Real estate investment trust (REIT) Simon Property Group (SPG 0.96%) is one of the largest owners of retail malls in the world. The global pandemic, however, hasn't been kind to malls, with economic shutdowns and social distancing leaving consumer traffic anemic at best. However, the stock is up 20% over the past month as investors have started to look past COVID-19. Should you join the crowd and buy in?

A strong portfolio

At its core, a real estate investment trust is only as good as the collection of assets it owns. On that score, Simon comes out pretty well, with a portfolio of around 200 enclosed malls and outlet centers. Most are in the U.S. market, but it also has some exposure to key foreign markets like Europe and Asia. The differentiating point here is the location of its properties, with most of its assets near densely populated regions that have high average incomes. In fact, it sits near the top of its peer group when it comes to these key metrics.

Image source: Getty Images.

It's also working to increase the value of its portfolio, agreeing to buy equally well-positioned but smaller peer Taubman Centers (TCO). This deal was first agreed to before the pandemic but has since been reworked, reducing the price given the tough retail backdrop. Still, the deal will add another 25 or so well-situated malls to Simon's portfolio once it's completed.

There are more than 1,000 malls in the United States, which is likely too many, and weaker malls are already closing down. But Simon's malls are in the top echelon, and they should not only survive, but get even more valuable as lesser malls go away. Essentially, shoppers and retailers will have fewer mall options in the future, so more will end up going to the malls that survive. That's something of a reverse network effect. This paints a fairly bright picture for Simon over the long term.

It's tough right now

The problem is that the near term is not going well for Simon (or any of its peers for that matter). Before the pandemic, malls were dealing with the retail apocalypse. Effectively, retailers that haven't kept up with consumer trends, including online shopping, have been falling by the wayside. Those with heavy debt loads were the first to trip up, but the pandemic has only added to the industry's troubles. Companies that managed to keep struggling through in the hope of adjusting over time often couldn't handle the hit of government-forced closures.

Essentially, the pandemic has sped up what was already a slow-moving industry shift. But that's just one piece of the equation since it only looks at the retailers that fill Simon's malls. Simon, as a landlord, has to deal with an increasing number of vacancies in its properties. That's not a good thing for the REIT or its other tenants. And it's not a problem that can be fixed overnight. A mall is a carefully curated list of retailers that have to make sense together or it won't be desirable to tenants or consumers. To look at an extreme example, putting a high-end jewelry store in the same mall as a dollar store would be a disaster for everyone. It simply takes time to find the right tenants and upgrade a space so it can open up for business.

In other words, Simon looks like it has a bright long-term future based on its strong portfolio of properties. But the near term isn't going to get much better for a while, because it still has material headwinds to work through, even after the world moves past COVID-19.

Know what you're getting into

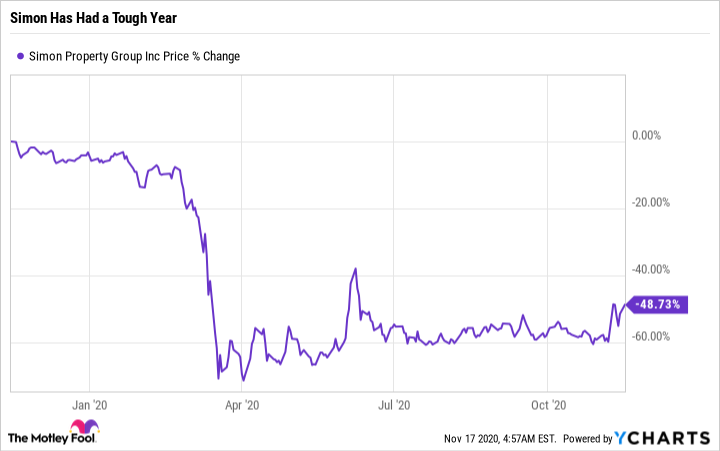

Simon is definitely not a bad REIT. In fact, it's probably one of the best-positioned mall owners around. However, that hasn't stopped the combination of the retail apocalypse and the coronavirus leading to a dividend cut and a steep price decline. Conservative investors should probably stay on the sideline here, as Simon is really most appropriate for those with long-term views and very strong stomachs for price volatility. Indeed, there's still a lot of work to be done before Simon can say it's turned its business around.