Chipotle Mexican Grill (CMG -1.42%) pioneered the fast-casual food category, serving customers quality Tex-Mex items made from responsibly-sourced ingredients. The stock, which has risen 176% over the past five years, showcases the company's remarkable success, something that will continue in the years ahead.

But even though business has been booming, I still don't own any shares in this top restaurant stock. Here's why.

Chipotle is a high-quality business ...

Taking a look at Chipotle's historical financials gives us a sense of just how successful the company has been. From 2016 to 2021, revenue increased at an annualized rate of 14%. Same-store sales growth averaged 8.5% per year, while the store count increased from 2,250 to about 2,950 over the same period. And net income surged from a low of $23 million in 2016 to $653 million last year.

Any way you look at it, Chipotle has been thriving. It carved out a niche in the cutthroat restaurant industry by offering a focused menu and doing it extremely well. What's impressive is Chipotle's performance over the past two years, an otherwise turbulent time for retail-based enterprises. The pandemic supercharged the business as consumers turned to the company's digital ordering options.

Customers can order online or from the mobile app, as well as from third-party delivery services. The management team, led by CEO Brian Niccol, implemented second-make lines in the back of restaurants specifically for online orders. This way, the convenient experience for in-person guests remained intact. Drive-throughs, known as Chipotlanes, are also expanding at a rapid pace to facilitate pick-up orders.

Chipotle launched its loyalty program in March 2019, and it now counts 28 million members. I like to point to Starbucks as the quintessential example of what a successful restaurant rewards program looks like. It has worked so well for the coffee-house chain, because not only is the product popular with consumers, but coffee lends itself to repeat purchases. Burritos are starting to fit in this category. In the most recent quarter, digital sales represented 41.9% of overall food and beverage sales at Chipotle.

With over 3,000 locations today, you might think Chipotle is close to reaching maturity. But management has huge expansion plans in the years ahead as it believes North America can one day have 7,000 stores. The ongoing success of Chipotle certainly makes the chances of reaching this goal very likely.

Image source: Getty Images.

... but the stock is expensive

While finding high-quality companies is important for long-term investors, it is only half of the equation. Valuation is also important to consider. A business must also be selling at an attractive price for it to end up being a solid investment. And as things stand today, I don't think Chipotle shares present this kind of opportunity.

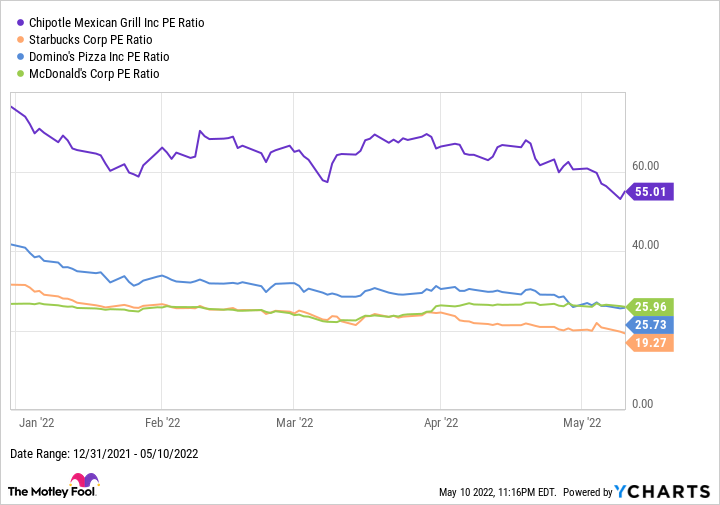

Chipotle's price-to-earnings (P/E) ratio of 55 is more than twice as high as restaurant peers like McDonald's, Domino's Pizza, and Starbucks. To be fair, these competitors are at a later stage of growth than the fast-casual pioneer, but there's still a sizable premium that investors must be willing to pay.

Data by YCharts.

And even if we consider Chipotle's future growth plans, I don't see how owning the stock today provides any margin of safety. Let's say the company manages to reach its target of 7,000 stores in North America by the end of 2030. This would be an aggressive pace of expansion with an average of 450 new locations opened every year, something Chipotle has never done before.

But assuming management does pull it off, profit is sure to be higher with over twice as many restaurants in operation. How much higher? It's hard to say, but between 2012 and 2021, Chipotle more than doubled its store count from 1,410 to 2,966, and in the process, earnings per share surged from $8.75 to $22.90.

Let's give the company the benefit of the doubt and forecast earnings per share will actually increase fourfold by 2030 (compared to 2021) with the 7,000 locations. If the stock's P/E ratio gets cut in half to 27 by 2030, in line with its peers today, Chipotle would provide an annualized return of about 8% between now and the end of this decade.

As you can see, the optimism surrounding Chipotle's stock is probably fully priced in already. Investors who purchase shares now would give themselves no margin of safety. Management could surprise to the upside by boosting expansion plans even further or penetrating more international markets. However, it's hard to underwrite this unknown scenario as an investor today.

For now, it's best to exercise patience and wait for a meaningful pullback before buying Chipotle stock.