Investors might not consider Delta Air Lines (DAL 0.94%) stock expensive due to its low price-to-earnings ratio of just over 8 times earnings. Still, some of them do stress over Delta's adjusted net debt of $16.9 billion and the traditional cyclicality of its revenue and earnings. That said, I think the risk is a lot less than in previous years. Here's why.

Airline profitability

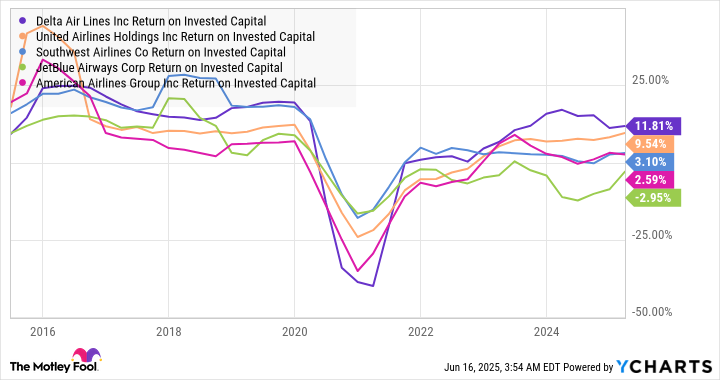

One of the longstanding, and justified, criticisms of the airline industry is that it hasn't generated a return on invested capital (ROIC) sufficient to cover its weighted average cost of capital (WACC). While airlines will all have different WACCs, a rough estimate interpolated from International Air Transport Association (IATA) figures suggests it averages around 8% or 9%.

Image source: Getty Images.

The following chart illustrates a clear bifurcation in the industry over recent years, with Delta and United Airlines' return on invested capital (ROIC) exceeding 8%, significantly ahead of American Airlines and the budget carriers. Moreover, note that the ROIC of Delta, United, and American Airlines is similar both before and after the pandemic lockdown period, while the ROIC of budget airlines has declined.

Data by YCharts.

Why Delta will continue to outperform

There are many reasons for this bifurcation:

- Rising labor, airport, and supply chain costs disproportionately hit budget airlines' low-cost and low-margin business models.

- It's easier for premium airlines to adjust and offer economy seats than it is for budget airlines to "go premium."

- Delta and other network airlines have substantial loyalty programs and also generate revenue through co-brand credit cards.

It all comes together to create an environment where Delta and United are likely to be more resilient in a downturn, particularly against budget airlines, as demonstrated by their ROIC. As such, a lower risk should result in a more favorable risk-reward calculation for Delta, meaning it's not as expensive a stock as many think.