Caterpillar (CAT 1.19%) is an iconic company. Its mix of construction machinery, resources (mining and aggregates) machinery, and energy and transportation equipment is widely recognized, and its power generation engines have encouraged investors to bid the stock up, thanks to its potential role in artificial intelligence (AI)/data centers.

With these factors in mind, here's what you need to know before buying the stock.

AI/data centers are one thing, cyclicality is another

Burgeoning demand for power generation equipment for data centers (it provides backup power if needed) will benefit the company, but it isn't likely to significantly move the growth needle. And it's far from enough to make Caterpillar an AI/data center stock. For example, its power generation sales were $2 billion in the first quarter, representing almost 15% of its machinery, energy, and transportation (MET) segment sales. It's not insignificant, and supports the case for buying the stock, but it doesn't change the fact that Caterpillar is still a highly cyclical stock.

Image source: Getty Images.

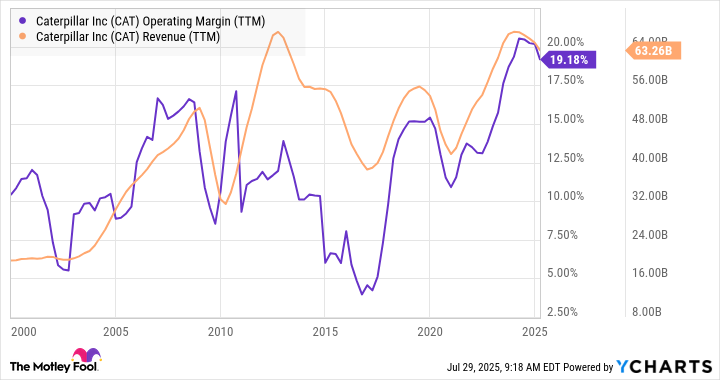

The cyclicality of its revenue, earnings, and cash flow is inherently recognized in the way management outlines its "target ranges" for key metrics during the cycle. Management last updated these ranges in early 2024, and they include a free-cash-flow (FCF) range of $5 billion to $10 billion through the cycle, and a range of operating profit margins depending on revenue. For example, the target call for an adjusted operating profit margin of 10% to 14% with revenue of $42 billion, reaching 18% to 22% with revenue of $72 billion.

As you can see below, Caterpillar's revenue is cyclical, and its operating margin is a factor of its revenue.

Data by YCharts.

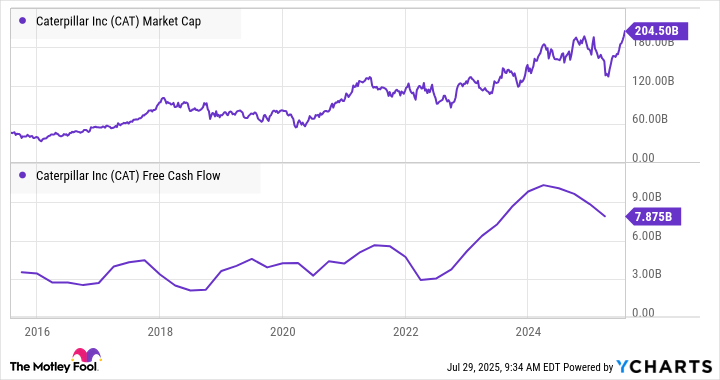

Valuation should reflect cyclicality

One way to value Caterpillar is to price it at the midpoint of its free-cash-flow range and assume it's a mature industrial company that trades at roughly 20 times its FCF. Doing so would give a "fair" value for the stock of 20 times $7.5 billion, or $150 billion. That approach would imply that Caterpillar is overvalued as it currently trades on a market cap of $200 billion.

Data by YCharts.

Why Caterpillar might deserve a higher valuation

That said, it's important to note that this is a conservative approach. As mentioned earlier, management last updated these target ranges in early 2024, when it increased its FCF target range from $4 billion to $8 billion to the current range of $5 billion to $10 billion.

Four factors might lead management to upgrade, or encourage investors to price Caterpillar toward the higher end of the range.

First, as discussed above, the growth in its power generation revenue (up 23% in the first quarter) is in line with increased data center capital spending.

NYSE: CAT

Key Data Points

Second, Caterpillar is trying to increase its less cyclical services revenue from $14 billion in 2016 to $28 billion in 2026, having hit $24 billion in 2024. Hitting this target would reduce the cyclicality in its earnings.

Third, and perhaps most importantly of all, Caterpillar is a beneficiary of the so-called commodity supercycle argument. In other words, ongoing demand for key mining commodities (Caterpillar's mining machinery), particularly those used in the energy transition, such as copper, energy (oil and gas equipment), and its construction machinery, also plays a key role in energy infrastructure.

The fourth factor would be an extended cycle of construction and infrastructure investment.

Is Caterpillar stock a buy now?

The AI/data center investment, ongoing services growth, and infrastructure spending growth angles are easier to get behind than the idea that a commodity supercycle is necessarily going to occur, and based on the valuation approximation made above, the current market cap of $203 billion (20 times the high end of its FCF target range) implies that the market is assuming an ongoing favorable commodity capital spending cycle.

That might prove a little optimistic.