AST SpaceMobile (ASTS 8.89%) has a great story behind it. And the story is about to take an important turn for the better. But is it the smartest investment you can make today? That's a harder question to answer and the answer depends on both your opinion and Wall Street's opinion of the business.

What does AST SpaceMobile do?

AST SpaceMobile is in the process of building a satellite network that will allow normal cellphones to have broadband connections "anywhere" on the planet. The word anywhere is in quotes because the service isn't fully operational yet. The big near-term goal is to provide coverage in the United States, Europe, and Japan. So there's a lot of the planet left to go.

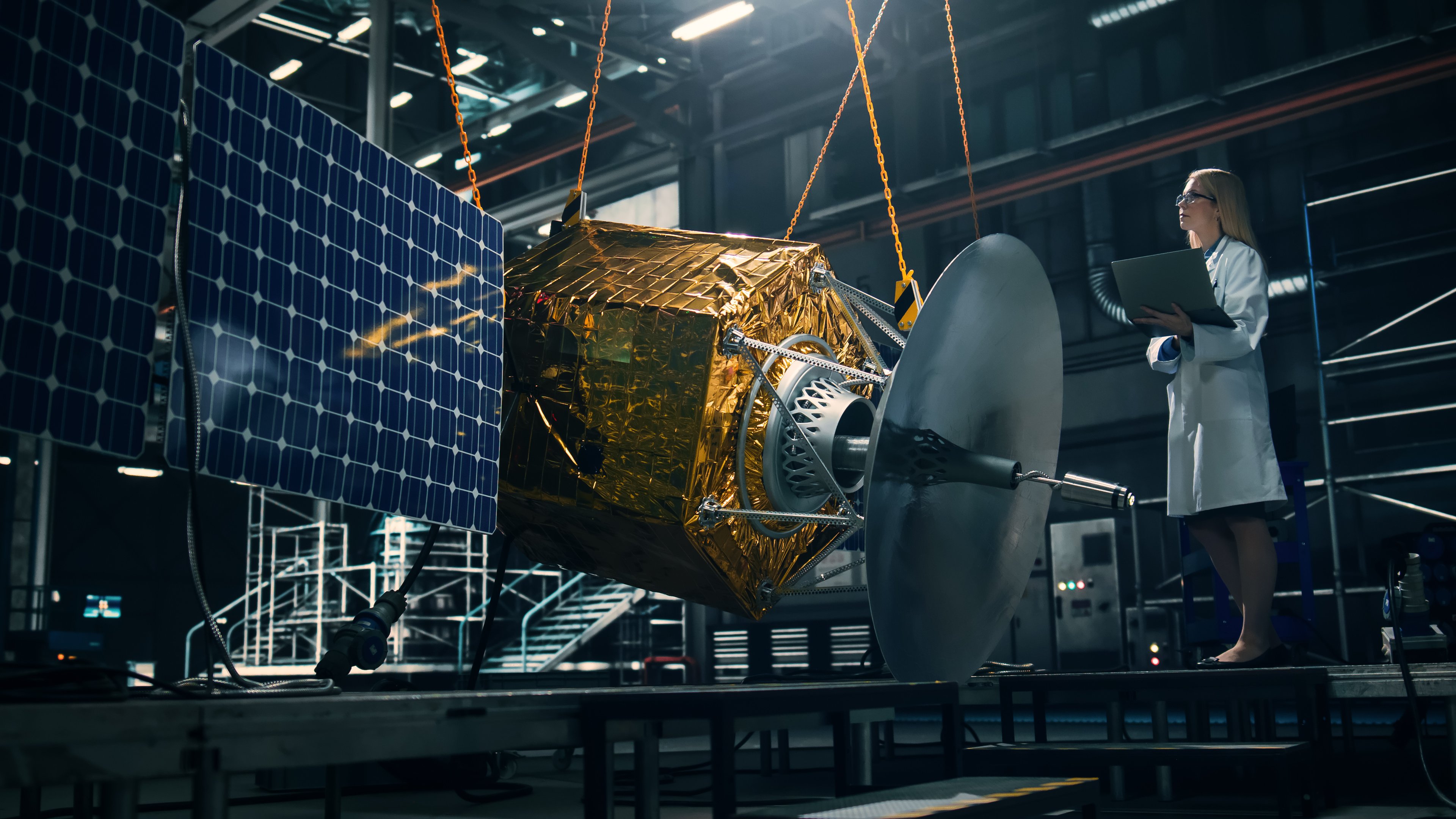

Image source: Getty Images.

Still, being able to get a cell connection in the middle of a desert or on top of a mountain is pretty attractive. A key part of the story, though, is that AST SpaceMobile isn't trying to go it alone. It is partnering with telecom giants like AT&T and Verizon Communications, which will sell the cell service to their customers. So AST SpaceMobile will be an add-on service, with monthly subscriptions for those who need it and lighter temporary options for those who only need such connectivity for a short time period.

The big problem is that AST SpaceMobile's service requires that it send a lot of expensive satellites into space. That takes time, and money, to get done. The money side looks increasingly doable, now that the service is about to launch. Notably, AST SpaceMobile was just able to get a $100 million loan backed by the satellites it is building.

Don't ignore AST SpaceMobile's price tag

The time factor involved in creating the satellite network, however, is a problem for investors in another way. Wall Street loves a good story, and AST SpaceMobile has a good story -- which helps explain why the stock is up more than 500% over the past three years. Over the past year alone the stock has risen more than 250%.

Given that AST SpaceMobile's business is still in the very early stages of its development, it seems like investors have priced in a lot of good news here. Keep in mind that the price-to-earnings ratio isn't a meaningful valuation tool because the company is losing money. And given the capital spending that still needs to take place it probably won't generate positive earnings for a long time to come.

NASDAQ: ASTS

Key Data Points

The price-to-sales ratio, another of the more traditional valuation metrics, is currently over 1,000. That's an absurd figure, which suggests Wall Street believes the company's revenue will someday be gigantic. AT&T has a five-year average P/S ratio of 1.1, for comparison. In other words, buying AST SpaceMobile means you are paying a material amount for a business that is still just in its infancy.

Is buying AST SpaceMobile smart today?

There's no good answer to this question, because it involves the unknowable future. If you believe that AST SpaceMobile's business has huge potential, you may be willing to buy it today expecting the company to grow into the valuation of the stock.

However, more conservative investors should probably tread with caution given the hefty premium being afforded a company that's still largely untested. And value investors, well, they should probably run for the hills here (but at least they can get cellular broadband service when they do).