What happened

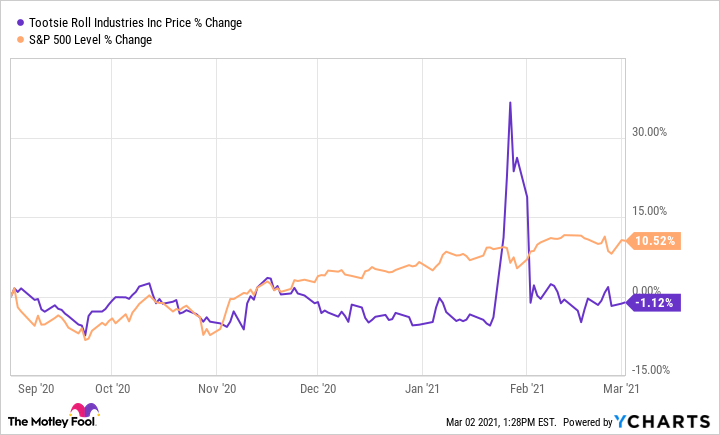

Shares of Tootsie Roll Industries (TR -0.40%) fell 22% in February, according to data provided by S&P Global Market Intelligence. The typically sleepy stock was caught up in short-squeeze mania in January, as traders looked to exploit its high level of short interest for quick gains. But interest cooled off as February began, dropping Tootsie Roll stock back down to where it had traded in the months prior.

So what

Tootsie Roll makes its namesake candies and many other well-known brands like Dots and Charlestown Chew. It's a stable business but not exactly a hot-growth story. Perhaps that's why many investors were actively betting against the stock through a strategy called shorting. In early January, 7.4 million shares of Tootsie Roll stock were sold short -- roughly half of the stock's float.

Image source: Getty Images.

When a high percentage of a stock's float is sold short, it makes a short squeeze (a quick jump in stock price caused by the short interest) more possible. Tootsie Roll was in an even better position than most stocks for a short squeeze because its stock doesn't have much trading volume. Therefore, when short squeezes started all over the market, Tootsie Roll was targeted for a squeeze as well, making the stock spike the most it has spiked in over a decade.

That's the thing with short squeezes, though -- they don't last long. Accordingly, Tootsie Roll's short squeeze was short-lived and ended right at the beginning of the month, resulting in the pullback. The chart below visually summarizes the story of Tootsie Roll stock in February.

Six-month returns for Tootsie Roll stock and the S&P 500. TR data by YCharts

Now what

There's still a decent amount of short interest in Tootsie Roll stock with almost 4 million shares sold short as of Feb. 12. However, that's down significantly, and it's unlikely to squeeze again anytime for soon. Expect sleepy returns going forward unless management somehow finds new growth avenues. It may not offer much growth, but it does offer stability as one of the most reliable dividend stocks on the market.