There are few companies with the name recognition of United States Steel (X +0.00%). But being well known doesn't mean a company is an industry leader. When it comes to steel, that distinction goes to Nucor Corporation (NUE 0.40%), a name that you probably wouldn't have heard of unless you were looking specifically at the steel sector. Here's a comparison of these two stocks that helps show why lesser-known Nucor is a much better company than U.S. Steel.

1. Consistency

Coming out of the last recession between 2007 and 2009, steel stocks were hit hard. Just about all of them lost money in 2009. The industry is highly cyclical, so that's not a surprise. However, the ten years that followed that downturn were all profitable for Nucor, while U.S. Steel lost money in seven of them. Some of that red ink was related to one-time charges, often reducing the value of assets that were no longer expected to produce as much income. But that's just the point: Nucor managed to get through the difficult period, which was marked by high levels of low-cost imports, without taking the same hit.

Image source: Getty Images

That brings up another place where Nucor shines: its streak of 47 consecutive annual dividend increases. That's impressive for any industry, let alone one marked by frequent peaks and valleys. U.S. Steel's dividend has been stuck at $0.20 per share per year for the last decade. Based on the company's red ink through that span, it's impressive that it managed to even maintain a dividend. But that still falls well short of what Nucor has achieved.

2. Business model

Part of the reason why Nucor has been able to excel is that it uses electric arc mini-mills. To simplify a great deal, these mills are more cost effective at lower volumes and are more flexible than the blast furnaces that underpin U.S. Steel's business. In fact, U.S. Steel has been looking to include more electric arc mini-mills in its portfolio, as it works on what it is calling its "Best of Both" strategy. To that end, it recently agreed to buy a 49.9% stake in an electric arc mill, with an option to buy the rest in the future. The intent of this move was to speed up its "Best of Both" overhaul. To be fair, blast furnaces are important and can be quite profitable, but they need to operate at high levels to achieve that. So financial performance tends to vacillate between large profits and large losses. Not ideal for investors looking to own a stock for the long haul.

There's another feature of Nucor's model that sets it apart: employee compensation. Nucor's pay structure includes a material profit-sharing component. When times are good, its employees get to share in that success. But they also see their compensation fall when times are tough for the company. Overall, the good years have generally more than made up for the bad years, but Nucor essentially sees one of its biggest costs (employees) fall just when it needs some financial breathing room. U.S. Steel doesn't have such a structure in place and, because of heavy unionization, is unlikely to ever get there. For reference, Nucor is basically union-free.

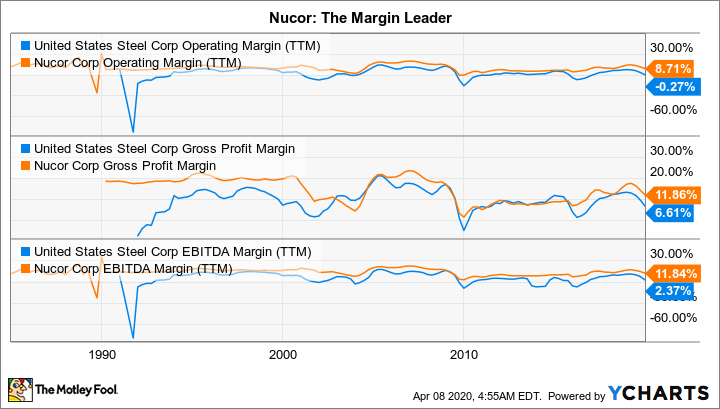

X Operating Margin (TTM) data by YCharts

To give a big-picture view of what all of this means, Nucor's operating margin, gross profit margin, and EBITDA margin have historically trended above those achieved by U.S. Steel, often by a wide degree. Clearly, Nucor is doing something better than U.S. Steel.

3. Financial strength

The last point here is the financial foundation of a company -- the balance sheet. Nucor's financial debt to equity ratio is roughly 0.25 times today. That's low for any company, let alone a cyclical one. And it is much lower than U.S. Steel's roughly 1.9 times. To be fair, the acquisition of a minority stake in an electric arc steel mill (highlighted above) just pushed that number higher. But even before that, it's financial debt to equity ratio was roughly twice that of Nucor. This isn't an unusual trend -- Nucor has long been at the low end of the industry leverage-wise. Maintaining a rock-solid balance sheet is part of the business model, since it gives the company the flexibility to invest in its business even during difficult times.

X Financial Debt to Equity (Quarterly) data by YCharts

With a lower level of leverage, it shouldn't be too much of a surprise to find that Nucor is able to cover its interest costs more easily than U.S. Steel. Note that U.S. Steel lost money in 2019, so it didn't cover its interest expenses, while Nucor, soundly in the black, covered its interest costs nearly 16 times over. However, the real difference here shows up over the long haul, since Nucor regularly bests U.S. Steel on this financial metric.

A better mousetrap

There's no denying that U.S. Steel has an iconic name. But that doesn't mean it is a great company. And it certainly isn't the industry leader in the U.S. steel sector -- that distinction goes to Nucor. If you are looking at steel stocks, Nucor should be at the top of your wish list, while U.S. Steel probably shouldn't even be on the list at all.