What happened

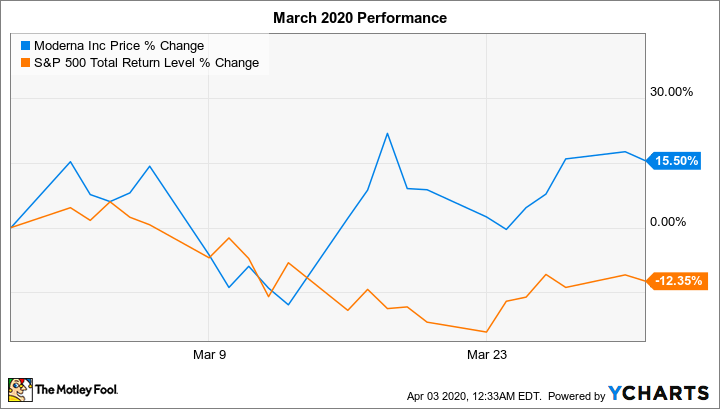

Shares of clinical-stage biotech Moderna (MRNA +6.28%) rose 15.5% in March, according to data from S&P Global Market Intelligence.

That's a much better performance than it might seem at first glance, when you consider that last month the S&P 500 index returned negative 12.4%. The market sell-off is being driven by investors' fears about the economic impact of the novel coronavirus pandemic.

(In April, Moderna stock has continued to run. In the first two trading days of the month through Thursday, it's up 10.9%, whereas the broader market is down 3.8%.)

There's no COVID-19 vaccine yet, but many companies are working on developing one. Image source: Getty Images.

So what

We can attribute Moderna stock's robust performance last month to investor enthusiasm about the company's prospects for developing a vaccine to immunize people against COVID-19, the disease caused by the novel coronavirus.

On March 16, Moderna stock soared 24.4% following the company's announcement of the start of the phase 1 clinical trial for its messenger RNA (mRNA) vaccine candidate, which is being conducted by its partner, the National Institutes of Health. With this milestone, the company became the first entity to have its COVID-19 vaccine candidate dosed in a human.

Data by YCharts.

Moving our time lens out further, the chart below shows how Moderna stock has performed in 2020 through April 2. And zooming that lens out as far as possible -- to the company's initial public offering (IPO) in December 2018 -- shares are up 44.3%. They debuted on the market at $23 per share.

Data by YCharts.

Now what

Moderna aims to begin phase 2 trials in the spring or early summer. If all goes as planned, it expects to have a vaccine available for public distribution in 12 to 18 months. That's super speedy in the world of vaccine development, yet it seems like too long a time given how fast the virus is spreading. The good news is that "it is possible that under emergency use, a vaccine could be available to some people, possibly including healthcare professionals, in the fall of 2020," according to the company's website, as well as a company filing to the Securities and Exchange Commission.

Moderna stock is high risk/high reward. The company's mRNA platform looks promising, and certainly demand for a COVID-19 vaccine will be massive. However, the furthest along it is in any of its nine vaccine programs is phase 2 clinical testing. It has no approved drugs.