What happened

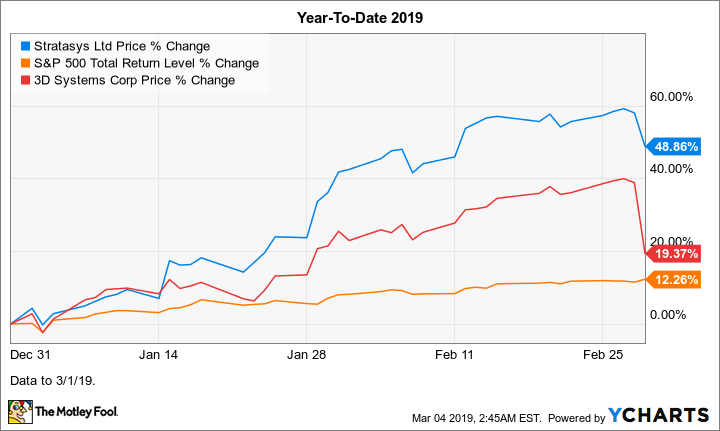

Shares of 3D printing company Stratasys (SSYS +0.42%) gained 11.5% last month, according to data from S&P Global Market Intelligence. They declined 5.8% on Friday, the first day of March, though they're still up 48.9% in 2019.

For some context, the S&P 500 index returned 3.2% in February, and has returned 12.3% so far this year. Meanwhile, shares of rival 3D Systems (DDD 1.33%) were up 10.7% in February, plummeted 14% on Friday, and are up 19.4% in 2019.

Check out the latest earnings call transcript for Stratasys.

Image source: Getty Images.

So what

February

Stratasys didn't make any notable announcements last month, nor was it the specific subject of any significant news. So we can probably attribute its stock's 11.5% rise to a combination of the overall strong market this year, particularly among stocks in the broad tech realm, and a continuation of the positive momentum that it's enjoyed since late last year.

This momentum is likely at least in part due to the company's release of results for the last two quarters that have beaten Wall Street's consensus earnings estimate by a considerable margin. On Nov. 1, after Stratasys released its better-than-expected third-quarter results, its stock soared 19.9%. In the quarter, revenue increased 3.9% year over year to $162 million, GAAP loss per share narrowed significantly to $0.01, and earnings per share (EPS) adjusted for one-time items jumped 38% to $0.11. The Street had been looking for adjusted EPS of $0.06 on revenue of $161.9 million.

March to date

We can probably safely attribute Stratasys stock's 5.8% drop on Friday to concerns about the health of the overall 3D printing market stemming from 3D Systems' release of its Q4 results on Thursday. Investors seemed initially satisfied with the results, as evidenced by the company's stock rising 5.9% in after-hours trading on Thursday. However, shares of 3D Systems plunged 14% on Friday following Bank of America Merrill Lynch paring back by 24% its 2019 EPS estimate for the company. The Wall Street firm cited concerns about its declining gross margin.

Now what

Investors shouldn't have long to wait for material news. Stratasys is slated to release its fourth-quarter and full-year 2018 results before the market opens on Thursday, March 7. For the quarter, Wall Street expects adjusted EPS of $0.21 on revenue of $185 million, representing growth of 31% and 3.2%, respectively, year over year.

Since Stratasys has sailed by the Street's earnings expectations in the last two quarters, some investors are likely thinking that there's a good chance of a hat trick. While this is certainly a possibility, it's far from a sure thing and investors should remain cautiously optimistic.