Intel (INTC 3.57%) was once a reliable blue chip stalwart for long-term investors. As the world's largest manufacturer of x86 CPUs for PCs and servers, it generated stable growth, consistently bought back its own shares, and paid a dependable dividend.

Unfortunately, its net income has declined for the past six consecutive years, it hasn't bought back any shares over the past four years, and it suspended its dividend at the end of 2024. Its stock price plummeted more than 60% over the past five years as the S&P 500 more than doubled. It was also removed from the Dow Jones Industrial Average last November.

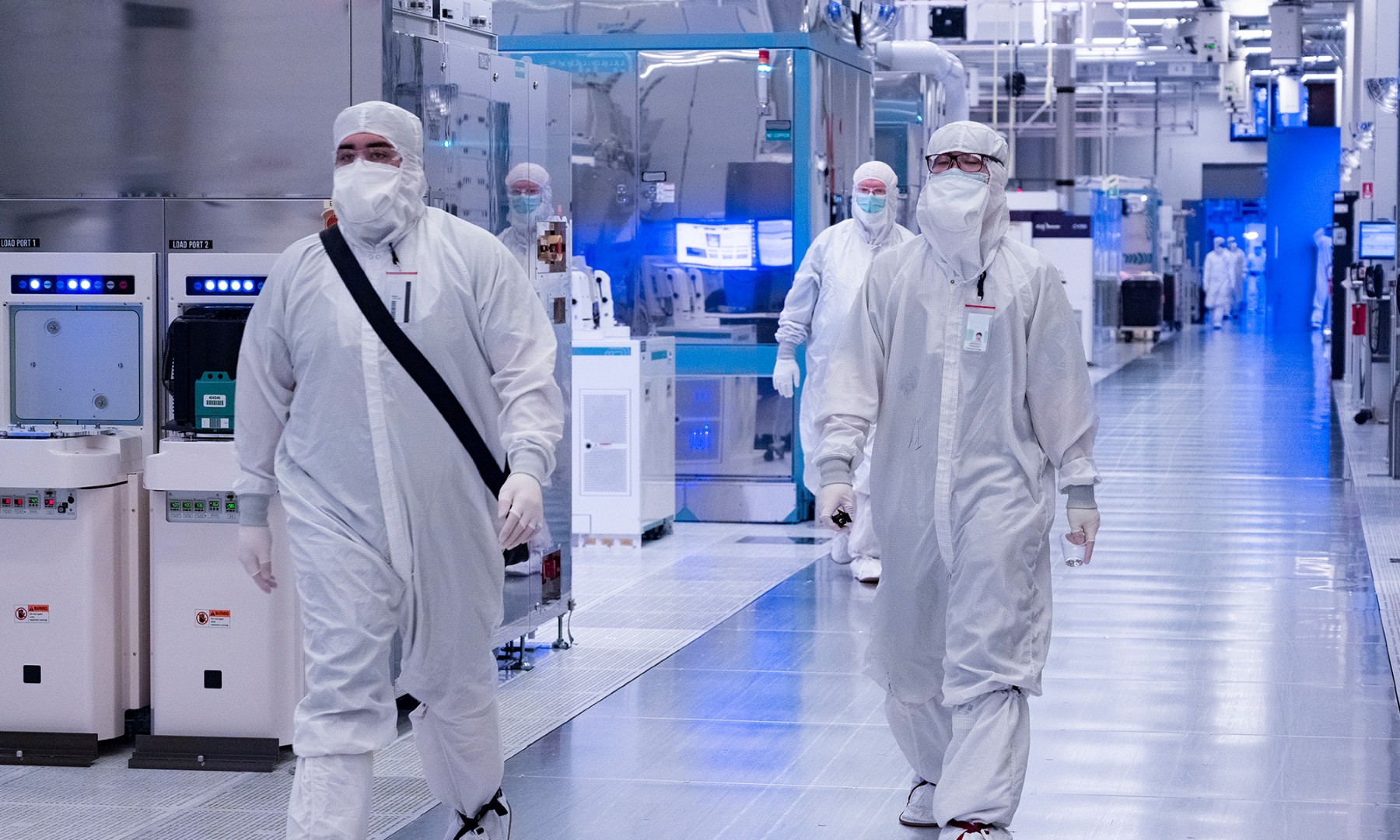

Image source: Getty Images.

