Investing in stocks for extended periods could potentially yield incredible results. If you had purchased $1,000 in Alphabet (GOOG 0.73%) (GOOGL 0.79%) stocks in 2010, you would have $4,180 today. Of course, if you had invested enormous sums, the absolute value of the return would have been even more remarkable.

So what caused Alphabet's stock to rise so incredibly in those years? Let's look closer at Alphabet's fundamental metrics to determine the cause of the stock price rise and to consider if today's purchasers of Alphabet's stock can expect similar results in the future.

NASDAQ: GOOGL

Key Data Points

Alphabet boasts a meaningful market share in a massive industry

Notably, Alphabet is home to one of the most dominant businesses in the world. Google ranks as the top search engine worldwide. That's a critical element of Alphabet's success because many purchase decisions start with an internet search. Marketers are willing to spend large sums to show their products and services in these search requests. And advertising is a colossal industry -- marketers spent $763 billion on advertising in 2021, a 22.5% increase from the prior year.

Holding a dominant position in a massive industry has helped Alphabet increase its revenue from $46 billion in 2012 to $258 billion in 2021. That is a compounded annual growth rate of 21.1%. While it maintains a significant market share in the advertising industry, there is room for further expansion. Marketers are shifting their budgets to digital channels because of the better return on investment. In 2021, digital's share of overall advertising increased to 64.4% from 52.1% in 2019.

GOOG revenue (Annual) data by YCharts

That trend is unlikely to reverse because of the structural advantages. For instance, purchasing ad placements in radio, newspapers, or billboards reduces your ability to measure the campaign's results. It is also further removed from consumers' buying point. When someone reads a newspaper, passes by a billboard, or listens to the radio, they are not close to a purchase decision. That's in contrast to an ad placement in a search request where the consumer is a couple of clicks away from buying something.

A profitable endeavor

Further boosting Alphabet's share price is the fact that digital advertising is a lucrative business. It doesn't cost Alphabet much more incrementally to sell additional advertising. The company has spent the upfront costs on developing automated capabilities, allowing a more significant percentage of the expanding revenue to flow to the bottom line. Indeed, Alphabet's earnings before interest and taxes averaged 25.9% in the last decade.

Will Alphabet's future be as lucrative as its past?

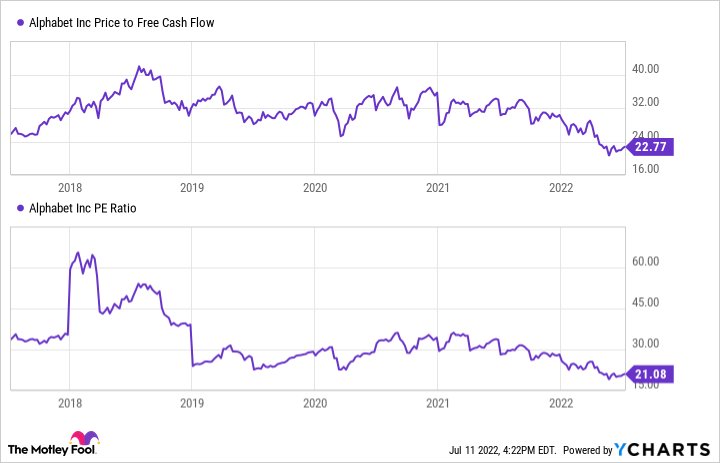

GOOG price-to-free cash flow data by YCharts

Admittedly, it will be difficult for Alphabet to replicate its impressive past performance. However, at a price-to-earnings ratio of 21 and a price-to-free cash flow ratio of 23, Alphabet is trading near its lowest valuation in the previous five years. The low price and excellent prospects mean investors interested in buying Alphabet today can expect that decision to increase their wealth over time.