BigBear.ai (BBAI 4.97%) has become one of the most popular artificial intelligence (AI) stocks on the market, rising around 50% this year, at the time of this writing. The attractiveness of the stock comes from its pure-play AI status alongside its small size. It's a less than $2 billion company right now, so if it can capitalize on the massive AI growth wave, it could deliver shareholders phenomenal returns.

But is it good enough that it could make you a millionaire? Let's take a look.

Image source: Getty Images.

BigBear.ai's growth is rather slow

BigBear.ai provides AI solutions for various clients, but it's most focused on government clients. It hired a new CEO at the start of 2025, Kevin McAleenan, who backs up this focus. He served as the Secretary of the Department of Homeland Security under the first Trump administration, so his ties to the current administration are likely strong. This could bode well for BigBear.ai's business, as it has a leader who understands how government departments look for products tailored to their use cases.

Additionally, BigBear.ai is looking outside the U.S. for business, and recently announced a key partnership in the United Arab Emirates. Still, none of these partnerships have spilled over to BigBear.ai's financials, as it's growing much slower than you'd expect a small AI-focused company to grow.

NYSE: BBAI

Key Data Points

In Q1, BigBear.ai's revenue rose 5% year over year. That slow growth isn't going to cut it for most investors, especially when there are multiple other options on the market with far more rapid growth. One positive note is that its revenue backlog rose 30% year over year, which indicates that some large deals have been signed over the past year. But it could be some time before that backlog is transformed into actual revenue growth.

While BigBear.ai's growth thesis is fairly straightforward, it hasn't resulted in any major financial effects yet. But if it rights the ship, could it be a huge winner?

BigBear.ai's margins are slimmer than those of most software companies

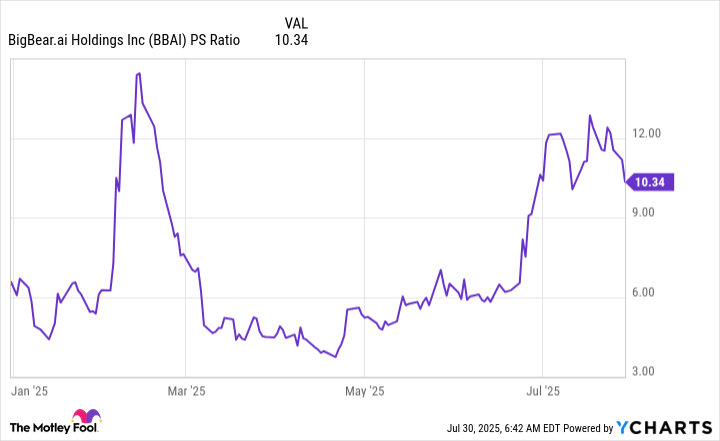

At first glance, BigBear.ai's stock looks pretty cheap at around 10 times sales.

BBAI PS Ratio data by YCharts.

Most software companies trade at between 10 and 20 times sales, which makes this stock appear rather cheap. However, that assumes that the software company has excellent gross margins, which BigBear.ai does not.

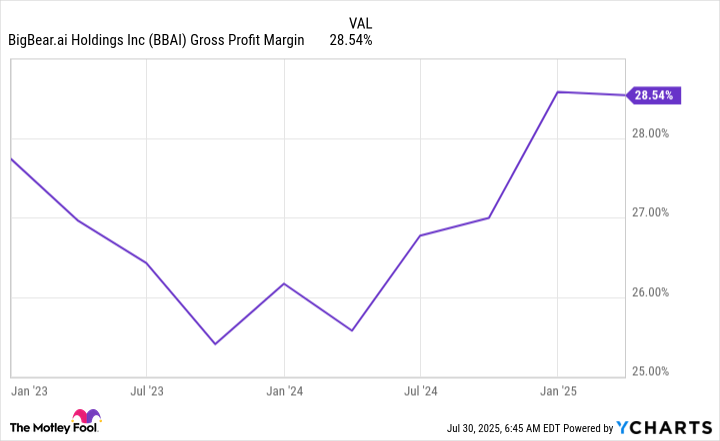

Because BigBear.ai is more focused on service and developing unique solutions, it doesn't have the same margin profile that some of the best software stocks do because its gross margin is quite low.

BBAI Gross Profit Margin data by YCharts.

With a gross margin of less than 30%, it's a far cry from software companies that produce gross margins in the 70% to 80% range that would normally trade between 10 and 20 times sales. These companies trade at that level because they have the potential to produce outstanding profit margins, often around 30%.

Because BigBear.ai's gross profit margins are even less than that, it will likely be unable to produce excellent profit margins at all.

As a result, I think investors can find much better companies to invest in than BigBear.ai. The long-term outlook for its profit picture is grim, and the company has a lot of work to do in terms of growth. There are plenty of investment options that are growing faster and producing massive profits already, and investors should consider those options before buying BigBear.ai stock.