes of existing shareholders.

Data by YCharts.

Is KushCo stock a buy?

After running through this exercise, I would not call KushCo stock a buy, though it appears worth putting on your watchlist. Investors should look for some indication that the company's strategy of sacrificing profitability to fuel revenue growth and win customers will eventually pay off. Keep an eye on gross margins when the company reports quarterly results.

Check out all our earnings call transcripts.