Real estate investment trust (REIT) Iron Mountain (IRM 0.75%) has an 8%-plus dividend yield, which is pretty eye-catching at a time when the broader market's yield is below 2%. But how safe is the dividend backing that fat yield? The answer isn't as clear-cut as you think.

Here's the good and bad of the situation and why, at the end of the day, Iron Mountain's yield isn't likely to be worth the risk for most investors.

The good news

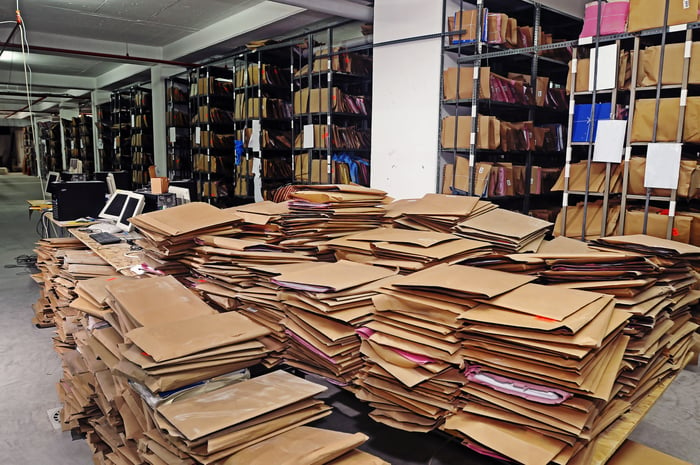

Iron Mountain is in a class by itself today because no other real estate investment trust does what it does, which makes peer comparisons impossible. However, the company's storage-focused business, while unique, is very resilient. Effectively, its core business is to put paper documents that need to be retained into its facilities so its customers don't have to clutter up their own properties with them.

The REIT claims a 98% retention rate and highlights that around half of the boxes it stores have been in its facilities for 15 years or more. It is one of the largest and most trusted names in the niche.

Image source: Getty Images.

However, paper is going away as a documenting medium as the world increasingly goes digital. To combat this trend, Iron Mountain is doing two things. First, it is expanding in emerging markets where digitization hasn't spread as much it has in more developed regions. Second, it is building a data center business so that, over time, it shifts its business into the areas to which its customers are migrating.

That's clearly a good decision. Right now "storage" makes up roughly 70% of Iron Mountain's revenue, with the physical records business accounting for 70% of that total. The rest of the "storage" business is largely digital, but not exclusively.

The other 30% of the company's revenue is derived from services. About 70% of that number is tied to its physical storage business, for things like moving boxes around and shredding old documents. Most of the rest comes from the digital side of its operations. Effectively, Iron Mountain is taking advantage of the captured nature of its customers to increase revenue, which is a great model.

At this point, investors might think that Iron Mountain's business is rock-solid and worth adding to a dividend-focused investment portfolio. Don't jump just yet, however, because there's some risks you'll want to consider here.

The bad news

The first issue to consider is the REIT's balance sheet. Iron Mountain's debt-to-equity ratio is roughly 11 today. That's the highest level in the company's history and up from closer to 3 at the start of 2018. Although there's no peer comparison here, leverage is obviously on the rise and at lofty levels compared to the company's own history. It's pretty high by just about any standard.

IRM Debt to Equity Ratio data by YCharts.

The takeaway here is that Iron Mountain has a reliable core business and it is working to expand into a new area to ensure its long-term survival. But that's taking a sizable toll on its balance sheet that will, at some point, have to be addressed. Maybe it can grow into that debt, or maybe it has to make dilutive stock issuances. Or, perhaps, it may even have to consider cutting the dividend to free up some cash.

That last point is the really big concern here. Through the first six months of 2020, Iron Mountain generated funds from operations (FFO) per share, which is like earnings for an industrial firm, of $1.12. That was up nearly 10% over the same period the previous year, so Iron Mountain is doing fairly well despite the current market headwinds. Based on its business, that makes complete sense. The problem is that it paid out roughly $1.24 per share in dividends in the first half of 2020 -- well more than the FFO it generated.

REITs can pay out more than FFO over short periods of time by using asset sales or debt to cover the difference, so this isn't the end of the world. However, paying a dividend that exceeds funds from operations can only go on for just so long before something has to give. The problem is that you have to add the payout issue to Iron Mountain's highly leveraged balance sheet and the ongoing costs associated with its digital shift. These three facts added together suggest there's a high level of risk here, even though the business itself is pretty solid and moving in a good direction.

Be careful with this REIT

There's a chance that Iron Mountain deftly manages its business and grows its way out of its debt and FFO payout ratio issues. It is making logical strategic moves to ensure its long-term survival, notably on the digital front. However, right now there is a material risk that the REIT could be forced to adjust its dividend lower so it is more in line with its FFO. For risk-averse dividend investors, that's a gamble that's probably not worth taking on.

If you do decide to buy Iron Mountain, go in understanding the very real negatives you are shouldering today. The company itself is unlikely to go away, but the dividend may not be as secure as you'd guess by looking at its business alone.