Most of the time, I prefer broad market-tracking index funds like the Vanguard S&P 500 ETF (VOO -2.03%). This exchange-traded fund (ETF) mirrors the component stocks of the classic S&P 500 (^GSPC -2.06%) market index. This way, it offers an unmatched combination of robust long-term returns and broad diversification.

But what if you want a quick shot of exposure to the artificial intelligence (AI) boom -- without spending too much time and effort on hand-picking individual stocks? There are several ETFs available for that role, but one stands out as a promising investment right now.

Meet the Global X AI fund

Let me introduce you to the Global X Robotics and Artificial Intelligence ETF (BOTZ -3.70%). For your convenience, I'll call it Global X AI from now on.

Many AI-themed ETFs turn out to be fairly similar to the basic S&P 500. That's a natural result from the massive market capitalization of the leading AI titans. I would slap the AI label on nine of the 10 largest market caps in the S&P 500 today. When funds are weighted by market cap alone, these giants easily bubble up to the top and dictate the performance of that index (and any index funds that track it).

But the Global X AI marches to a different drum.

A refreshingly different AI portfolio

The overlap between this fund and the S&P 500 is very limited. Nvidia (NVDA -2.63%) is the only one of Global X AI's top ten names that also makes an appearance among the 10 heaviest weights in the market index.

Nvidia gets a fund-leading 11.5% weight in the Global X AI portfolio, compared to 7.4% among the S&P 500 members. But the rest of the top-ten list is refreshingly different. The same is true for the remainder of Global X AI's 98 total components.

Only two of the top 20 Global X AI stocks are S&P 500 members. That would be Nvidia and robotic surgery expert Intuitive Surgical. The same list includes 9 stocks from the Japanese, Swedish, and South Korean stock exchanges. That's a healthy serving of geographical diversity. You'll also find a 2.4% allotment of process automation specialist UiPath, and a 1.7% weight for the exciting voice command company SoundHound AI (SOUN -3.50%).

This is not your average batch of familiar AI names, but a hand-curated list of "companies that potentially stand to benefit from increased adoption and utilization of robotics and AI."

Image source: Getty Images.

Why this AI fund looks tasty right now

So the Global X AI fund brings a new dimension to the AI investor. It relies on a dramatically different list of AI stocks than most of its peers. But why am I recommending this particular ETF at this specific moment?

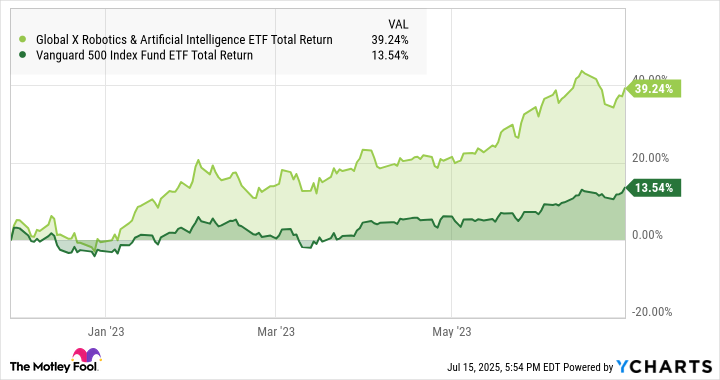

You see, this fund has a history of really soaring when the AI market is hot. For example, it tripled the returns of the S&P 500 in the first few months of the current AI boom, going back to the ChatGPT launch in November 2022:

BOTZ Total Return Level data by YCharts

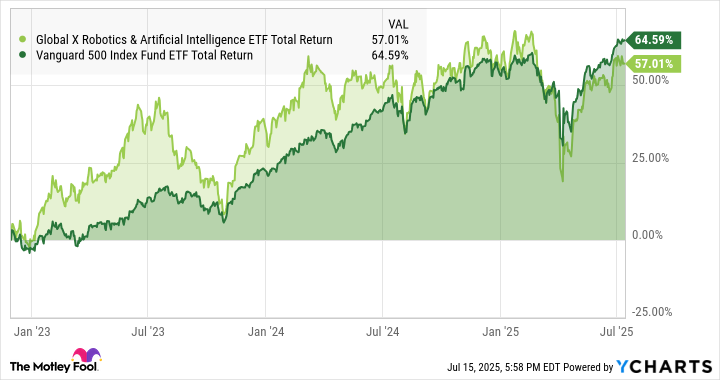

At the same time, it has let out steam by lagging behind the broader market in the last two years. In total, the S&P 500 has caught up to Global X AI since ChatGPT made a splash. If Global X AI was a high-flying market darling two years ago, it has dropped back to Earth in recent months.

BOTZ Total Return Level data by YCharts

If you feel like the S&P 500 might be overvalued these days, with too much market value based on risky gains from a handful of early AI leaders, this could be your moment to bet on a different group.

I can't guarantee that this fund will outperform the Vanguard S&P 500 ETF (or any other fund) in the long run, but you know what they say about buying low and selling high. That's the kind of opportunity I see in the Global X AI ETF today.