Bear markets can be brutal on your portfolio. The seemingly unending slide in stock prices can make it challenging to stick with your investments.

However, they can also be great opportunities if you have some cash to invest. One benefit of lower stock prices is that dividend yields move higher, meaning investors can often lock in bigger income streams on some high-quality dividend stocks. Three top dividend stocks that are starting to look really attractive these days are American Tower (AMT 0.65%), Camden Property Trust (CPT 0.58%), and Prologis (PLD 0.98%).

NYSE: AMT

Key Data Points

Towering dividend growth

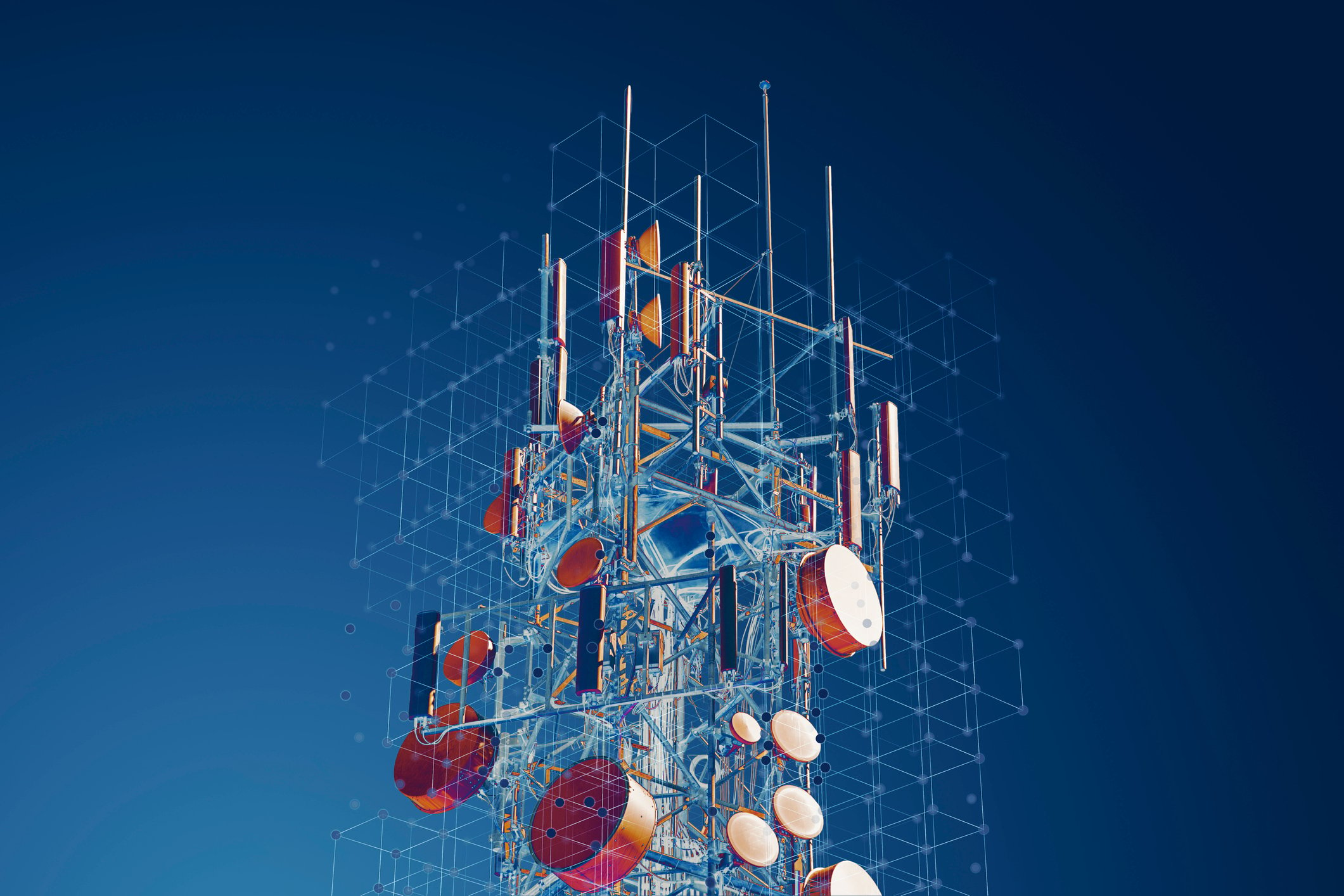

American Tower entered this year with a dividend yield of below 2%. However, it currently offers a yield of over 2.5%. Driving the payout higher has been a more than 20% stock price decline and the continued growth of its dividend. The real estate investment trust (REIT) recently increased its quarterly dividend payment by 2.8% above the second quarter level and 12.2% above the year-ago amount. That continued the company's steady streak of increasing its dividend since it became a REIT a decade ago.

American Tower should be able to continue growing its dividend in the future. The company is benefiting from increasing demand for infrastructure to support rising data usage. That's enabling the REIT to add more tenants to its cell towers and build new ones. It's also allowing the data infrastructure company to expand its recently acquired data center platform. Meanwhile, the company has a strong financial profile to support additional acquisitions and developments in the future. Those drivers should enable American Tower to continue growing its dividend at an attractive rate.

NYSE: CPT

Key Data Points

A growing disconnect

Camden Property Trust's dividend yield began this year below 2%. However, it's currently over 3%, driven higher by a more than 30% decline in the stock price from its peak and a 13.3% dividend increase earlier this year.

The sell-off in Camden's stock price comes even though it has reported excellent financial results. The residential REIT's adjusted funds from operations (AFFO) surged more than 27% during the first six months of 2022 compared to the prior year. It's benefiting from strong market conditions, which are pushing rents higher while keeping properties nearly fully occupied. Camden has also expanded its portfolio by completing some development projects and acquiring full ownership of several apartment communities from joint venture partners.

Camden expects to continue growing its AFFO at a healthy rate in the future, driven by continued rent growth, new developments, and additional acquisitions. With one of the strongest balance sheets in the apartment sector, it has the flexibility to expand.

NYSE: PLD

Key Data Points

Enormous embedded growth

Prologis' dividend yield is approaching 3% these days. That's almost double where it was to start the year. The drivers have been the nearly 40% slide in its stock price from the peak and a 25% dividend increase earlier this year.

Shares of Prologis have been under tremendous pressure on concerns that the industrial real estate market is cooling off. However, the company isn't seeing any signs of that yet. Instead, it's seeing continued rent growth as demand shifts from e-commerce companies to other businesses.

Meanwhile, because of the long-term nature of its rental contracts, it has enormous embedded future rent growth as a result of the widening gap between current market rents and the rates of its existing leases. The company estimates its net operating income will grow at an 8% annual rate through 2025 as existing leases expire and it signs market rate contracts.

In addition, the company has a large and growing pipeline of development projects and recently agreed to acquire top rival Duke Realty in a $26 billion deal. These investments will drive additional income growth in the coming years, which should allow Prologis to continue increasing its dividend.

These top dividend stocks are growing increasingly attractive

The sagging share prices of American Tower, Camden Property Trust, and Prologis are pushing up their dividend yields to more attractive levels, allowing investors to lock in even better passive income streams that should continue growing at impressive rates in the future. That makes them great dividend stocks to buy during the current bear market.