Apple (AAPL +0.62%) was the defining stock of the late 2010s and into the early 2020s, but time is up for its leadership position. Although it's still the third-largest company in the world, Microsoft and Nvidia have overtaken Apple, likely for good, as the growth these two are putting up far surpasses Apple's.

However, I don't think we've seen the last of companies surpassing Apple in terms of market cap over the next few years. I think we'll see Amazon (AMZN 1.00%) and Alphabet (GOOG 0.02%) (GOOGL 0.05%) surpass Apple by 2030. Several key factors play into this prediction, but Amazon's and Alphabet's performances aren't the only reason they'll surpass Apple.

Image source: Getty Images.

Apple's stock appears overvalued for its growth

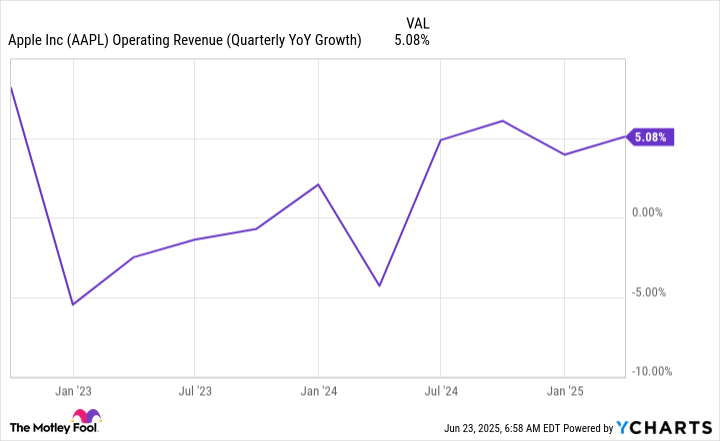

Apple's brand may be the most valuable on Earth, but that's about all it has going for it. Apple has posted anemic growth over the past few years, and it could be debated that Apple's growth has been essentially nonexistent when inflation is factored into the calculation.

AAPL Operating Revenue (Quarterly YoY Growth) data by YCharts. YOY = year over year.

Despite that, Apple's stock trades like a hot growth stock, trading at 28 times forward earnings. The S&P 500 trades at 22.8 times forward earnings, with an average growth rate of about 10% per year. Apple's growth rate is far below that pace, so at most, Apple's stock should receive a market-average multiple, at least from my perspective.

If Apple's valuation were to decline to a market-average multiple, it would tumble nearly 20%. That would put Apple's market cap at around $2.44 trillion, which is where we'll start our comparison.

NASDAQ: AAPL

Key Data Points

Amazon's operating profit growth is propelling the stock higher

Currently, Amazon's market cap is $2.23 trillion and Alphabet's is $2.03 trillion. That's not far from the $2.44 trillion that I think Apple should be trading at, but even if Apple's stock stays at its elevated level, I think these two can catch Apple by 2030.

Let's start with Amazon, whose growth rate looks rather slow at first glance, similar to Apple's.

AMZN Operating Revenue (Quarterly YoY Growth) data by YCharts. YOY = year over year.

However, that's the wrong way to look at Amazon's stock. Amazon can be split into two businesses: commerce and Amazon Web Services (AWS), its cloud computing wing. While the consumer-facing commerce division is widely known and what most people value the stock for, the real cash cow is AWS. In the first quarter, AWS accounted for 63% of Amazon's operating profits despite making up just 19% of revenue. Furthermore, AWS's operating income rose 23% year over year in Q1.

This makes revenue growth a poor metric for evaluating Amazon's stock. Instead, investors should consider operating income growth.

AMZN Operating Income (Quarterly YoY Growth) data by YCharts. YOY = year over year.

This is the key metric to consider with Amazon, and with massive tailwinds in the cloud computing space (such as artificial intelligence (AI) workload growth), it will continue to produce market-beating operating income growth. This will propel Amazon's stock up over the next few years, allowing it to surpass Apple.

Alphabet already makes more profits than Apple

Alphabet's path to surpassing Apple is easier than Amazon's: It needs to be valued at the same level. Over the past 12 months, Alphabet's net income surpassed Apple's.

GOOGL Net Income (TTM) data by YCharts. TTM = trailing 12 months.

During the last quarter, Alphabet's net income rose 46% year over year, so it's clear that Alphabet's growth trajectory from this standpoint is far greater than Apple's.

If these two traded at the same valuation, Alphabet's stock would be worth more than Apple's. While Apple gets a premium valuation, Alphabet's stock trades at a huge discount to the market, with a valuation of just 17.4 times forward earnings.

If Alphabet were to achieve the same valuation level, it would be worth far more than Apple. I expect Apple's valuation to trend downward over the next five years while Alphabet's rises, which would allow Alphabet to surpass Apple's valuation by 2030, even without its superior growth.