The coronavirus pandemic has had a host of secondary and tertiary consequences beyond the millions of deaths it has caused. People have been less willing to go to work when doing so means a high risk of exposure to the virus. Governments have repeatedly imposed restrictions on businesses in their attempts to stem COVID outbreaks, but this has disrupted supply chains worldwide -- and many of those disruptions have proven stubbornly persistent.

Meanwhile, thanks to governments' stimulus actions to support households and businesses through the crisis, demand has remained robust. Of course, when rising demand is combined with falling output, the result is usually inflation, and that is the case this time as well.

Pet goods retailer Chewy (CHWY -3.27%) has so far been effectively managing the impacts of inflation, but does this mean that investors should buy its stock now?

Chewy is demonstrating operational skills

In its fiscal 2022 first quarter, which ended on May 1, Chewy's gross profit margin declined by 10 basis points to 27.5%. That was a surprisingly good result from an e-commerce company that must ship all the products it sells directly to consumers.

Fuel prices, which were already high due to supply/demand imbalances before Russia's invasion of Ukraine, have surged since then. Further, it has not been an easy task securing enough workers to operate its fulfillment centers. Given those and other inflationary pressures, it's impressive that Chewy managed its profit margins as well as it did.

Of course, it is easier for a business to maintain its profit margins if management is willing to accept a sales decline. That's because a business can increase prices to protect margins, but it may lose sales to competitors. This was not the case for Chewy. Net sales in its fiscal Q1 actually increased by a robust 13.7% year over year.

Instead, Chewy maintained its profitability through operational improvements. For instance, it adjusted inventory allocation to reduce the amount of long-distance deliveries, which are more expensive, by 15%. It also started handling inbound inventory in larger batch sizes, lowering its costs. Finally, it is expanding operations in its newer automated facilities, which have variable costs that are 19% lower than its older facilities.

CHWY Revenue (Annual) data by YCharts

Chewy's recent performance extends its pattern of solid execution. From 2016 to 2022, its revenue increased from $901 million to $8.9 billion. During that same period, the gross profit margin expanded from 16.6% to 26.7%. That suggests the recent success is no fluke -- the company has a history of finding ways to become more efficient.

A good time to consider buying Chewy stock

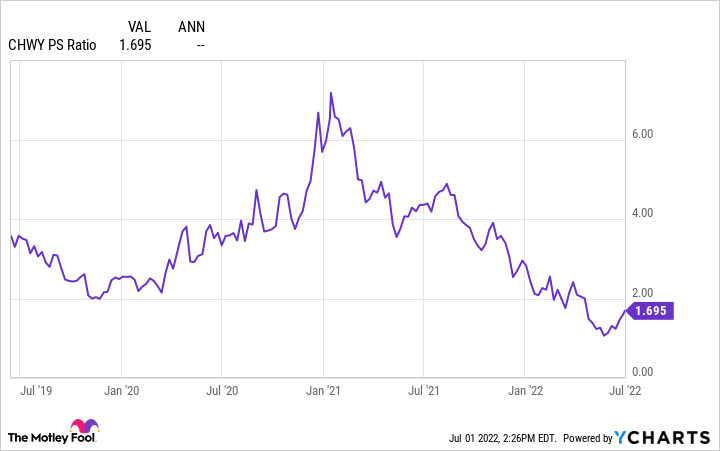

CHWY PS Ratio data by YCharts

Chewy is trading at a price-to-sales ratio of 1.7, which is near its lowest valuation by that metric in its young history as a public company. Therefore, this might be a good time for long-term investors to consider adding Chewy stock to their portfolios. The company is demonstrating operational skills amid difficult circumstances while maintaining robust revenue growth.