Intel's decline was mainly caused by the manufacturing issues at its own foundries, its market share losses to a resurgent Adanced Micro Devices, and its jarring strategic shifts under four different CEOs over the past seven years. But should value-seeking investors take a chance on Intel's stock as it languishes at its lowest levels in more than a decade?

What happened to the chipmaking giant?

Intel made several major mistakes over the past few decades. Instead of licensing Arm Holdings' technology to develop its own mobile chips, it desperately tried to sell its own Atom x86 chips for mobile devices. However, its Atom chips were less power-efficient, and it eventually lost the entire mobile market to Arm-based chipmakers like Qualcomm and MediaTek.

Intel also stopped developing its own discrete GPUs in 1999 to focus on producing weaker integrated GPUs for its CPUs. By the time it returned to the discrete GPU market in 2022, the market was already firmly controlled by Nvidia.

Nvidia's dominance of the discrete GPU market turned it into the world's top artificial intelligence (AI) stock since those chips can process complex AI tasks much more efficiently than stand-alone CPUs. By failing to spot that long-term opportunity, Intel surrendered the booming AI GPU market to Nvidia.

NASDAQ: INTC

Key Data Points

Meanwhile, Intel's core x86 CPU business faced an existential crisis. Its chips became harder to manufacture as they became smaller and denser, and it struggled with severe delays and shortages during its grueling transition from 14nm to 10nm chips between 2015 to 2019. It was plagued by even more delays with its transition from 10nm chips to 7nm chips (rebranded as Intel 4 to avoid direct comparisons against Taiwan Semiconductor Manufacturing's nodes) in 2023.

As Intel struggled to manufacture its own chips, AMD redesigned its CPUs and outsourced its production to TSMC's superior foundries. As a result, AMD provided a steady supply of cheaper, smaller, and denser chips as Intel struggled with ongoing delays. According to PassMark Software, Intel's share of the global x86 CPU market fell from 82.5% to 58.6% between the third quarter of 2016 and the second quarter of 2025. AMD's share rose from 17.5% to 39.9%.

Why did Intel's priorities keep changing?

Intel's problems were exacerbated by its constant CEO changes. Under Brian Krzanich, who resigned in 2018, Intel "di-worsified" its business with too many adjacent acquisitions instead of strengthening its core foundry business. His successor, Bob Swan, focused too much on cutting costs and buying back shares, and even briefly considered shutting down its foundries to become a "fabless" chipmaker like AMD before he was fired in 2021.

Pat Gelsinger, who replaced Swan, then doubled down on expanding Intel's foundries to catch up to TSMC and Samsung in the "process race" to manufacture smaller and denser chips. But that costly effort never paid off in the challenging macro environment, and Gelsinger was dismissed in late 2024.

Intel's newest CEO, Lip-Bu Tan, wants Intel to improve its engineering capabilities, develop more CPUs with integrated AI features, and strengthen its core foundry business while outsourcing the production of some of its chips to TSMC. Tan also reportedly plans to lay off about a fifth of Intel's entire workforce and divest its programmable chipmaker, Altera, in the second half of this year to streamline its business.

What will happen to Intel?

As for its near-term roadmap, Intel has been ramping up its newest 18A process (comparable to TSMC's 2nm node) to support the launch of its newest Panther Lake CPUs for PCs in late 2025. It also expects to roll out its newest Granite Rapids Xeon 6 CPUs for servers.

Those new chips might stabilize its near-term growth, but they might not be enough to halt its long-term decline or secure its defenses against TSMC, AMD, and Nvidia.

Intel remains committed to manufacturing chips for fabless chipmakers, but CFO David Zinsner recently admitted there was still only a limited demand for its foundry services. In other words, it's still probably far behind TSMC and Samsung in the contract chipmaking market.

From 2024 to 2027, analysts expect Intel's revenue to only grow at a compound annual rate of 2%. They expect it to turn profitable again by 2027 -- assuming Tan's turnaround efforts pay off, it keeps pace with TSMC, and it stops ceding its market to AMD. But at $22 a share, it still isn't a bargain at 23 times its 2027 earnings -- so I'd stay away until more green shoots appear.